US reserves established order: Gold, oil and the rising function of Bitcoin

The US authorities has lengthy relied on gold and oil as reserve property, however with the rising institutional adoption of Bitcoin (BTC), its potential function as a strategic reserve has elevated considerably. This risk and potential of the Bitcoin strategic reserve have seen a serious tailwind as the brand new administration took cost within the US in January 2025.

Whereas gold has traditionally backed financial programs and oil stays a key financial and safety asset, Bitcoin represents a new kind of digital reserve that challenges conventional monetary paradigms.

The US holds substantial reserves in gold and oil, however its Bitcoin holdings are comparatively small and primarily acquired via asset seizures. As of the third quarter of 2024, the US holds roughly 8,133.46 metric tons of gold, valued at round $789. 87 billion (on March 8, 2025), making it the most important sovereign holder of gold reserves.

These reserves have traditionally been used as a hedge in opposition to financial uncertainty and to again the greenback earlier than the gold customary was deserted in 1971.

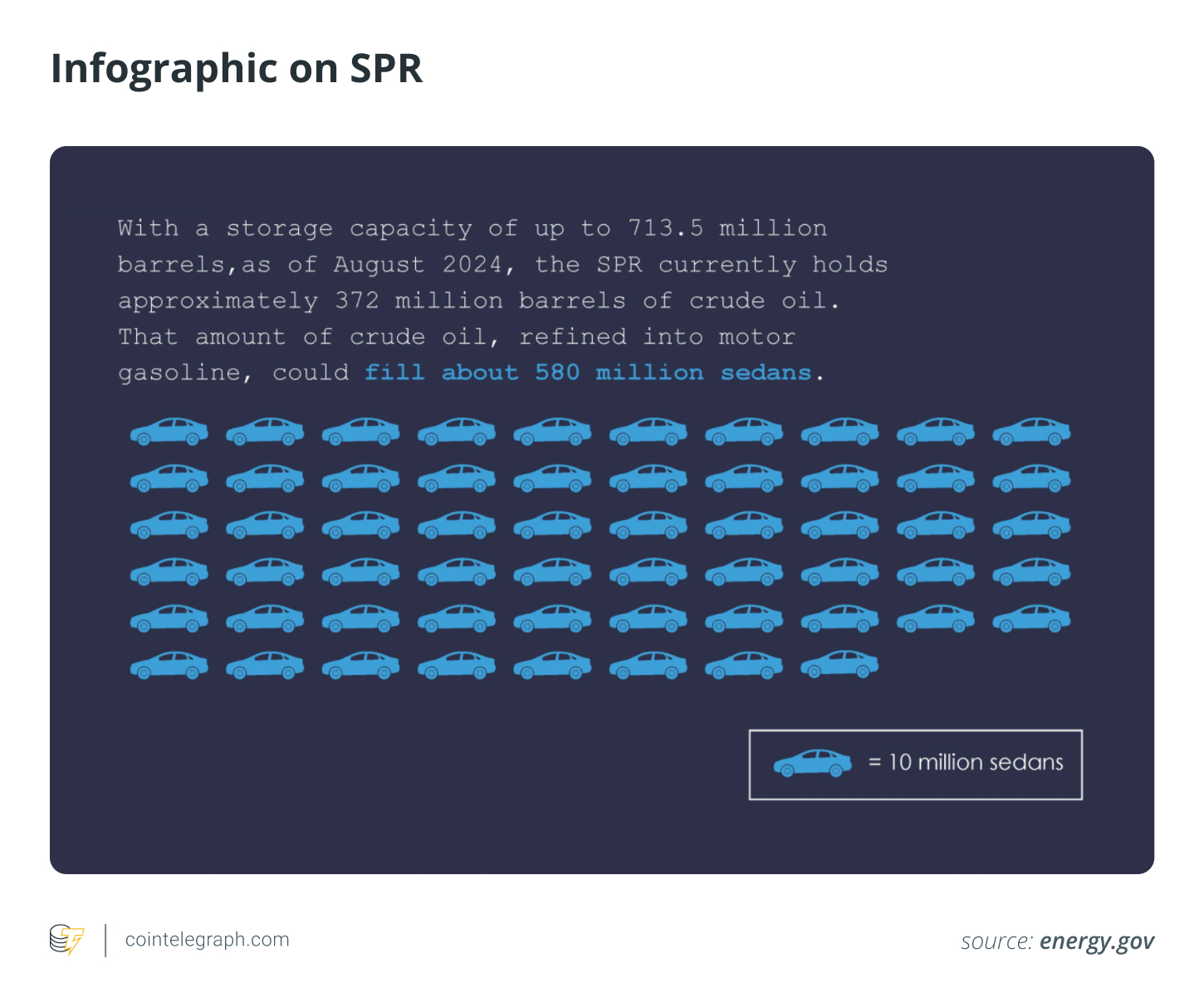

