Business voices warned that politically endorsed cryptocurrencies should undertake stronger investor protections and liquidity safeguards to stop one other main market collapse.

Investor sentiment stays shaken after the Libra (LIBRA) token, which was endorsed by Argentine President Javier Milei, suffered a $4 billion market cap wipeout on account of insider cash-outs.

In response to blockchain analytics agency DWF Labs, not less than eight insider wallets withdrew $107 million in liquidity, triggering the huge collapse.

Supply: Kobeissi Letter

To keep away from an identical meltdown, tokens with presidential endorsements will want extra sturdy security and financial mechanisms, similar to liquidity locking or making the tokens within the liquidity pool non-sellable for a predetermined interval, DWF Labs wrote in a report shared with Cointelegraph.

The report said that tokens from high-profile leaders would additionally want launch restrictions to restrict participation from crypto-sniping bots and enormous holders or whales.

“Limiting bot and whale exercise is important in limiting the influence of people performing on insider data to nook a big proportion of the token provide,” in accordance with Andrei Grachev, managing accomplice at DWF Labs:

“Initiatives should attempt to ship as honest a launch as potential so that each one contributors have an equal alternative to safe an allocation and aren’t deprived by a handful of well-funded or well-informed gamers claiming the lion’s share of the provision.”

Supply: DWF Labs

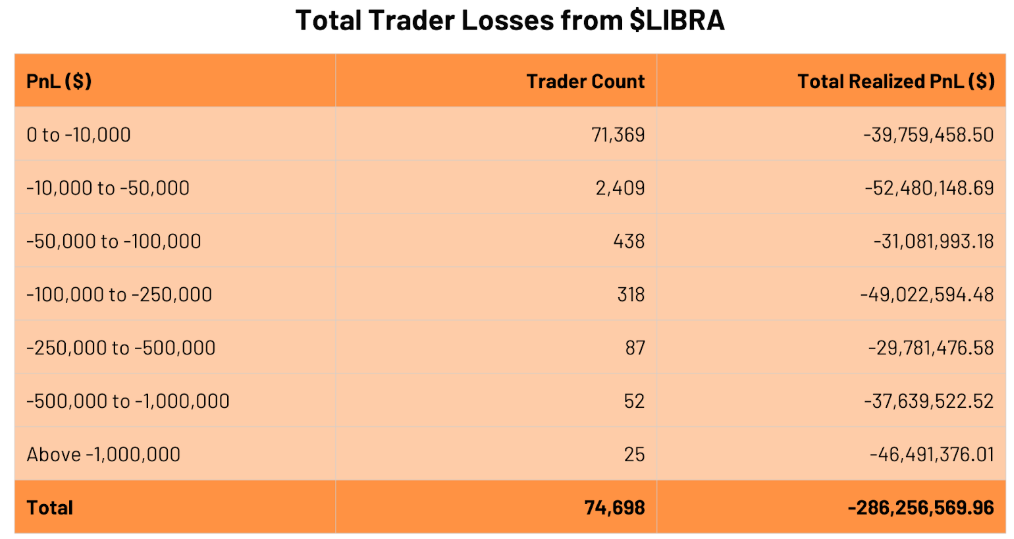

The Libra scandal resulted in 74,698 merchants dropping a cumulative $286 million value of capital, in accordance with DWF Labs’ report.

The token’s fast meltdown additional illustrated the necessity for liquidity locking, which “ensures that there's ample liquidity for customers to purchase and promote into with out excessive slippage,” Grachev mentioned, including:

“That is significantly priceless through the launch part of a token when there's excessive volatility, guaranteeing there's ample liquidity to fulfill giant trades with out main value influence.”

DWF Labs’ report comes per week after New York lawmakers introduced laws geared toward defending crypto traders from rug pulls and insider fraud, amid the newest wave of memecoin scams.

Associated: TRUMP, DOGE, BONK ETF approvals ‘more likely’ under new SEC leadership

Extra transparency wanted for token launches

The Libra token’s meltdown illustrates the need for extra clear token launch mechanisms, defined DWF Labs’ Grachev, including:

“These embrace pre-launch pockets transparency and launchpads conducting and higher due diligence on initiatives.”

“There’s all the time a level of danger when launching any token, one thing which might’t simply be totally mitigated,” he mentioned.

“However, by fastidiously scrutinizing the initiatives they accomplice with and taking full benefit of the transparency that's considered one of blockchain’s core options, launchpads can empower customers to make extra knowledgeable selections,” he added.

Associated: Memecoins: From social experiment to retail ‘value extraction’ tools

Some troubling developments have emerged because the meltdown of the memecoin endorsed by the Argentine president, together with that Libra was an “open secret” in some memecoin circles, which had been conscious of the token’s launch as much as two weeks forward.

Milei has requested the Anti-Corruption Workplace to analyze all authorities members, together with the president, for potential misconduct, according to a Feb. 16 X assertion issued by Argentina’s presidential workplace, Oficina del Presidente.

Milei faces impeachment calls from his political opponents after endorsing the cryptocurrency that became a $100 million rug pull.

Journal: Caitlyn Jenner memecoin ‘mastermind’s’ celebrity price list leaked