Digital asset change DigiFT has launched Invesco’s tokenized personal credit score technique on Arbitrum, additional increasing the use instances of real-world belongings (RWA) and giving institutional buyers entry to onchain credit score markets.

Based on a March 13 announcement, Invesco’s US Senior Mortgage Technique (iSNR) token is now reside on Arbitrum, a preferred Ethereum layer-2 community.

The tokenized asset was launched on Feb. 19 and is designed to trace the efficiency of a non-public credit score fund managed by Invesco, a publicly traded funding supervisor headquartered in Atlanta, Georgia.

On the time of launch, the Invesco fund had $6.3 billion in belongings below administration, in line with Bloomberg.

DigiFT described the iSNR token because the “first and solely tokenized personal credit score technique.”

The iSNR tokenized fund has a minimal funding of $10,000. Supply: DigiFT

DigiFT CEO Henry Zhang stated including iSNR to Aribitrum will increase its utility by “permitting DeFi functions, DAOs and institutional buyers to combine with a regulated, onchain personal credit score technique.”

In keeping with the preliminary launch of iSNR on Ethereum final month, buyers on Arbitrum can buy tokenized shares utilizing well-liked stablecoins USDC (USDC) and USDt (USDT).

Associated: Cantor Fitzgerald taps Anchorage Digital, Copper as Bitcoin custodians

DeFi tokenization on the rise

Regardless of the current crypto market downtrend, RWA tokenization seems to be heating up with the launch of a number of DeFi-oriented merchandise. Constructive regulatory developments, the rise of liquid multichain economies and improvements in decentralized exchanges are anticipated to push RWA tokenization into the crypto limelight this 12 months.

Earlier this week, tokenization firm Securitize introduced that oracle supplier RedStone will deliver price feeds for its tokenized merchandise, which embrace the BlackRock USD Institutional Liquidity Fund (BUIDL) and the Apollo Diversified Credit score Securitize Fund (ACRED).

The combination implies that Securitize’s funds “can now be utilized throughout DeFi protocols comparable to Morpho, Compound or Spark,” RedStone’s chief working officer, Marcin Kazmierczak, advised Cointelegraph.

In the meantime, asset supervisor Franklin Templeton has launched a tokenized money fund on the Coinbase layer-2 community Base and a US government money fund on Solana.

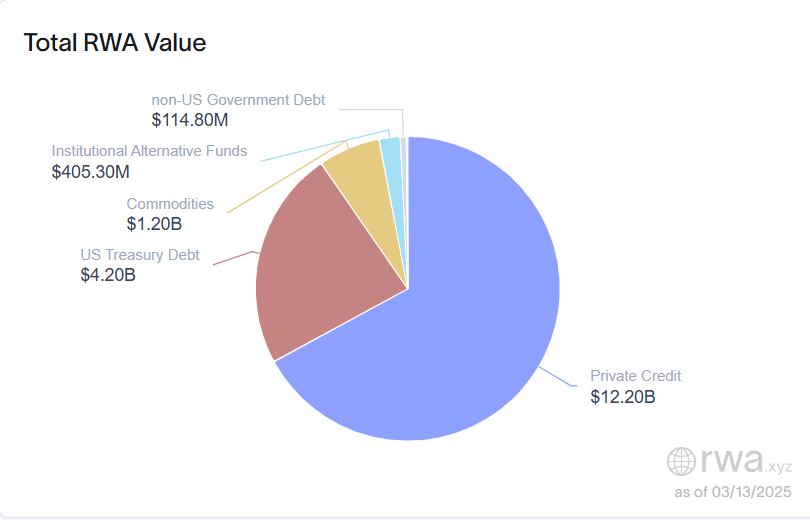

Non-public credit score ($12.2 billion) and US Treasury debt ($4.2 billion) have dominated real-world asset tokenization up to now. Supply: RWA.xyz

Based on trade knowledge, the whole worth of RWAs onchain has grown by 17.5% over the previous 30 days to achieve $18.1 billion. Non-public credit score and US Treasury debt account for almost 91% of that complete.

Associated: Trump-era policies may fuel tokenized real-world assets surge