The decentralized finance (DeFi) business is respiratory a sigh of aid as Congress relaxes reporting obligations, however questions stay about how lawmakers will regulate DeFi.

On March 12, the Home of Representatives voted to nullify a rule that required DeFi protocols to report gross proceeds from crypto gross sales, in addition to data on taxpayers concerned, to the Inside Income Service (IRS).

The rule, which the IRS issued in December 2024 and wasn’t set to take impact till 2027, was regarded by main business foyer teams as burdensome and past the company’s authority.

The White Home has already signaled its support for the bill. President Donald Trump is able to signal when it reaches his desk. However DeFi observers observe that the business has but to strike a stability between privateness and regulation.

Bipartisan vote on repealing the rule. Supply: DeFi Education Fund

Privateness issues over IRS DeFi rule

The crypto business was fast to laud the vote within the Home. Marta Belcher, president of the Filecoin Basis, stated that blocking the rule was notably essential for person privateness.

She advised Cointelegraph it's “important to guard individuals’s capacity to transact immediately with one another through open-source code (like good contracts and decentralized exchanges) whereas remaining nameless, in the identical approach that individuals can transact immediately with one another utilizing money.”

Privateness issues had been central to the crypto business’s objections to the rule, with business observers claiming that it was not match for objective and infringed on person privateness.

Invoice Hughes, senior counsel and director of world regulatory issues for Consensys Software program wrote in December 2024, “Buying and selling entrance ends must monitor and report on person exercise — each US individuals and non-US individuals [...] And it applies to the sale of each single digital asset — together with NFTs and even stablecoins.”

The Blockchain Affiliation, a significant crypto business foyer group, stated that the rule was “an infringement on the privateness rights of people utilizing decentralized know-how” that might push DeFi offshore.

Whereas the rule has been stopped for now, there nonetheless aren’t mounted privateness tips in place — one thing Etherealize CEO Vivek Raman stated the business wants to maneuver ahead.

“There must be clear frameworks for blockchain-based privateness whereas sustaining [Know Your Customer/Anti-Money Laundering] necessities,” he advised Cointelegraph.

Raman said that some transactions and buyer knowledge might want to stay personal, “and we want steerage on what privateness can appear to be.”

How do you regulate DeFi?

The crypto house has lengthy juggled person privateness calls for and regulators’ Anti-Cash Laundering and Know Your Buyer issues.

One downside lies within the know-how itself — if a community is created by many and managed by no single entity, who can the federal government contact?

Per Raman, “It’s exhausting for a decentralized protocol that's managed by no one to problem 1099s or fulfill broker-dealer tasks! Corporations can actually be [broker-dealers], however software program has not been designed for [broker-dealer] guidelines.”

DeFi builders can and have been proactive in working with regulators, Chainalysis suggested, as was the case with sure protocols freezing funds after the disastrous $285 million KuCoin hack.

Associated: Timeline: How Bybit's lost Ethereum went through North Korea's washing machine

Cinneamhain Ventures companion and marketing consultant Adam Cochran claimed that each protocol has sure strain factors regulators might press on if a protocol had been used to commit against the law:

Supply: Adam Cochran

Nevertheless, these particular cases don't make a complete regulatory framework that each the business and investor safety businesses can level to.

In that regard, crypto analytics agency Chainalysis stated in 2020 that regulators could have to craft laws for the DeFi house with decentralized reporting limitations in thoughts.

Raman advised that one doable answer could possibly be zero-knowledge proofs, which permit customers to substantiate sure knowledge with out revealing it.

He's optimistic about regulators’ capacity to discover a option to regulate the house whereas nonetheless sustaining person privateness: “I believe we’ll see a constructive sum setting the place DeFi and compliance will coexist.”

The long-awaited crypto regulatory framework

Trump has already made quite a lot of pro-crypto measures by govt orders and appointing pro-crypto people to move components of his administration — the latest being the institution of a strategic Bitcoin reserve.

