Bitcoin’s worth was up 3% after fixed drawdowns because the finish of January. The highest cryptocurrency managed to rebound above $80,000 after a short decline beneath the vary on March 11.

Bitcoin weekly chart. Supply: Cointelegraph/TradingView

After the US core Client Value Index (CPI) came in lower than expected at 3.1% on March 12, Bitcoin's market construction now sees the potential of a fast bullish turnaround.

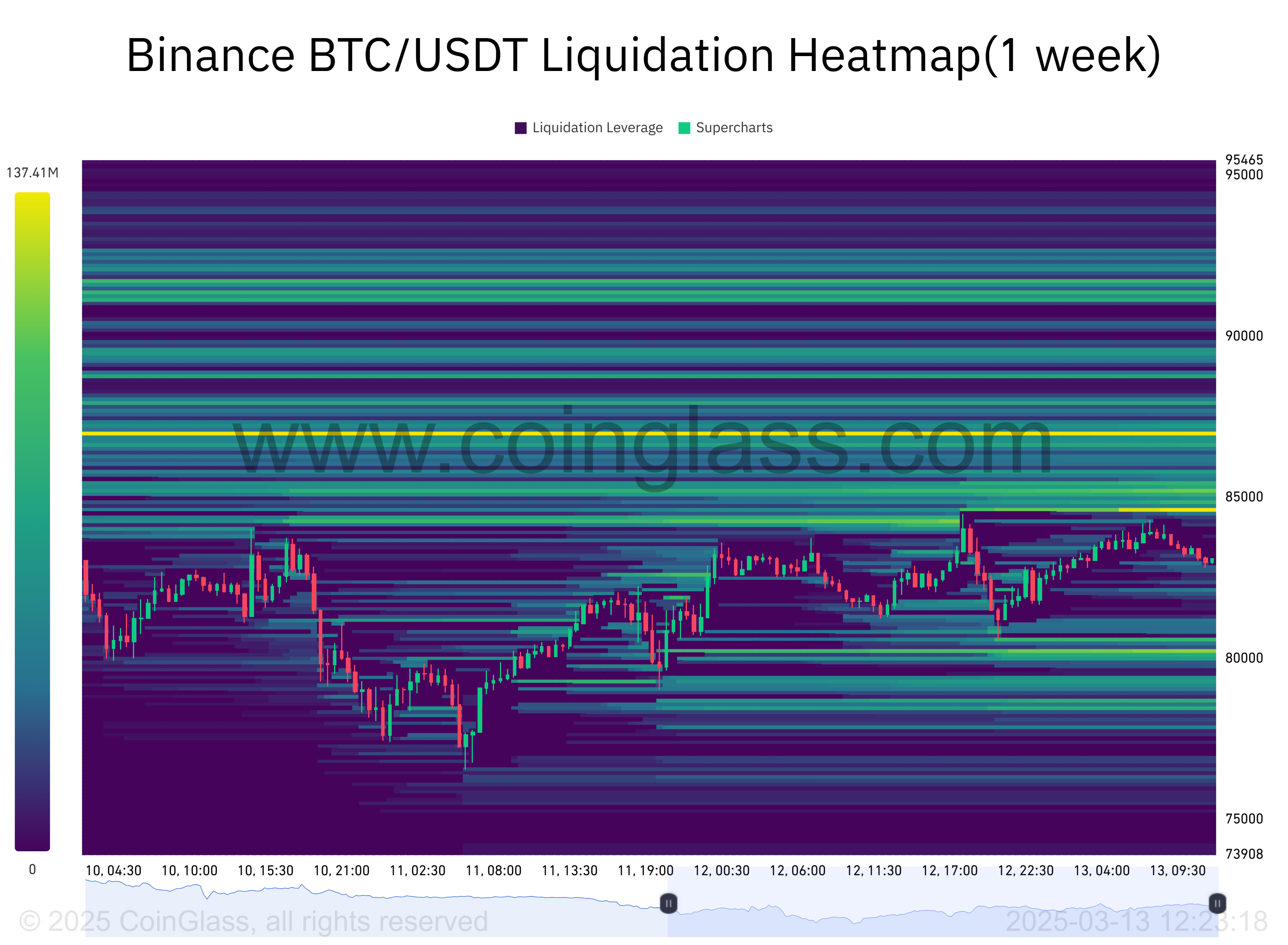

Bitcoin liquidity clusters at $84K-$85K

After Bitcoin's (BTC) worth tumbled on March 9, it rebounded to check the overhead resistance zone between $84,000 and $85,000 thrice, spurring merchants to aggressively construct quick positions on this vary.

The liquidation heatmap information recommended that greater than $300 million briefly positions had been piled on this worth area, which might be liquidated if the worth moved above the $85,000 resistance.

Bitcoin 1-week liquidation heatmap. Supply: CoinGlass

With a scarcity of draw back liquidity beneath $77,000, the chance of BTC transferring towards upside liquidity elevated. Furthermore, triggering liquidations above $85,000 may gasoline additional bullish momentum, permitting Bitcoin to kind the next excessive and switch this degree into new assist.

A CME Bitcoin futures hole from the earlier weekend additionally remained unfilled between $85,000 and $86,000. With a 100% document of six gaps stuffed up to now 4 months, this setup additional elevated the possibilities of flipping the overhead resistance into assist at $85,000.

Bitcoin 4-hour chart. Supply: Cointelegraph/TradingView

If this occurs, the following main resistance lies at $90,000, which may liquidate over $1.6 billion briefly positions for a retest of the $95,000 resistance degree above, i.e., a 12% leap from the present worth.

