A big cryptocurrency dealer, often called a whale, misplaced greater than $308 million on a leveraged Ether place, underscoring the dangers of leveraged buying and selling throughout unstable market situations.

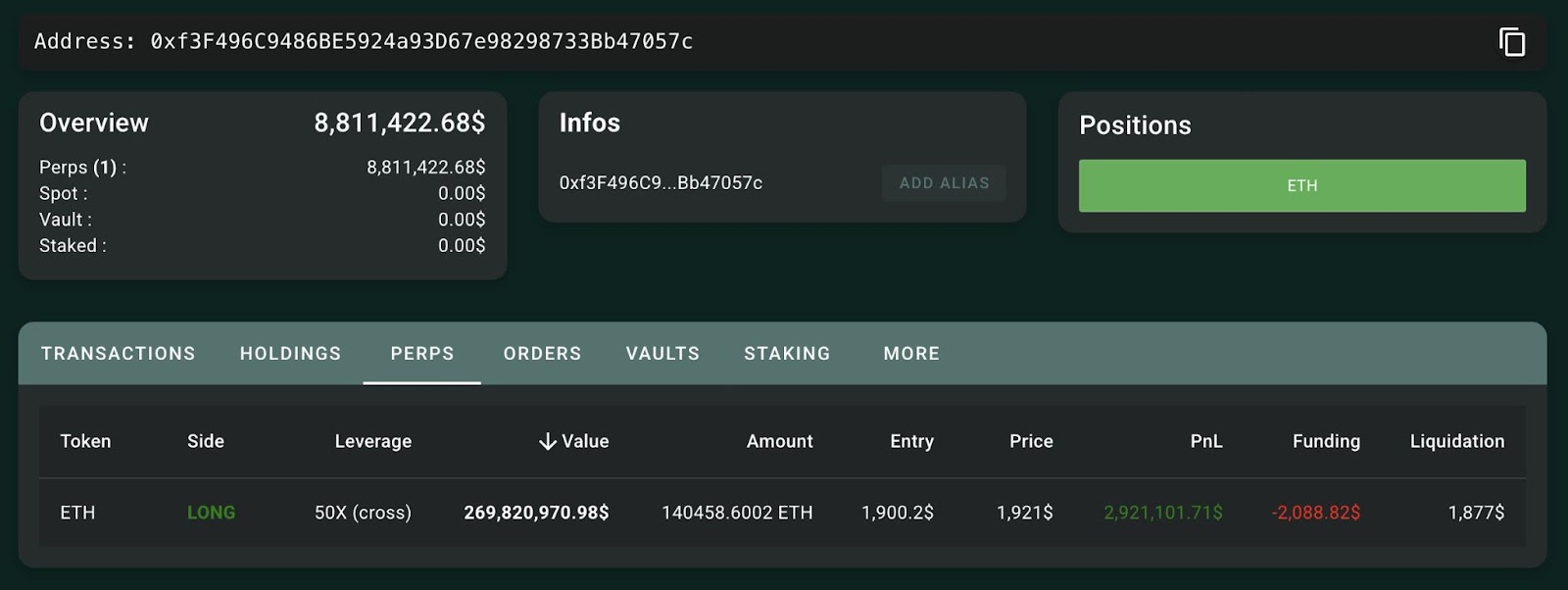

An unknown crypto dealer was liquidated on their 50x leveraged lengthy place for over 160,234 Ether (ETH), price greater than $308 million on the time of writing, Hypurrscan knowledge reveals.

Leveraged positions use borrowed cash to extend the dimensions of an funding, which may enhance the dimensions of each positive factors and losses, making leveraged buying and selling riskier in comparison with common funding positions.

The crypto dealer’s handle exhibiting transactions. Supply: Hypurrscan

The crypto whale opened the preliminary 50x leveraged place when ETH traded at $1,900, with a liquidation value of $1,877.

Supply: Lookonchain

In line with onchain intelligence agency Lookonchain, the whale had rotated all of his Bitcoin (BTC) holdings into the leveraged Ether commerce earlier than struggling the $306 million liquidation.

