Turkey is advancing its cryptocurrency rules with new guidelines for crypto asset service suppliers (CASPs).

On March 13, the Capital Markets Board (CMB) of Turkey published two regulatory paperwork associated to the licensing and operations of CASPs, together with crypto exchanges, custodians and pockets service suppliers.

The framework grants the CMB full oversight of crypto platforms, guaranteeing compliance with nationwide and worldwide requirements.

An excerpt from the title web page of the CASP regulation doc by the CMB. Supply: Official Gazette

It additionally units requirements and necessities for establishing and offering crypto asset providers in Turkey, reminiscent of institution capital, historical past of executives, shareholder guidelines and others.

Stricter necessities for CASPs

Below the framework, CASPs can be required to put money into compliance infrastructure and set up devoted danger administration groups to determine and handle a variety of dangers. The suppliers can even have to determine a worth monitoring system to alert suspicious buying and selling exercise.

Turkish CASPs can even have to stick to stringent reporting necessities, offering the CMB with well timed details about their operations.

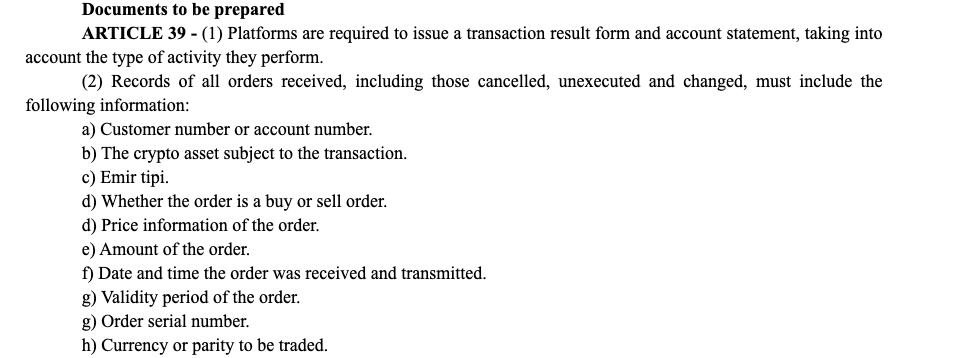

Moreover, the brand new framework additional strengthens Turkey’s crypto Anti-Cash Laundering (AML) requirements, requesting CASPs to document vital information units of transaction data, together with canceled and unexecuted transactions.

An excerpt from CMB’s CASP regulation doc (translated by Google). Supply: Official Gazette

Turkey beforehand introduced crypto AML regulations in December 2024, requiring customers to share figuring out data with CASPs for transactions of greater than 15,000 Turkish liras ($409).

In keeping with the doc, Turkey’s new crypto rules align with international requirements and comply with regulatory approaches set by Europe’s Markets in Crypto-Assets Regulation (MiCA) and the US Securities and Trade Fee.

Journal: How crypto laws are changing across the world in 2025