European customers have proven minimal curiosity in adopting a central financial institution digital forex (CBDC), elevating issues for the European Central Financial institution (ECB) because it prepares for a possible rollout of the digital euro.

An ECB working paper on “Client attitudes in direction of a central financial institution digital forex,” which surveyed about 19,000 respondents throughout 11 euro-area nations, highlighted important communication challenges which are discouraging European households from adopting the digital euro.

When requested to hypothetically allocate 10,000 euros (roughly $10,800) throughout numerous property, Europeans allotted solely a small portion to the digital euro, having little influence on conventional liquid property like money, present accounts or financial savings accounts.

Causes for not adopting a digital euro for retail funds. Supply: European Central Financial institution

According to the March 12 ECB working paper, Europeans have a powerful desire for current fee strategies and see no actual profit in a brand new sort of fee system amid myriads of offline and on-line alternate options:

“This discovering additionally means that convincing some customers of the worth added of a CBDC would possibly pose a problem for policymakers, and extra analysis will definitely be wanted on this space.”

The examine steered that whereas a digital euro could possibly be launched with minimal disruption to monetary stability, its adoption faces important hurdles because of client habits.

Moreover, it pressured the significance of focused communication to handle persistent client reluctance towards a digital euro.

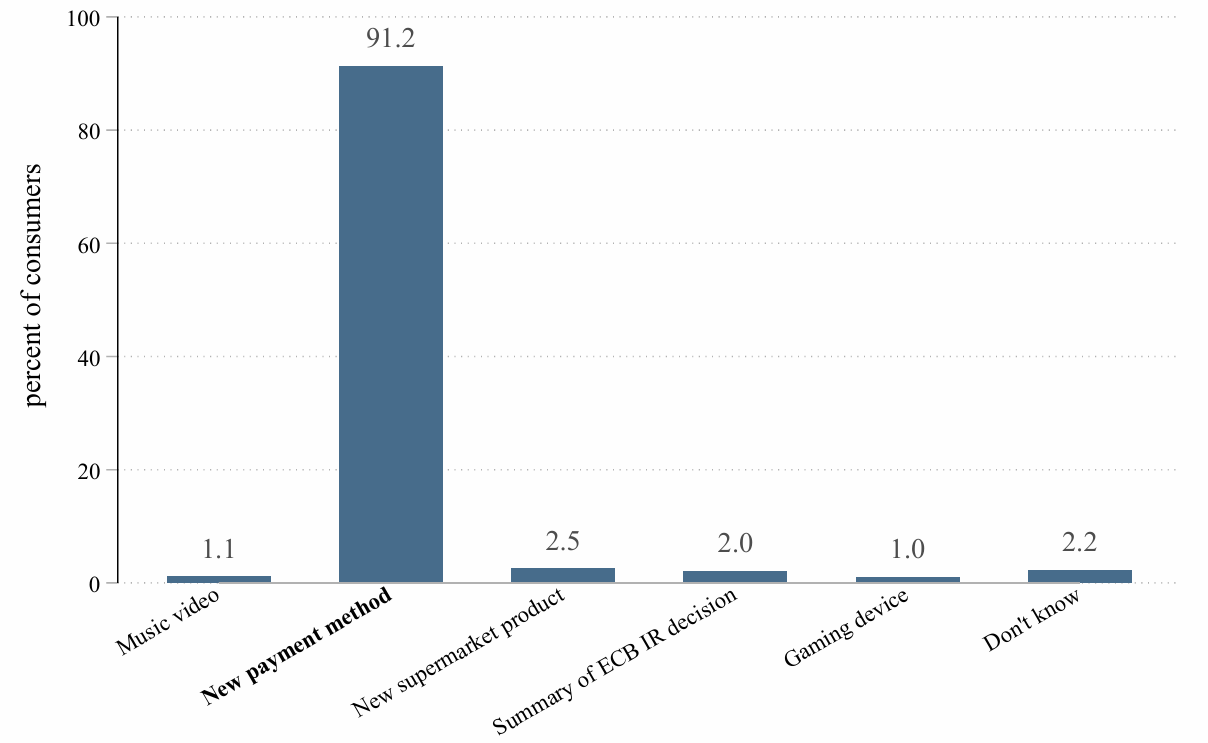

Put up-treatment consideration checks carried out on European respondents. Supply: ECB

The ECB paper discovered that European customers have been receptive to video-based schooling and coaching and concluded that educating the lots with CBDC-related video info may assist with the widespread adoption of the digital euro:

“We discover proof that customers who're proven a brief video offering concise and clear communication about the important thing options of the digital euro are considerably extra prone to replace their beliefs about this new type of fee, which, in flip, will increase their quick probability of adopting it in comparison with an untreated management group.”

Associated: European lawmakers silent on US Bitcoin reserve amid digital euro push

The examine’s launch comes as US lawmakers intensify their opposition to CBDCs. Speaking at the House Financial Services Committee listening to on March 11, Consultant Tom Emmer mentioned Congress ought to “prioritize pro-stablecoin laws alongside anti-CBDC laws.”

Emmer speaks through the Home Monetary Companies Committee Listening to on CBDCs. Supply: emmer.home.gov

Emmer mentioned, “CBDC know-how is inherently un-American” and unelected officers shouldn't be allowed to concern it. Emmer additionally reintroduced the CBDC Anti-Surveillance State Act, which might forestall future US administrations from launching CBDCs.

In the meantime, Deutsche Börse CEO Stephan Leithner just lately referred to as for the establishment of a permanent digital euro, amongst different reforms, to strengthen the area’s monetary autonomy.

Journal: Crypto fans are obsessed with longevity and biohacking: Here’s why