The liquidations got here throughout a interval of heightened volatility, as each crypto and conventional markets are restricted by international trade war concerns as a result of newest retaliatory tariffs from the European Union.

Associated: Bitcoin reserve backlash signals unrealistic industry expectations

Ether dangers correction to $1,800 amid tariff fears, ETF outflows

Ether’s value has fallen by greater than 53% because it started its downtrend on Dec. 16, 2024, after it had peaked above $4,100.

ETH/USD, 1-day chart, downtrend. Supply: Cointelegraph/ TradingView

The principle causes behind Ether’s downtrend are the continued macroeconomic issues and lack of builder exercise on the Ethereum community, in accordance with Bitfinex analysts.

“An absence of recent tasks or builders shifting to ETH, primarily because of excessive working charges, is probably going the principal cause behind the lackluster efficiency of ETH. [...] We consider that for ETH, $1,800 might be a powerful stage to observe,” the analysts advised Cointelegraph.

Associated: Deutsche Boerse to launch Bitcoin, Ether institutional custody: Report

“Nevertheless, the present sell-off isn't being seen solely in ETH, we have now seen a marketwide correction as fears over the affect of tariffs hit all danger property,” they added.

The US spot Ether exchange-traded funds (ETFs) are additionally limiting Ether’s upside.

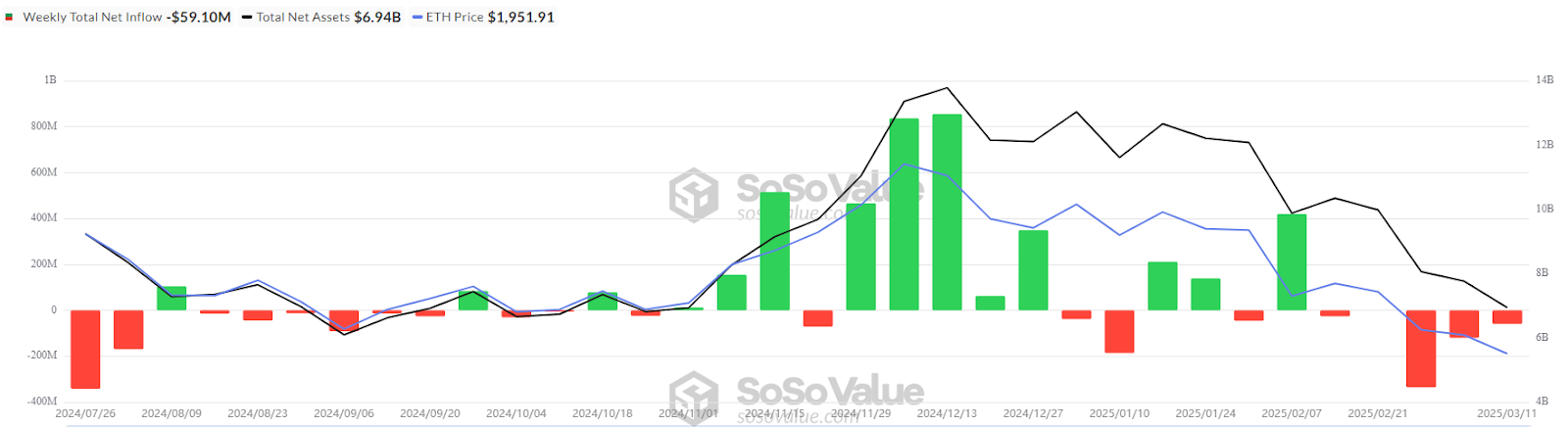

Complete spot Ether ETF web influx. Supply: Sosovalue

US spot Ether ETFs have entered a fourth consecutive week of web destructive outflows, after seeing over $119 million price of cumulative outflows in the course of the earlier week, Sosovalue knowledge reveals.

Journal: Ethereum L2s will be interoperable ‘within months’: Complete guide