Within the case of oil, the US maintains a Strategic Petroleum Reserve (SPR), which, as of August 2024, holds round 372 million barrels. The SPR was established within the Seventies in response to the oil disaster and is valued at roughly $28 billion at present market costs. These reserves handle provide disruptions, management inflationary pressures, and stabilize power markets throughout geopolitical crises.

Bitcoin, not like gold and oil, isn't an official reserve asset, however the US authorities possesses a significant amount through confiscations. Estimates counsel the federal government controls roughly 200,000 BTC, price round $15.90 billion at a Bitcoin worth of $79,515 (as of March 10).

Nonetheless, not like gold and oil, these holdings are usually not saved as strategic reserves however quite as property pending public sale or liquidation by the Division of Justice and the US Marshals Service.

Liquidity and market dynamics of gold, oil and Bitcoin

Gold, oil and Bitcoin every exhibit distinctive liquidity and market dynamics, with gold being the stablest, oil pushed by geopolitical elements and Bitcoin characterised by excessive volatility and 24/7 accessibility.

The depth of liquidity of an asset in a market is a particularly vital indicator of the asset’s well being. Sometimes, the upper the liquidity, the higher the choices buyers have round pricing and danger administration.

Let’s perceive how gold, oil and Bitcoin differ from one another by way of liquidity and market dynamics:

