The European Union’s newest retaliatory tariffs have deepened macroeconomic uncertainty, prompting crypto analysts to forecast elevated volatility for Bitcoin costs, which can drop beneath the vital $75,000 help stage.

The EU will impose counter-tariffs on 26 billion euros ($28 billion) value of US items beginning in April, the European Fee announced on March 12, responding to US President Donald Trump’s latest transfer to impose 25% tariffs on metal and aluminum imports.

This transfer is the newest retaliatory tariff announcement in response to US import tariffs, which can set off renewed trade war concerns and market volatility within the close to time period.

Supply: European Fee

“Counter tariffs aren’t a constructive sign as they counsel a possible bounce again from the opposite facet once more,” in line with Marcin Kazmierczak, co-founder and chief working officer of blockchain oracle answer agency, RedStone.

This will likely see Bitcoin (BTC) revisit $75,000, he informed Cointelegraph, including that “given stablecoins and RWAs [real world assets] stay at all-time-highs, it has the potential to rebound.”

“I don’t imagine that information can have a robust affect for now, however we’ll observe the response on the US finish,” he added.

Associated: Bitcoin reserve backlash signals unrealistic industry expectations

Different analysts nonetheless eye a short lived Bitcoin retracement below $72,000 as a part of a “macro correction” in the course of the present bull market cycle earlier than Bitcoin’s subsequent leg up.

Nonetheless, import tariffs will not be the one issue influencing Bitcoin’s value, Ryan Lee, chief analyst at Bitget Analysis, informed Cointelegraph, including:

“The costs are correlated with wider financial circumstances however are additionally influenced by elements past commerce insurance policies. Worldwide institutional adoption, regulatory updates and excessive utility make it extra resilient than conventional monetary devices.”

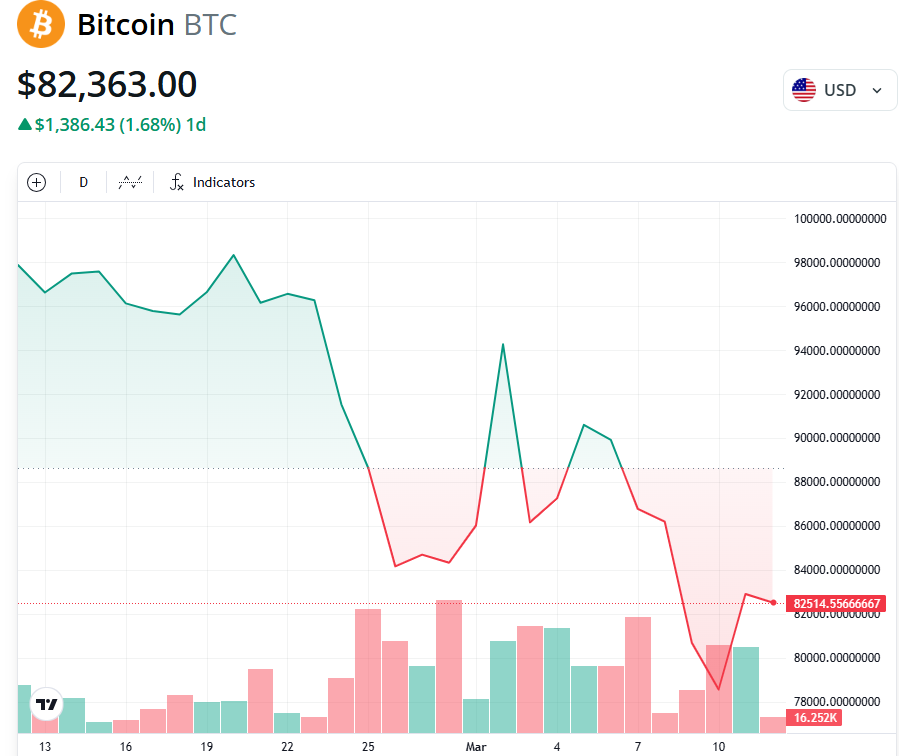

BTC/USD, 1-month chart. Supply: Cointelegraph

Europe introduced its retaliatory tariffs the identical day Trump’s elevated 25% tariffs on all metal and aluminum imports took impact. Europe’s present suspension of tariffs on US items will finish on April 1, and its new tariffs will take full impact by April 13.

Associated: Bitcoin may benefit from US stablecoin dominance push

International commerce tariff uncertainty might restrict markets till April 2

Conventional and cryptocurrency markets could also be restricted by tariff-related issues till April 2, in line with Aurelie Barthere, principal analysis analyst at Nansen.”

“Tariff noise is more likely to proceed until after April 2, and the reciprocal tariff bulletins, after which negotiations, and put a lid on danger urge for food.”

“That mentioned, we noticed tentative stabilization within the main US fairness indexes and BTC yesterday, on the low of their respective RSI, which we're monitoring,” she added.

Trump threatened to “considerably enhance” duties on automobiles coming into the US from Canada, set to take impact on April 2, except Canada decides to drop a few of its commerce tariffs.

Journal: SCB tips $500K BTC, SEC delays Ether ETF options, and more: Hodler’s Digest, Feb. 23 – March 1