American asset supervisor Franklin Templeton has entered the rising XRP exchange-traded fund (ETF) race, turning into the most recent agency to file for a spot XRP ETF in the US.

Franklin Templeton’s XRP (XRP) ETF is designed to trace the efficiency of the XRP worth, with XRP holdings saved at Coinbase Custody Belief, according to an official submitting with the US Securities and Alternate Fee on March 11.

On the identical day, the SEC postponed decisions on multiple crypto ETF filings, together with Grayscale’s proposal to transform its XRP Belief into an ETF.

Regardless of the rising XRP ETF submitting frenzy, BlackRock — issuer of the biggest spot Bitcoin (BTC) ETF — has but to submit a submitting for an XRP-based product.

Who has filed for an XRP ETF within the US?

As of March 12, 9 corporations have filed for XRP ETF merchandise within the US, together with main issuers like Bitwise, ProShares, 21Shares and others.

Bitwise, one of many world’s largest crypto funds managers, was the first firm to submit a Form S-1 filing for an XRP ETF on Oct. 2, 2024.

Canary Capital subsequently adopted, filing a Form S-1 for the same product on Oct. 8, 2024.

Switzerland-based crypto investment firm 21Shares and US ETF provider WisdomTree additionally filed for XRP ETFs in late 2024, with filings coming in November and December, respectively.

Asset supervisor ProShares joined the XRP ETF race in 2025 by submitting for a number of XRP ETF merchandise with the SEC on Jan. 17, including the ProShares XRP ETF and three further XRP funding merchandise.

Associated: VanEck registers Avalanche ETF in US as AVAX drops 55% year-to-date

One other XRP ETF submitting came from the European crypto funding agency CoinShares in January, with Grayscale proposing to convert its XRP Belief into an XRP ETF buying and selling on the New York Inventory Alternate on Jan. 30.

Volatility Shares, a Florida-based monetary companies agency based in 2019, additionally filed three XRP ETF merchandise on March 7, together with the Volatility Shares XRP ETF, the Volatility Shares 2x XRP ETF and the Volatility Shares -1x XRP ETF.

Different filings that includes XRP ETFs

Past devoted XRP ETF filings, no less than two asset managers have included XRP in broader crypto ETF merchandise.

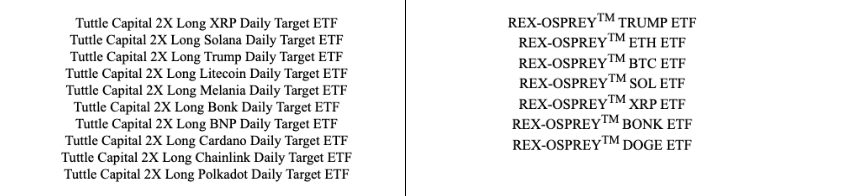

On Jan. 21, asset supervisor REX-Osprey filed for an “ETF Alternatives Belief,” which incorporates seven ETFs monitoring property together with main cash resembling XRP and Bitcoin, in addition to memecoins like Bonk (BONK) and Official Trump (TRUMP).

Equally, Tuttle Capital Administration submitted an ETF alternatives belief submitting, together with 10 each day goal ETFs, overlaying property resembling XRP and Melania (MELANIA).

ETF compositions within the ETF alternatives trusts by Tuttle Capital Administration and REX-Osprey. Supply: SEC

Other than BlackRock, various crypto ETF suppliers haven't but filed for XRP ETFs, together with Invesco, VanEck, ARK Make investments, Constancy Investments and Galaxy Digital.

Journal: SEC’s U-turn on crypto leaves key questions unanswered