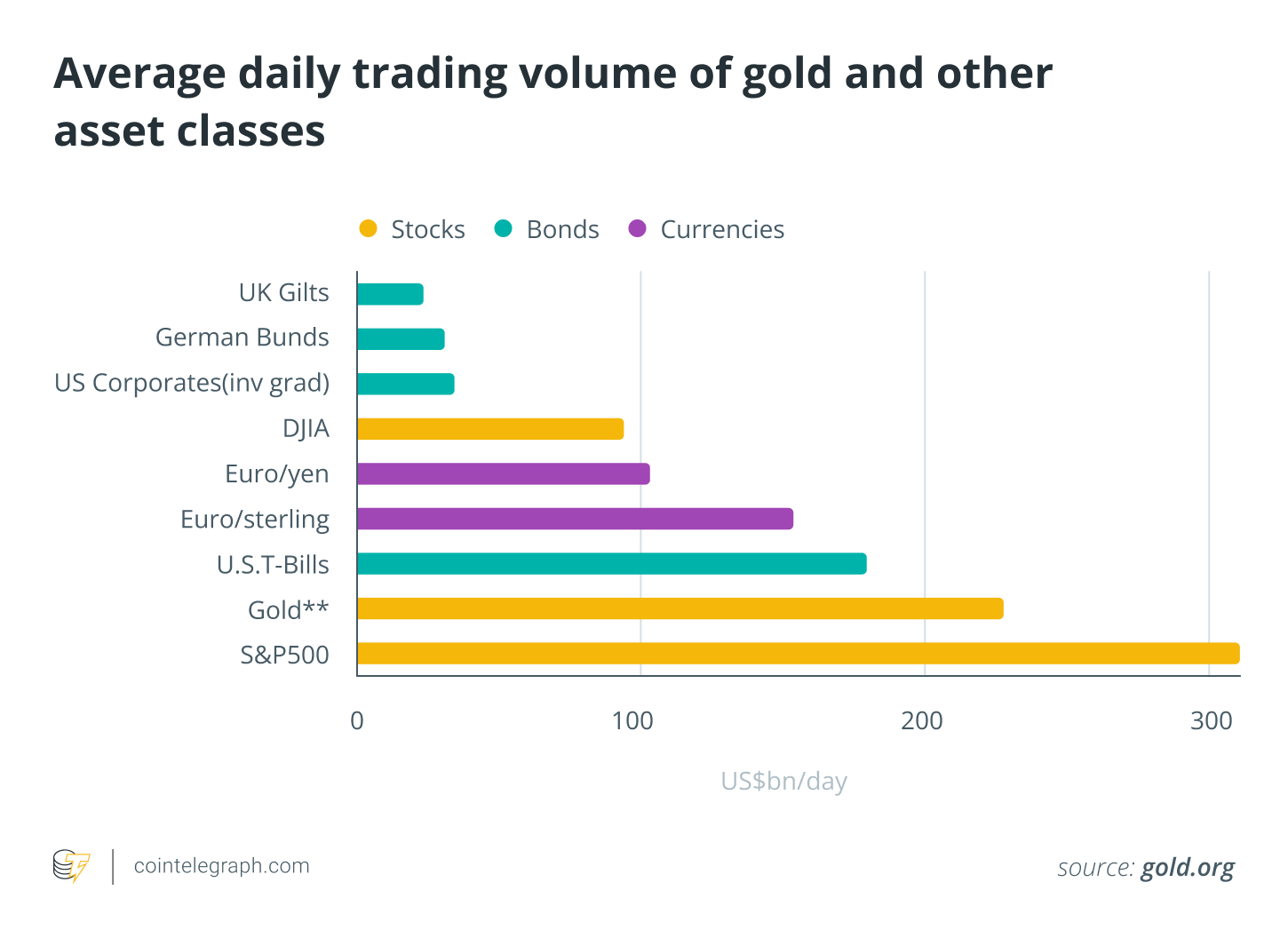

- Gold: It stays one of the liquid monetary property, with day by day buying and selling volumes exceeding $200 billion throughout futures markets, exchange-traded funds (ETFs) and over-the-counter (OTC) trades. Its deep liquidity and common recognition make it a most popular asset for central banks, institutional buyers and governments trying to hedge in opposition to inflation and foreign money fluctuations. Whereas gold’s worth varies, it has traditionally maintained decrease volatility than most different property.

