The US Securities and Change Fee has delayed its resolution to approve a number of XRP, Solana, Litecoin and Dogecoin exchange-traded funds.

In a slew of filings on March 11, the company stated it has “designated an extended interval” to determine on the proposed rule adjustments that might permit the ETFs to proceed.

Among the many affected ETFs are Grayscale’s XRP (XRP) and Cboe BZX Change’s spot Solana (SOL) ETF filings, with the choices on them pushed till Might.

The SEC has delayed making a call to approve a number of altcoin ETFs. Supply: SEC

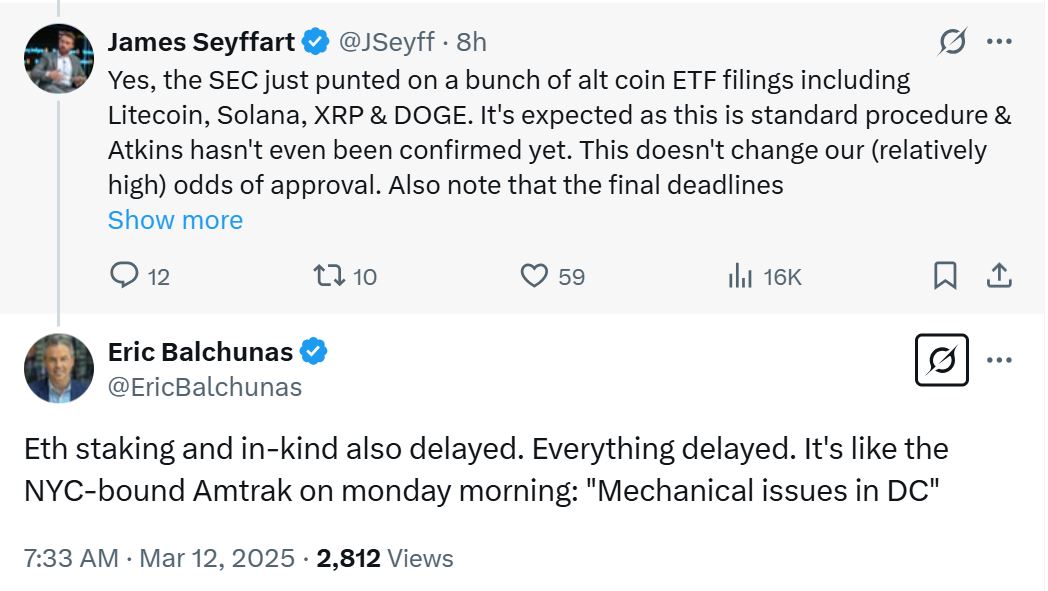

Bloomberg ETF analyst James Seyffart said in a March 11 X submit that whereas the SEC simply “punted on a bunch of altcoin ETF filings,” he didn’t see it as a trigger for concern. “It’s anticipated, as that is customary process.”

He added that US President Donald Trump’s decide to chair the SEC, Paul Atkins, “hasn’t even been confirmed but.”

“This doesn’t change our (comparatively excessive) odds of approval. Additionally notice that the ultimate deadlines aren’t till October,” Seyffart stated.

Supply: Samuel Maverick

Fellow Bloomberg ETF analyst Eric Balchunas additionally chimed in, saying that “every part [is] delayed,” together with ETFs that includes Ether (ETH) staking and in-kind redemptions.

Un early December, Trump picked pro-crypto businessman and former SEC Commissioner Atkins to be the company’s subsequent chair. Nevertheless, congressional affirmation hearings are but to be scheduled.

This isn't the primary time the SEC has prolonged an ETF resolution deadline. On Feb. 28, it extended the deadline for Cboe Exchange’s request to record choices tied to Ether (ETH) ETFs.

This adopted the SEC receiving a raft of altcoin ETF filings within the wake of Trump’s election and the resignation of former SEC Chair Gary Gensler.

Associated: Altcoin ETFs are coming, but demand may be limited: Analysts

Gensler’s time on the SEC got here with what the trade stated was an aggressive regulatory stance toward crypto, with 100 crypto-related regulatory actions throughout his tenure from 2021 till his resignation on Jan. 20.

Since Gensler’s departure, a rising variety of companies going through authorized motion from the regulator have had their circumstances dismissed, together with crypto exchange Gemini on Feb. 26 and crypto buying and selling agency Cumberland DRW on March 4.

In the meantime, acting SEC Chairman Mark Uyeda has additionally proposed abandoning part of a rule change that might have expanded regulation of other buying and selling methods to incorporate crypto companies.

Journal: SEC’s U-turn on crypto leaves key questions unanswered