Associated: US Rep. Byron Donalds to introduce bill codifying Trump’s Bitcoin reserve

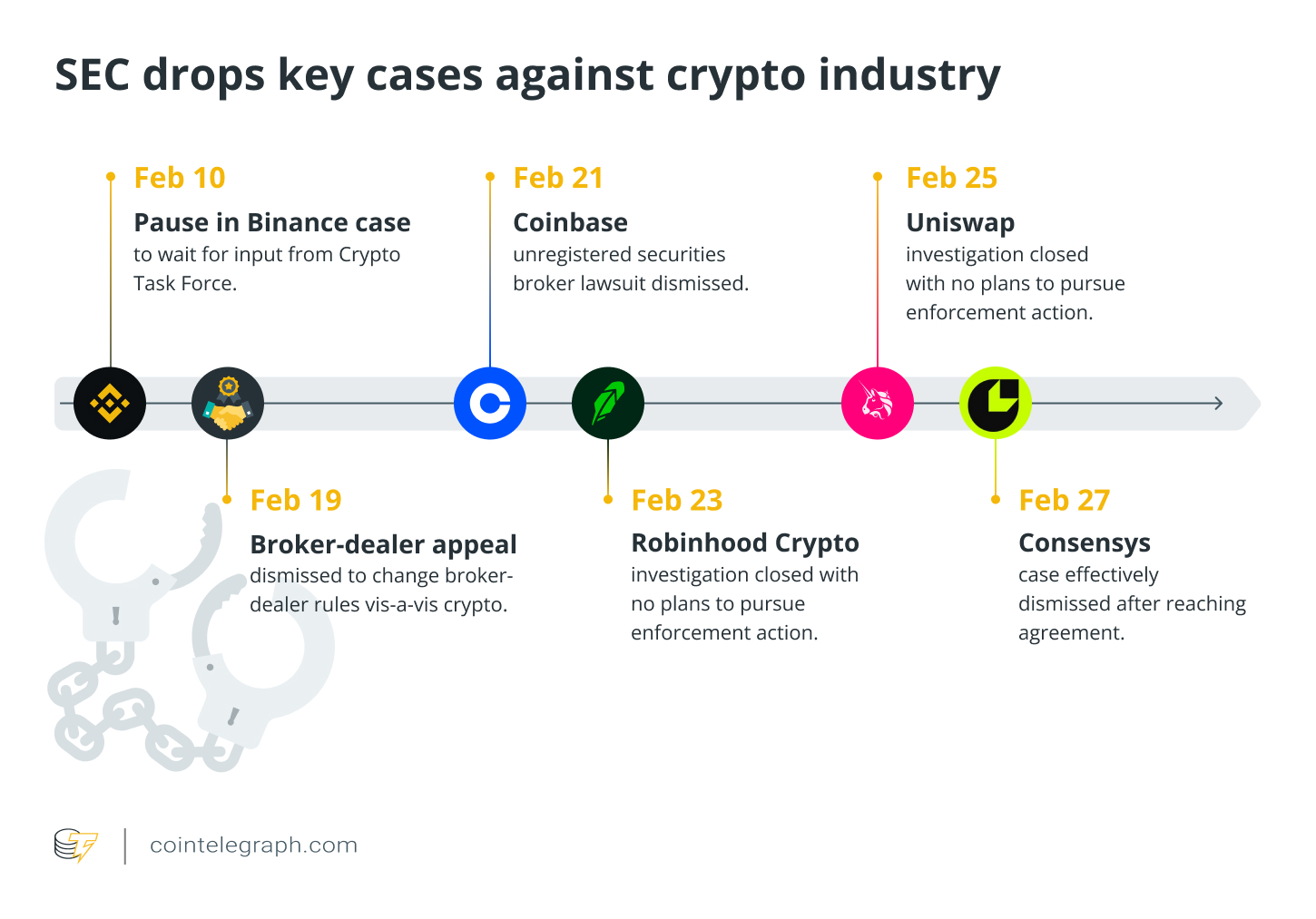

The professional-crypto tenure of essential monetary regulators just like the Securities and Alternate Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) has dropped quite a lot of high-profile enforcement instances in opposition to crypto companies.

Whereas notable, the massive fish that the crypto business is ready for is the crypto regulatory framework and stablecoin payments circulating in Congress, which might give the business the guardrails it claims it must thrive.

On March 13, the Senate Banking Committee approved the GENIUS Act, the stablecoin invoice, placing it one step nearer to a vote on the Senate flooring.

The crypto framework invoice, FIT 21, was first launched within the 2024 legislative session, finally failing within the Senate. Nevertheless, in February, Home Monetary Providers Committee Chair French Hill stated that he anticipated the invoice might go on this session with “modest modifications.”

However even when FIT 21 had been handed quickly, laws for DeFi could possibly be far off. The invoice would exclude DeFi from SEC and CFTC oversight, however it will additionally set up a working group to analysis 12 key areas associated to DeFi.

This research will search to grasp the dangers and advantages of DeFi and can finally make regulatory suggestions.

Journal: Vitalik on AI apocalypse, LA Times both-sides KKK, LLM grooming: AI Eye