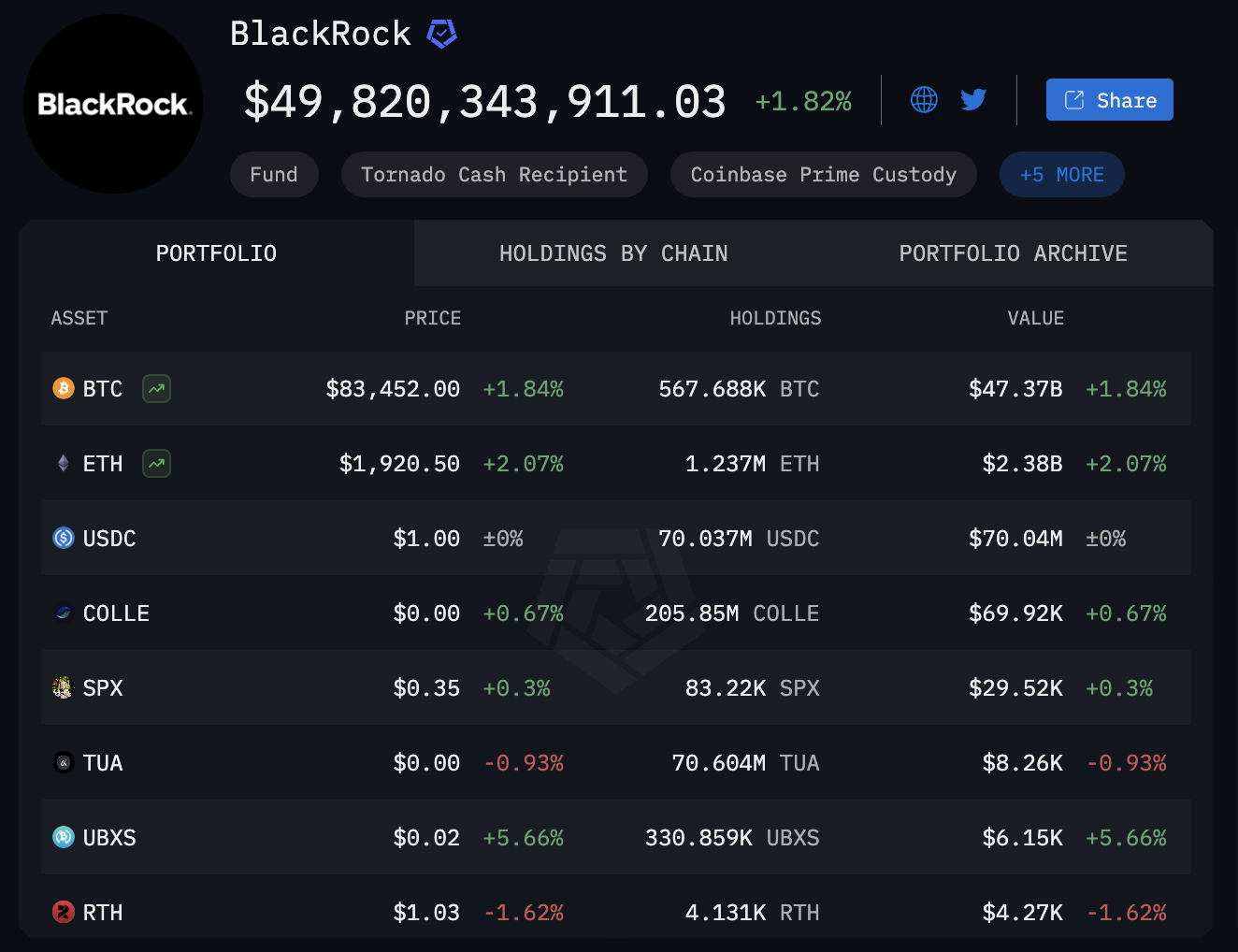

BlackRock, the world’s largest asset supervisor with roughly $11.6 trillion in property below administration, at present holds over 567,000 Bitcoin (BTC), valued at over $47.8 billion — making the asset supervisor one of many largest holders of BTC on this planet.

Based on Arkham Intelligence, the asset supervisor’s most up-to-date BTC acquisition occurred on March 14 when a Coinbase Prime pockets transferred 268 BTC, valued at over $22 million, to the asset supervisor’s iShares Bitcoin ETF (IBIT) pockets.

Monitoring onchain funds to and from BlackRock. Supply: Arkham Intelligence

Information from Arkham additionally reveals that the asset supervisor holds over 1.2 million Ether (ETH), valued at over $2.3 billion, roughly 70 million of the USDC (USDC) stablecoin and an extended listing of altcoins.

The Bitcoin exchange-traded funds (ETFs) are broadly cited as probably the most profitable ETF launch in historical past, as asset managers like BlackRock drive tens of billions in liquidity to the crypto markets and disrupt the cyclical capital rotation that characterizes crypto funding.

