The current GENIUS stablecoin invoice is merely a thinly veiled try and usher in central financial institution digital foreign money (CBDC) controls via privatized means, in line with Jean Rausis, co-founder of the Smardex decentralized buying and selling platform.

In a press release shared with Cointelegraph, Rausis mentioned that the US authorities will punish stablecoin issuers that don't adjust to the brand new regulatory framework, much like the European Union Markets in Crypto-Property (MiCA) rules. The manager added:

“The federal government realizes that in the event that they management stablecoins, they management monetary transactions. Working with centralized stablecoin issuers means they will freeze funds anytime they need — primarily what a CBDC would enable. So, why trouble making a CBDC?”

“With stablecoins beneath the federal government’s management, the end result is similar, with the false veneer of decentralization added as a bonus,” the manager continued.

Decentralized alternate options to centralized stablecoins, resembling algorithmic stablecoins and artificial {dollars}, will show to be a worthwhile bulwark towards this creeping government control over crypto, Rausis concluded.

First web page of the GENIUS Act. Supply: United States Senate

Associated: America must back pro-stablecoin laws, reject CBDCs — US Rep. Emmer

Revamped GENIUS invoice to incorporate stricter provisions

The Guiding and Establishing Nationwide Innovation for US Stablecoins (GENIUS) Act, introduced by Tennessee Senator Bill Hagerty on Feb. 4, proposed a complete framework for overcollateralized stablecoins resembling Tether’s USDt (USDT) and Circle’s USDC (USDC).

The bill was revamped to incorporate stricter Anti-Cash Laundering, reserve necessities, liquidity provisions and sanctions checks on March 13.

These extra provisions will presumably give US-based stablecoin issuers an edge over their offshore counterparts.

Through the current White Home Crypto Summit, US Treasury Secretary Scott Bessent mentioned the US would use stablecoins to ensure US dollar hegemony in funds and defend its position as the worldwide reserve foreign money.

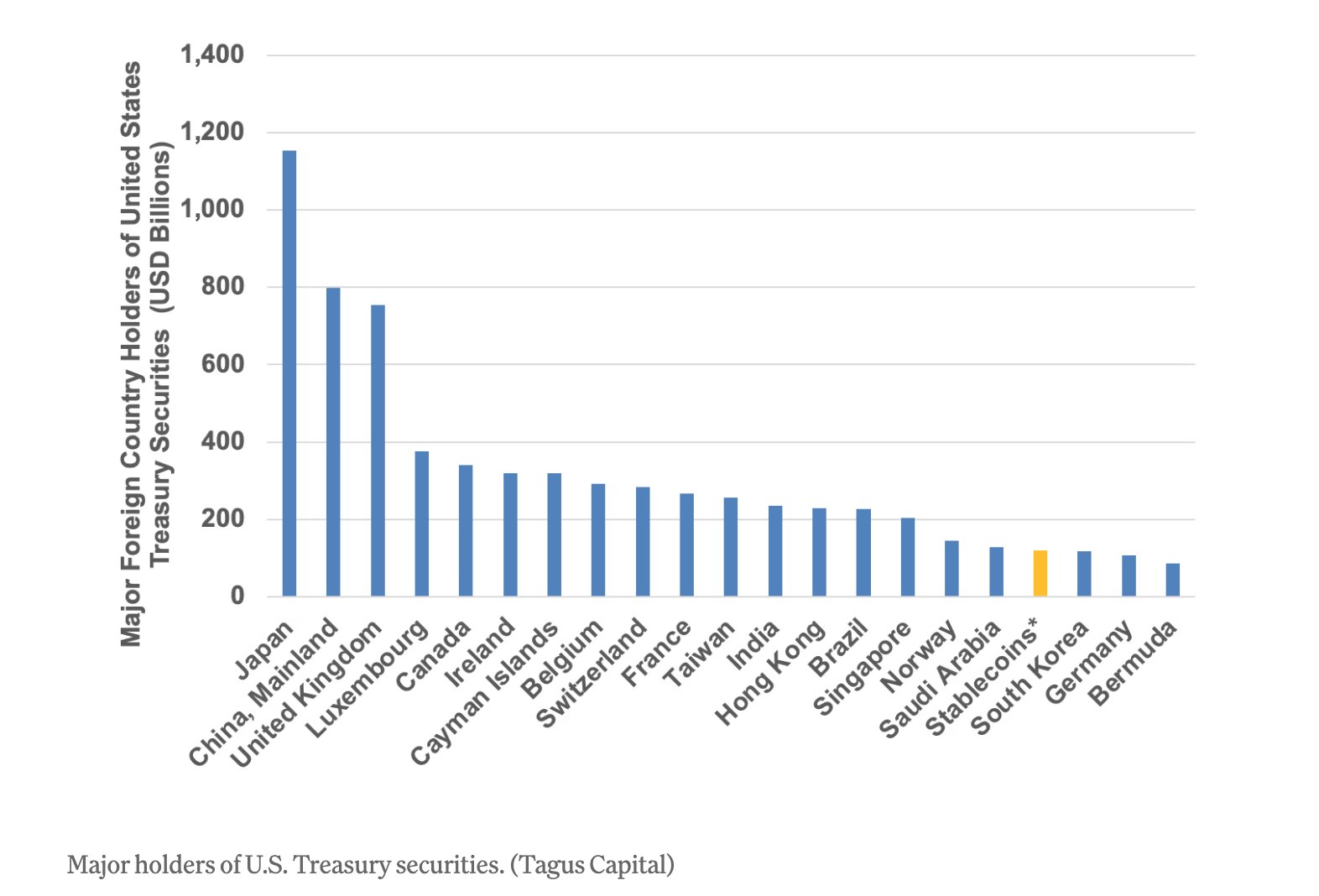

Largest holders of US authorities debt. Supply: Peter Ryan

Centralized stablecoin issuers depend on US financial institution deposits and short-term money equivalents resembling US Treasury payments to again their digital fiat tokens, which drives up demand for the US greenback and US debt devices.

Stablecoin issuers collectively maintain over $120 billion in US debt — making them the 18th-largest purchaser of US authorities debt on the planet.

Journal: Bitcoin payments are being undermined by centralized stablecoins