Ethereum’s native token, Ether (ETH), dropped under $2,000 on March 10, and the altcoin has struggled to regain a place above the psychological degree.

Whereas Bitcoin (BTC) and XRP (XRP) exhibited minor recoveries over the previous 24 hours, Ether costs didn't show bullish momentum within the charts.

The altcoin plummeted to a multi-year low of $1,752 on March 11. Nonetheless, onchain knowledge and technical evaluation point out that the worth might drop a further 15% within the coming weeks.

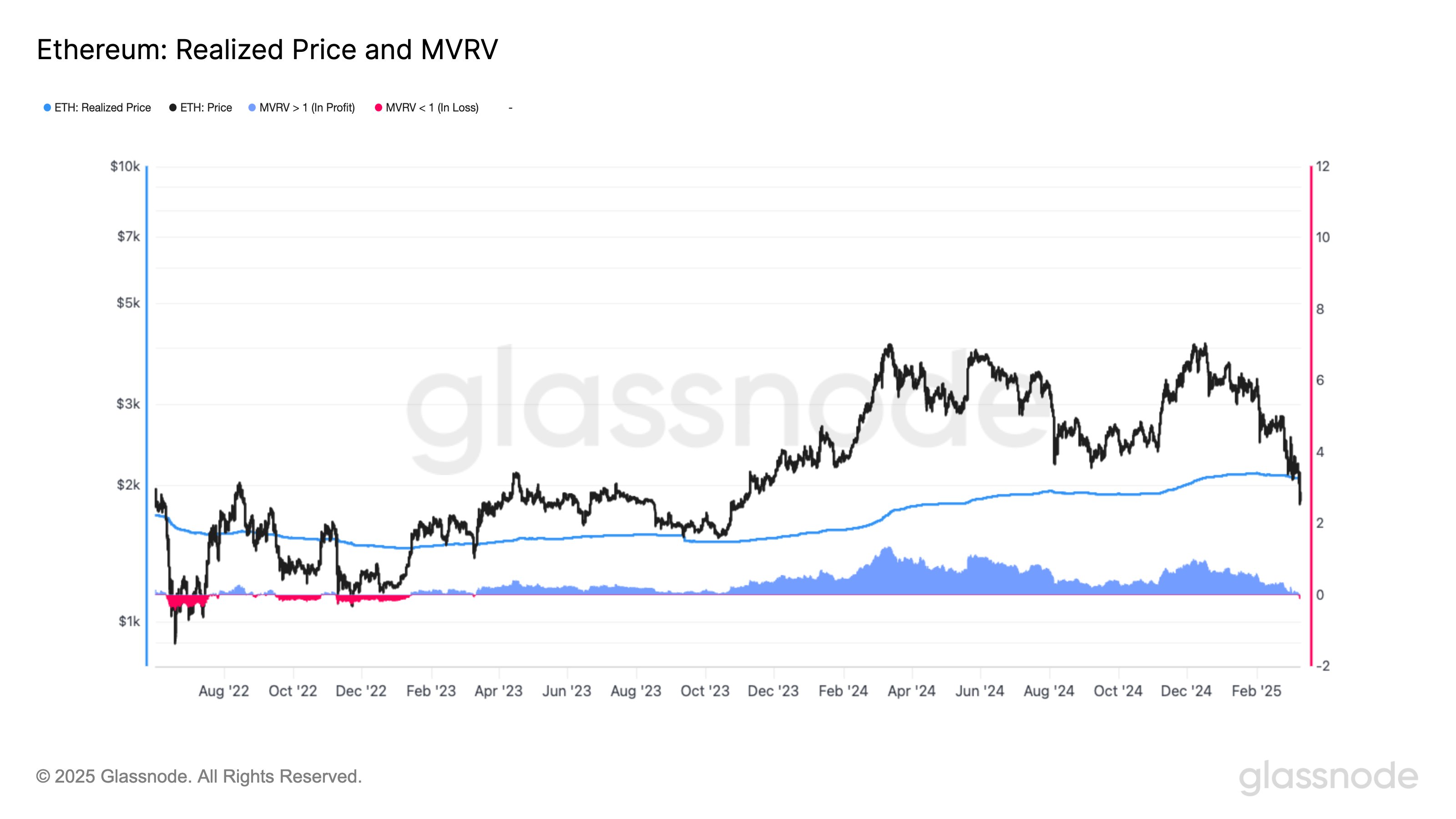

Ethereum dips under realized value after 2 years

The present value deviation under $2,000 carried onchain implications for the altcoin. In keeping with Glassnode, a knowledge analytics platform, ETH dropped under its realized value of $2,054 for the primary time since February 2023.

Ethereum realized value and MVRV. Supply: X.com

ETH realized value calculates the typical value of every ETH final moved, representing the typical value foundation of the overall circulating provide. The present drop under the realized value signifies widespread unrealized loss for all ETH holders.

The market worth to realized worth (MVRV) ratio additionally dropped to 0.93, indicating a 7% common loss for all ETH holders throughout the community. Nonetheless, you will need to observe that the realized value displays the weighted common of all historic transactions. Therefore, it encompasses the associated fee foundation of each ETH holder, not a particular timeframe like 2023 to 2025.

Ethereum’s TVL chart. Supply: DefiLlama

In the meantime, Ethereum’s complete worth locked (TVL) dropped to a six-month low of $45.6 billion on March 12, down 41% from its peak of $77 billion on Dec. 17, 2024.

Moreover, the overall charges customers paid to make use of Ethereum fell to $46.28 million—the bottom degree since July 2020—additional signaling weakening community engagement.

Related: Starknet to settle on Bitcoin and Ethereum to unify the chains

Ether value between $1.6K-$1.9K is “engaging”

In a current X put up, Glassnode explained how Ethereum’s cost-basis distribution could possibly be helpful in figuring out potential help ranges for ETH. Based mostly on a weekly outlook, Ether’s current drop under $1,880 led to an accumulation of 600,000-700,000 ETH round $1,900. The put up states,

“This means $1.9K might set up itself as a help if $ETH consolidates at present ranges. Above spot, $2.2K (465K $ETH) is the potential subsequent resistance. The availability hole between $1.9K and $2.2K stays skinny, making a short-term transfer in direction of resistance believable.”

Ethereum weekly evaluation by Ninja. Supply: X.com

On the identical time, nameless analyst Ninja believes that the ground value for Ethereum stays between $1,600 and $1,900.

The dealer added that the above vary is an “engaging area for industrial cash” and set a excessive swing goal at $2,500.

Related: Bitcoin whales hint at $80K ‘market rebound’ as Binance inflows cool

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.