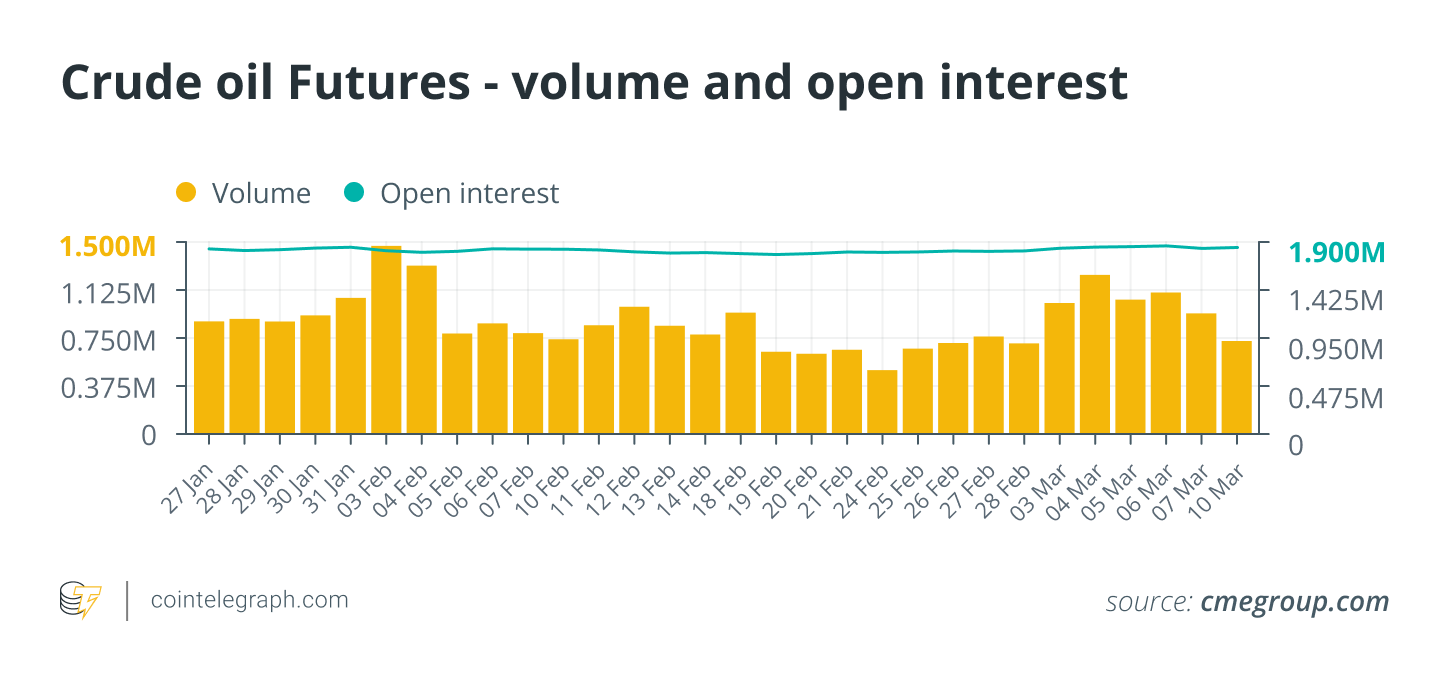

- Oil: It's traded at immense volumes in each spot and futures markets, with day by day future volumes reaching about 1 million barrels globally. In contrast to gold, oil’s liquidity is essentially tied to its industrial demand and geopolitical developments. The value of oil is extremely delicate to provide chain disruptions, the Group of the Petroleum Exporting Nations (OPEC) selections and macroeconomic insurance policies. Given its function in power markets, oil volatility is far larger than gold, with worth swings that may outcome from political instability, manufacturing cuts or main conflicts.

- Bitcoin: Bitcoin, regardless of being a comparatively new asset, is extremely liquid, with day by day trading volumes usually exceeding $30 billion–$50 billion throughout world exchanges. Whereas BTC has gained legitimacy amongst institutional buyers, it stays considerably extra unstable than gold and oil attributable to speculative demand, regulatory uncertainty and market construction. In contrast to gold and oil, Bitcoin operates on a 24/7 buying and selling cycle, making it distinctive by way of accessibility and world liquidity.

Storage and safety issues for reserve property

Storage and safety issues are essential for any reserve asset, with every asset presenting distinctive challenges and prices.

