Bitcoin miners are adapting their enterprise methods because the continued commerce conflict between the US and Canada makes power costs and insurance policies all of the extra unsure.

US President Donald Trump threatened to double his tariffs on metal and aluminum from 25% to 50%, leading the federal government of the province of Ontario to stroll again its personal plan to extend the price of energy exports to the US.

Ontario Premier Doug Ford had promised to additional improve the surcharge or even “shut off the electrical energy utterly,” given additional provocation. Nonetheless, he seems to have softened his stance, at the very least for now.

The commerce conflict could have reached a lull, however some crypto corporations are trying forward at doable coverage modifications with a view to shield their development.

Bitcoin miners anticipate modifications in power markets

Ben Ganon, the CEO of Canadian Bitcoin mining agency Bitfarms, told Bloomberg on March 11 that the latest power worth hikes, had they gone by means of, have been unlikely to have an effect on his agency’s enterprise.

Bitfarms’ operations are principally in Quebec and British Columbia, each of which boast important hydroelectric capability in relation to the whole provincial power combine. Ontario, by comparability, is “not as sturdy of an power market. And over the past a number of years, they’ve actually taken a giant push on reducing again on baseload capability.”

However regardless that Bitfarms’ power scenario could look strong in the meanwhile, Ganon stated that the tariffs “have implications for what coverage and regulatory frameworks are going to appear to be sooner or later.”

He stated that his agency desires to see “better entry to electrical energy markets” in addition to fewer rules on organising a brand new enterprise or new energy purposes.

Power coverage has been a contentious space of debate in Canadian politics, with critics accusing the Liberal authorities — now led by Prime Minister Mark Carney — of harming the Canadian financial system with their methods to decrease emissions.

Associated: What Canada’s new Liberal PM Mark Carney means for crypto

Ganon stated: “The alternatives which are current in america are additionally current in Canada. And I feel that this may all resolve itself and find yourself in a way more deregulated and easy and environment friendly market as a result of for years it’s been tied up in regulatory pink tape.”

How would a Bitcoin miner profit from tariffs?

Tariffs on items similar to metal, aluminum, and different industrial merchandise — supposed to encourage home manufacturing within the US— additionally influence Bitcoin miners, with some results being unexpectedly helpful.

Whereas Ganon famous that miners can’t management the Bitcoin worth, they will management their electrical energy prices. “One of many ways in which we are able to do that's we are able to search for pockets of power which are underutilized, that used to energy heavy trade, which has been outsourced to different nations over the past 20 or 30 years.”

In line with Ganon, Bitfarms has operations in Pennsylvania — a “Rust Belt” state closely affected by the outsourcing of American metal and metals industries. His agency’s property may quickly be in excessive demand if the US manufacturing trade have been to come back again from the lifeless.

Ganon stated that Bitcoin miners have been investing closely in power infrastructure that “used to energy aluminum smelters and metal refineries and all of the stuff which was outsourced.”

“Now Bitcoin miners have these property. And because the pendulum swings again to America, these property are actually in excessive demand.”

China tariffs squeeze Bitcoin mining {hardware}

Canadian miners like Bitfarms could also be unconcerned for now, however Trump’s tariffs on China have already begun to squeeze American crypto miners, who import {hardware} from China-based corporations like Bitmain.

In line with Bloomberg, shipments of Bitcoin mining {hardware} from China to the US have been experiencing important delays as of February 2025. The delays reportedly have been the results of the US blacklisting Bitmain’s AI affiliate Xiamen Sophgo Applied sciences.

Heavy customs charges for inspections of Bitmain-affiliated {hardware} have price US miners as much as $500,000, in response to Vishnu Mackenchery, director of worldwide logistics and companies at Compass Mining Inc. New tariffs may make new imports of next-gen miners to the US “utterly cost-prohibitive,” in response to Synteq Digital CEO Taras Kulyk.

China-based mining {hardware} producers like Bitmain may arrange operations in different nations to keep away from US sanctions. Throughout Trump’s first time period, when he imposed a 25% tax obligation on a variety of shopper digital items from China, many mining {hardware} producers moved to Malaysia, Indonesia and Thailand to keep away from tariffs.

Bitmain even introduced it could launch a US manufacturing line in December 2024 to “present quicker response occasions and extra environment friendly companies to the North American prospects.” Bloomberg famous that the agency didn't present the precise location of its US line.

Associated: Treasury Secretary Scott Bessent says US ought to convey BTC onshore

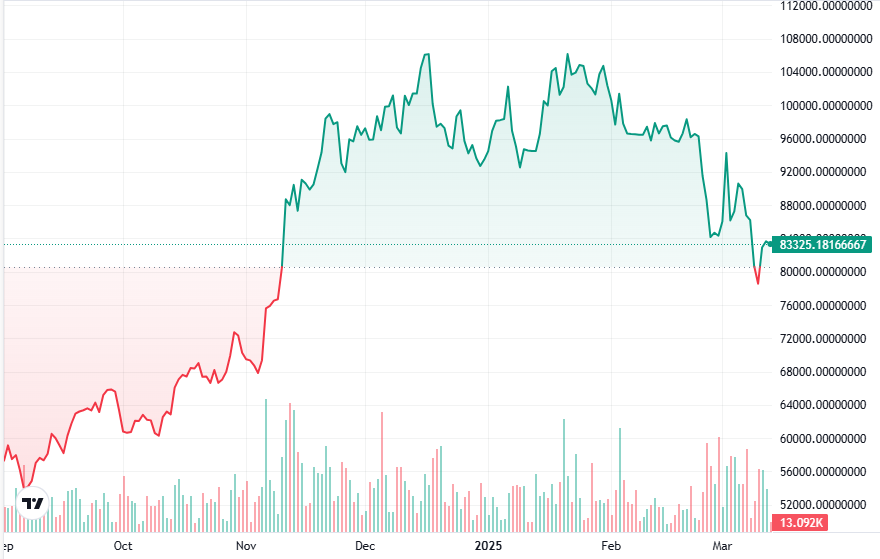

Trump’s financial insurance policies proceed to be a blended bag for the crypto trade. Wild fluctuations in commerce coverage and last-minute reversals have made the market troublesome to foretell. Elsewhere, the European Union has promised to impose counter-tariffs on the US, additional threatening asset valuations.

Bitcoin worth chart Sept. 1, 2024 to March 13, 2025. Supply: TradingView

Marcin Kazmierczak, co-founder and chief working officer of blockchain oracle resolution agency RedStone, advised Cointelegraph this might see Bitcoin sink to $75,000, a degree not seen since November 2024.

Journal: Mystery celeb memecoin scam factory, HK firm dumps Bitcoin: Asia Express