BlackRock’s crypto holdings. Supply: Arkham Intelligence

Associated: BlackRock Bitcoin fund sheds $420M as ETF losing streak hits day 7

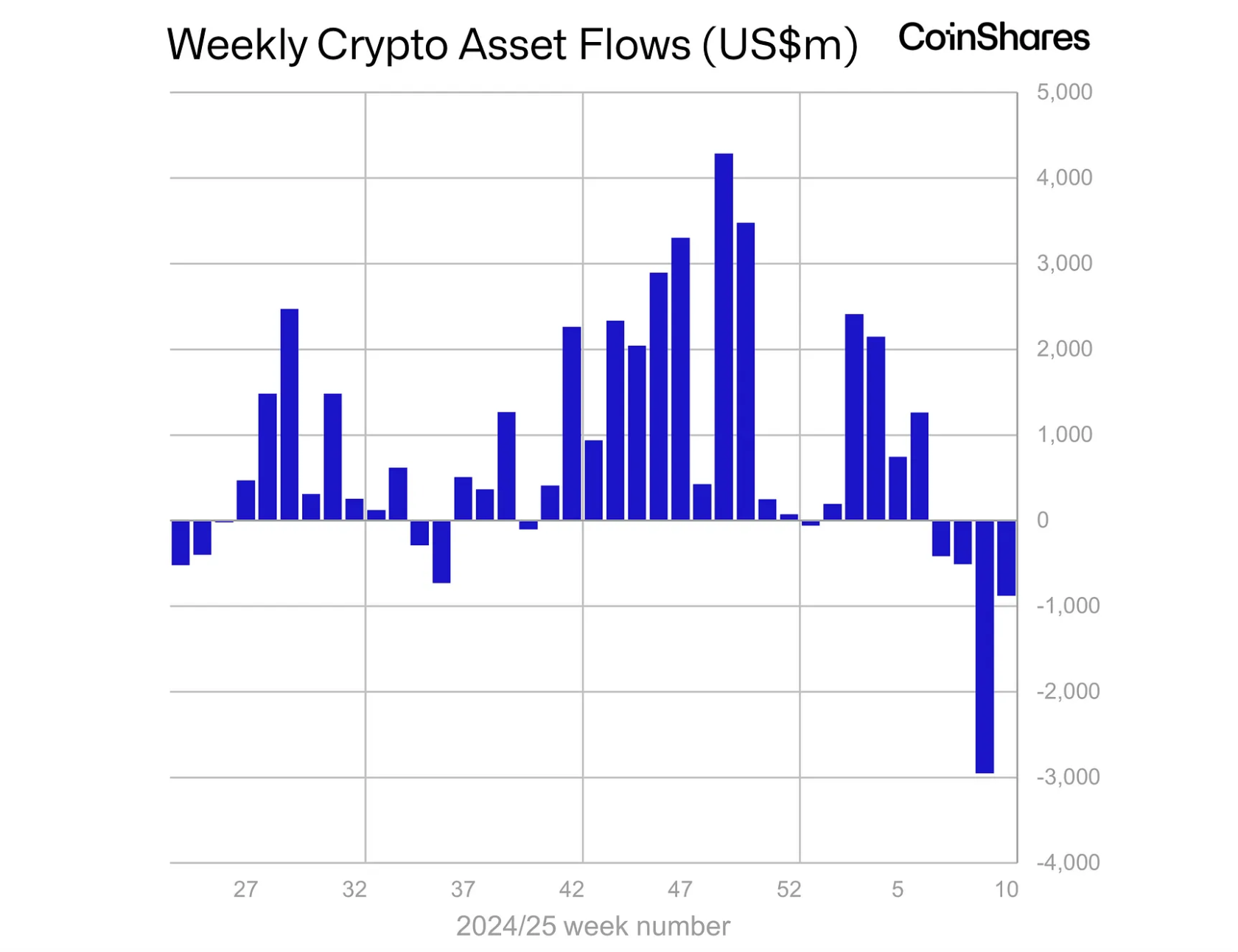

Crypto ETFs expertise 4 weeks of outflows

Crypto ETFs skilled four consecutive weeks of outflows in February 2025 and early March as a consequence of macroeconomic uncertainty and fears over a prolonged trade war.

Based on CoinShares, outflows from the latest market downturn totaled $4.75 billion, with the week of March 9 recording a complete of $876 million in outflows.

BlackRock’s iShares Bitcoin fund skilled $193 million in outflows for the week of March 9, with all BTC ETFs recording $756 million in month-to-date outflows.

Weekly crypto fund flows present a latest downturn that includes 4 weeks of consecutive outflows. Supply: CoinShares

Regardless of the heightened volatility and macroeconomic uncertainty, BlackRock added IBIT to its model portfolio in February 2025.

BlackRock’s mannequin portfolios are preset funding plans that function a spread of diversified monetary devices and totally different danger profiles. The portfolios are promoted to asset managers, who pitch the preset funding plans to buyers.

The inclusion of an ETF or an asset within the mannequin portfolio can considerably enhance inflows into the asset by attracting recent capital.

Within the case of IBIT, together with the ETF in a preset funding portfolio will expose buyers, who could take a extra passive method, to Bitcoin with out these buyers having to self-custody the digital asset or make any onchain transactions.

Journal: Bitcoin ETFs make Coinbase a ‘honeypot’ for hackers and governments: Trezor CEO