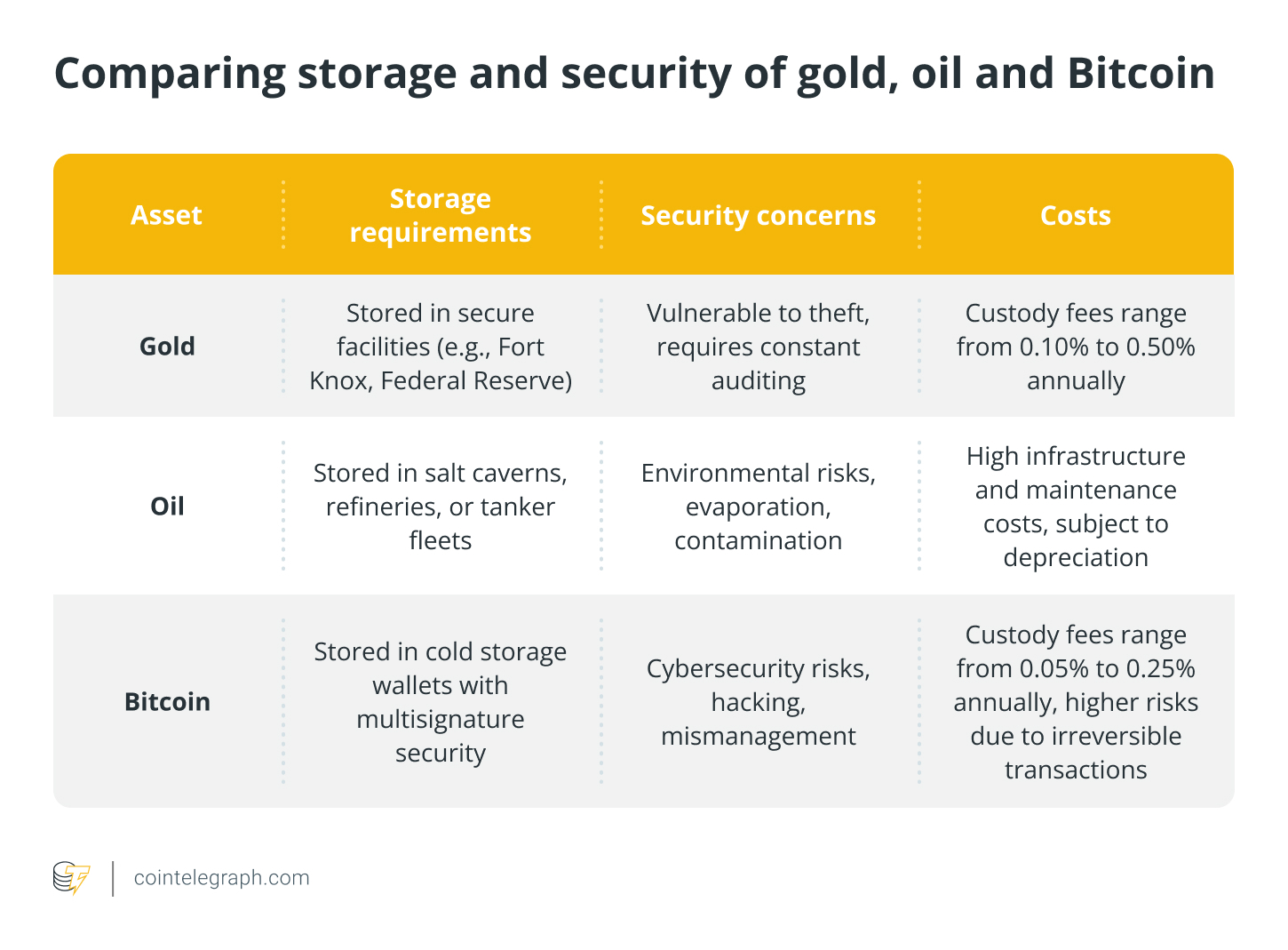

- Gold: It's sometimes saved in extremely safe services comparable to Fort Knox, the Federal Reserve Financial institution of New York and different vaults worldwide. The price of storing gold varies, however large-scale sovereign reserves require substantial safety infrastructure, transportation prices and insurance coverage. Moreover, bodily gold is susceptible to theft and requires fixed auditing to make sure authenticity and weight accuracy. Plus, custody charges for establishments storing gold in vaults vary from 0.10% to 0.50% per yr, relying on the storage supplier.

- Oil: In contrast to gold and Bitcoin, oil presents logistical challenges because it should be saved in underground salt caverns, refineries or tanker fleets. The price of sustaining the Strategic Petroleum Reserve requires billions of {dollars} in infrastructure, upkeep and safety. Furthermore, oil storage is topic to depreciation attributable to environmental circumstances, evaporation and contamination dangers, making it costlier to keep up than gold or Bitcoin.