Related: Bitcoin must secure weekly close above $89K to confirm bottom has passed

Bitcoin analyst Mark Cullen underlined an analogous outlook for Bitcoin however warned that the worth continues to maneuver “correctively,” implying additional sideways motion earlier than a brief squeeze.

Quite the opposite, Valeria, a crypto analyst and funded dealer, said that BTC was exhibiting indicators of distribution close to the $85,000 vary, which is short-term bearish. The dealer highlighted that the BTC worth would possibly thread decrease beneath $80,000 earlier than a bullish breakout happens.

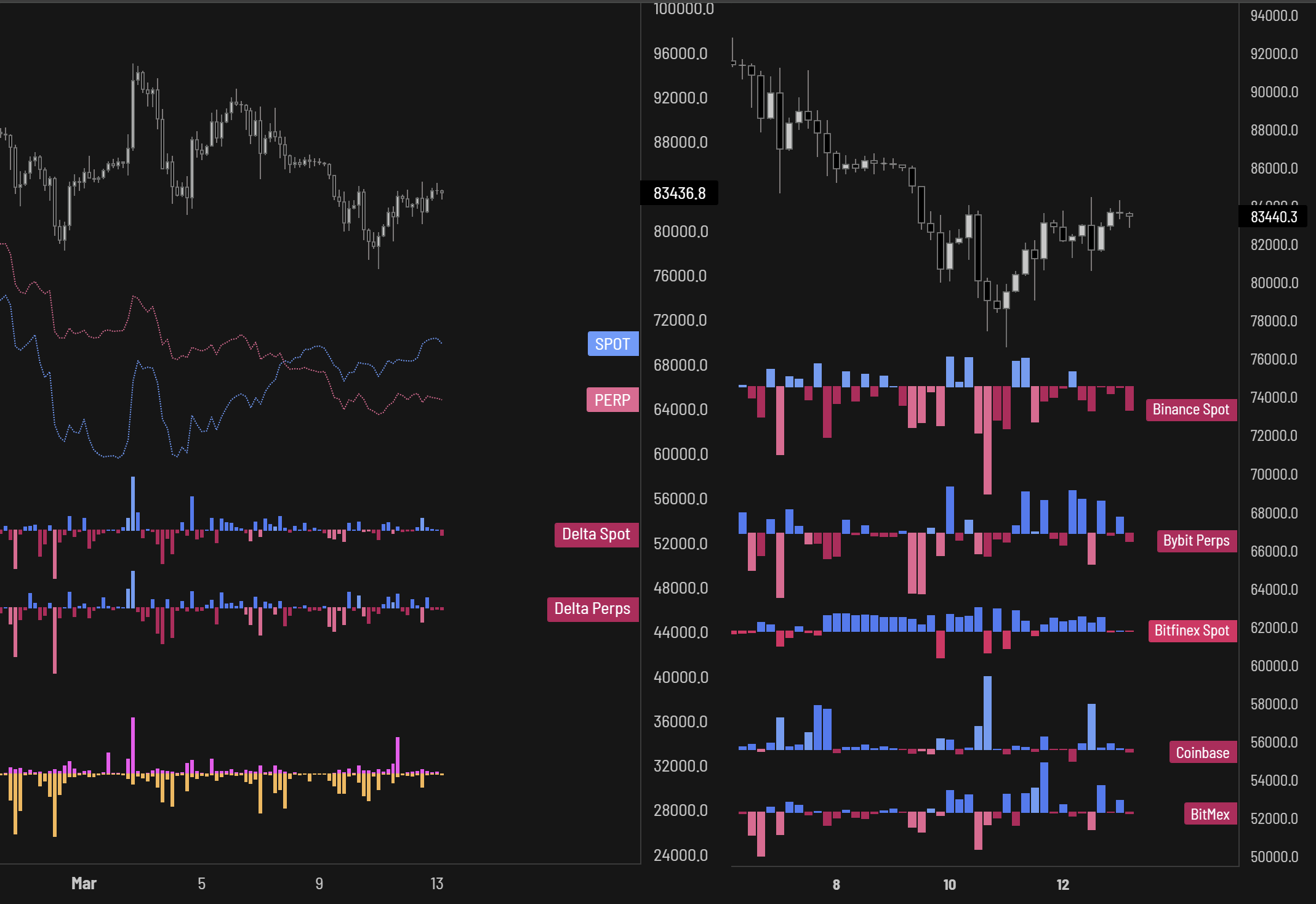

Coinbase, Binance diverge on orderbook traits

Spot merchants on Binance have been aggressively promoting over the previous few days, in keeping with data from Aggr.commerce, with promoting strain peaking in the course of the native lows at $76,650.

Conversely, Coinbase spot patrons positioned bids right here, resulting in BTC’s rebound above $80,000.

Binance, Coinbase orderbooks. Supply: Aggr.commerce

On March 12, an analogous discrepancy was noticed, with Binance spot merchants promoting close to the $85,000 resistance, as Coinbase merchants defended the worth at $81,000 in the course of the early US buying and selling session, avoiding additional draw back.

Related: Crypto trading volume slumps, signaling market exhaustion: Analysis

Whereas Coinbase has led BTC’s rally up to now, an opposing stance between the 2 main exchanges would possibly sluggish BTC’s momentum to maneuver swiftly by the resistance ranges.

Thus, for Bitcoin to reclaim greater highs at $85,000, $90,000 and $95,000 over the following couple of weeks, spot buying and selling exercise between the 2 main exchanges may have extra collective route.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.