Business voices warned that politically endorsed cryptocurrencies should undertake stronger investor protections and liquidity safeguards to stop one other main market collapse.

Investor sentiment stays shaken after the Libra (LIBRA) token, which was endorsed by Argentine President Javier Milei, suffered a $4 billion market cap wipeout on account of insider cash-outs.

In keeping with blockchain analytics agency DWF Labs, not less than eight insider wallets withdrew $107 million in liquidity, triggering the large collapse.

Supply: Kobeissi Letter

To keep away from the same meltdown, tokens with presidential endorsements will want extra sturdy security and financial mechanisms, equivalent to liquidity locking or making the tokens within the liquidity pool non-sellable for a predetermined interval, DWF Labs wrote in a report shared with Cointelegraph.

The report acknowledged that tokens from high-profile leaders would additionally want launch restrictions to restrict participation from crypto-sniping bots and enormous holders or whales.

“Limiting bot and whale exercise is important in limiting the impression of people appearing on insider data to nook a big share of the token provide,” based on Andrei Grachev, managing associate at DWF Labs:

“Tasks should attempt to ship as honest a launch as doable so that each one contributors have an equal alternative to safe an allocation and aren’t deprived by a handful of well-funded or well-informed gamers claiming the lion’s share of the availability.”

Supply: DWF Labs

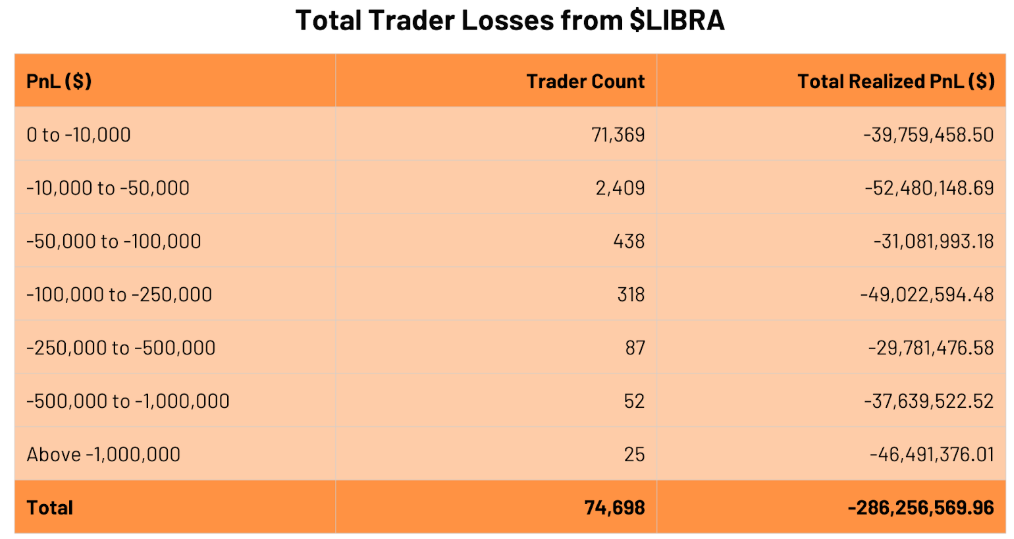

The Libra scandal resulted in 74,698 merchants shedding a cumulative $286 million price of capital, based on DWF Labs’ report.

The token’s fast meltdown additional illustrated the necessity for liquidity locking, which “ensures that there's ample liquidity for customers to purchase and promote into with out excessive slippage,” Grachev mentioned, including:

“That is notably beneficial in the course of the launch part of a token when there's excessive volatility, making certain there's ample liquidity to fulfill giant trades with out main worth impression.”

DWF Labs’ report comes per week after New York lawmakers introduced laws aimed toward defending crypto traders from rug pulls and insider fraud, amid the most recent wave of memecoin scams.

Associated: TRUMP, DOGE, BONK ETF approvals ‘more likely’ under new SEC leadership

Extra transparency wanted for token launches

The Libra token’s meltdown illustrates the need for extra clear token launch mechanisms, defined DWF Labs’ Grachev, including:

“These embody pre-launch pockets transparency and launchpads conducting and higher due diligence on tasks.”

“There’s at all times a level of danger when launching any token, one thing which might’t simply be totally mitigated,” he mentioned.

“However, by rigorously scrutinizing the tasks they associate with and taking full benefit of the transparency that's certainly one of blockchain’s core options, launchpads can empower customers to make extra knowledgeable choices,” he added.

Associated: Memecoins: From social experiment to retail ‘value extraction’ tools

Some troubling developments have emerged for the reason that meltdown of the memecoin endorsed by the Argentine president, together with that Libra was an “open secret” in some memecoin circles, which have been conscious of the token’s launch as much as two weeks forward.

Milei has requested the Anti-Corruption Workplace to analyze all authorities members, together with the president, for potential misconduct, according to a Feb. 16 X assertion issued by Argentina’s presidential workplace, Oficina del Presidente.

Milei faces impeachment calls from his political opponents after endorsing the cryptocurrency that become a $100 million rug pull.

Journal: Caitlyn Jenner memecoin ‘mastermind’s’ celebrity price list leaked