- Bitcoin: Bitcoin storage differs essentially, as it is a digital asset. Governments and establishments sometimes use chilly storage wallets and multisignature security to guard their holdings. Whereas Bitcoin custody doesn't require bodily storage services, cybersecurity dangers comparable to hacking, private key mismanagement and regulatory oversight current main challenges. Institutional-grade custody options like BitGo, Fireblocks and Coinbase Custody cost anyplace from 0.05% to 0.25% per yr, considerably decrease than gold storage prices. Nonetheless, the irreversibility of Bitcoin transactions will increase the dangers related to mismanagement or unauthorized entry.

Strategic and financial function of reserve property

Gold, oil and Bitcoin every play strategic roles in world economics, with gold as a hedge, oil influencing geopolitical stability, and Bitcoin rising as a decentralized asset for inflation safety.

All of those property have gained strategic and macroeconomic significance over time. Their narrative with relevance to the broader capital markets is maybe what is required to drive buyers’ curiosity.

- Gold: Gold’s strategic function within the world economic system dates again 1000's of years, serving as a common retailer of worth and a medium of trade. The US formally tied its foreign money to gold within the Bretton Woods system (1944–1971), which established the greenback because the world’s reserve foreign money backed by gold. Even after the US deserted the gold customary in 1971, gold remained a key strategic asset held by central banks worldwide as a hedge in opposition to foreign money devaluation and inflation.

- Oil: It has advanced into an indispensable financial and safety asset, with its worth fluctuations immediately impacting inflation, client spending and geopolitical stability. The formation of OPEC in 1960 and the next oil crises within the Seventies demonstrated oil’s potential to drive inflation and form financial coverage. The petrodollar system, wherein oil transactions are settled in US {dollars}, has additional solidified oil’s function in world finance, guaranteeing sustained demand for the greenback and influencing US international coverage.

- Bitcoin: BTC’s potential as a reserve asset lies in its decentralized nature, fixed supply (21 million BTC) and resistance to financial debasement. In contrast to gold and oil, which require intensive infrastructure, Bitcoin could be transferred globally in minutes and saved at near-zero price.

As institutional adoption grows, Bitcoin’s strategic worth as a hedge in opposition to inflation and authorities debt is more and more acknowledged.

The way forward for US authorities’s Bitcoin coverage

Coverage strikes counsel that the institution of a strategic Bitcoin reserve might place it alongside conventional property like gold and oil sooner or later.

In January 2025, President Donald Trump signed an govt order titled “Strengthening American Management in Digital Monetary Expertise,” establishing the Presidential Working Group on Digital Asset Markets to discover the creation of a nationwide digital asset stockpile.

Constructing upon this initiative, on March 7, President Trump signed another executive order to create a “Strategic Bitcoin Reserve” and a “US Digital Asset Stockpile,” aiming to place the US as a leader in the cryptocurrency space. These reserves might be funded completely via cryptocurrencies seized throughout regulation enforcement operations, guaranteeing no taxpayer funds are utilized.

Nonetheless, the reserve might be funded utilizing cryptocurrencies already held by the federal government, primarily obtained via asset forfeitures quite than via new authorities purchases.

This technique has had blended reactions. Whereas some view it as a optimistic step towards embracing digital property, others specific concern over the shortage of recent investments and the potential implications of utilizing forfeited property. As of March 10, 2025, Bitcoin’s worth declined by greater than 5% to roughly $79,515, reflecting market disappointment over the reserve’s funding strategy.

Trying forward, the US authorities’s Bitcoin coverage is more likely to proceed evolving. The Presidential Working Group is predicted to supply suggestions by July 2025, which might affect future regulatory frameworks, funding methods and the mixing of digital property into the broader monetary system.

As world curiosity in cryptocurrencies grows, the US might additional refine its insurance policies to stability innovation with safety and financial stability alongside conventional property comparable to gold and oil, which stay integral to the nation’s monetary technique.