The US greenback has lengthy reigned because the world’s main reserve forex and the default alternative for world commerce and worldwide transactions. However its dominance is now dealing with rising scrutiny as shifting geopolitical and financial forces—and issues over the potential weaponization of the dollar—push extra international locations to speed up efforts to loosen their dependence on the greenback.

By nearly each measure, the US greenback’s command of the worldwide financial system is staggering. Though the nation accounts for roughly 25% of worldwide GDP, its forex reigns over practically 60% of worldwide overseas alternate reserves—far outpacing its nearest rival, the euro.

However this dominance is more and more underneath stress, with the strategic use of financial sanctions previously main some international locations to hunt options, whilst US President Donald Trump repeatedly threatens 100% tariffs on international locations that actively search to substitute the dollar.

In Russia, whose entry to the SWIFT cost platform is crippled by sanctions, firms have been utilizing cryptocurrencies as a method to skirt restrictions, turning to Bitcoin and different digital belongings to conduct cross-border enterprise. Whereas crypto was barred as unlawful by the nation´s central financial institution years in the past, current modifications to the regulation have paved the way in which for firms to embrace cryptocurrencies since late final 12 months.

The nation permitted using cryptocurrencies in overseas commerce and has taken steps to make it authorized to mine cryptocurrencies, together with Bitcoin.

Bitcoin, sanctions and the push for dedollarization

Since Bitcoin’s inception, crypto advocates have been fixated on “dedollarization,” usually described because the push to scale back the US greenback’s dominance as the worldwide reserve forex. The time period broadly refers to transferring away from the greenback in key monetary and commerce actions, together with oil and commodity transactions (the petrodollar system), overseas alternate reserves, bilateral commerce agreements, and investments in dollar-denominated belongings.

A 2024 paper by Morgan Stanley’s head of Digital Asset Markets, Andrew Peel, prompt that the rise of digital currencies presents “alternatives to each erode and reinforce” the US greenback’s dominance, with the potential to considerably alter the worldwide forex panorama.

Nonetheless, whereas digital belongings—most notably stablecoins— are more and more gaining traction, the crypto market’s dedollarization expectations look untimely.

Whereas Bitcoin is more and more seen as a strategic reserve asset, specialists warning that it’s nonetheless too quickly to name it a real different to the US greenback. Nations like El Salvador have embraced Bitcoin aggressively, with the asset now making up about 15% to twenty% of the nation’s whole reserves. The US has reportedly thought of comparable strikes, however widespread adoption stays restricted, and questions persist about whether or not such steps would undermine the greenback quite than help it.

Based on Bitcoin Depot CEO Brandon Mintz,

“For Bitcoin to turn into a real different to the USD, it will require broader mainstream adoption, clearer regulatory frameworks, and extra scalable infrastructure.”

At the moment, Bitcoin acts extra like a hedge and a retailer of worth than a greenback substitute, however its position may shift as world monetary dynamics evolve. Elements like inflation and geopolitical tensions, Mintz stated, may drive extra curiosity.

Whereas institutional adoption and cross-border use are on the rise, Mintz stated that it stays to be seen “whether or not Bitcoin can genuinely problem the dominance of the greenback as this may rely upon how these developments develop over time.”

Related: 3 reasons why Bitcoin sells off on Trump tariff news

Regardless of its rising attraction, Bitcoin’s volatility stays a major problem. Based on the World Gold Council, Bitcoin displays significantly increased volatility than gold and reveals a higher correlation with Nasdaq tech shares than with conventional safe-haven belongings.

Gold and main asset 5-year common day by day volatility - annualized. Supply: World Gold Council.

Eswar Prasad, a commerce professor at Cornell College, instructed Cointelegraph,

“Decentralized cryptocurrencies similar to Bitcoin nonetheless have extremely risky values, rendering them unsuitable as mediums of alternate or as reserve currencies.”

US greenback world overseas reserves decline

Because the finish of World Warfare II, the US greenback has reigned because the world’s dominant forex, powering round 88% of worldwide commerce transactions in 2024.

The greenback’s standing because the main worldwide forex is well-established. Based on the International Monetary Fund, as of the third quarter of 2024, central banks held about 58 p.c of their allotted reserves in US {dollars}—a lot of it in money and US bonds. That is considerably increased than the euro, second within the race, which accounts for as a lot as 20%

Allotted overseas alternate reserves by central banks. Supply: Worldwide Financial Fund

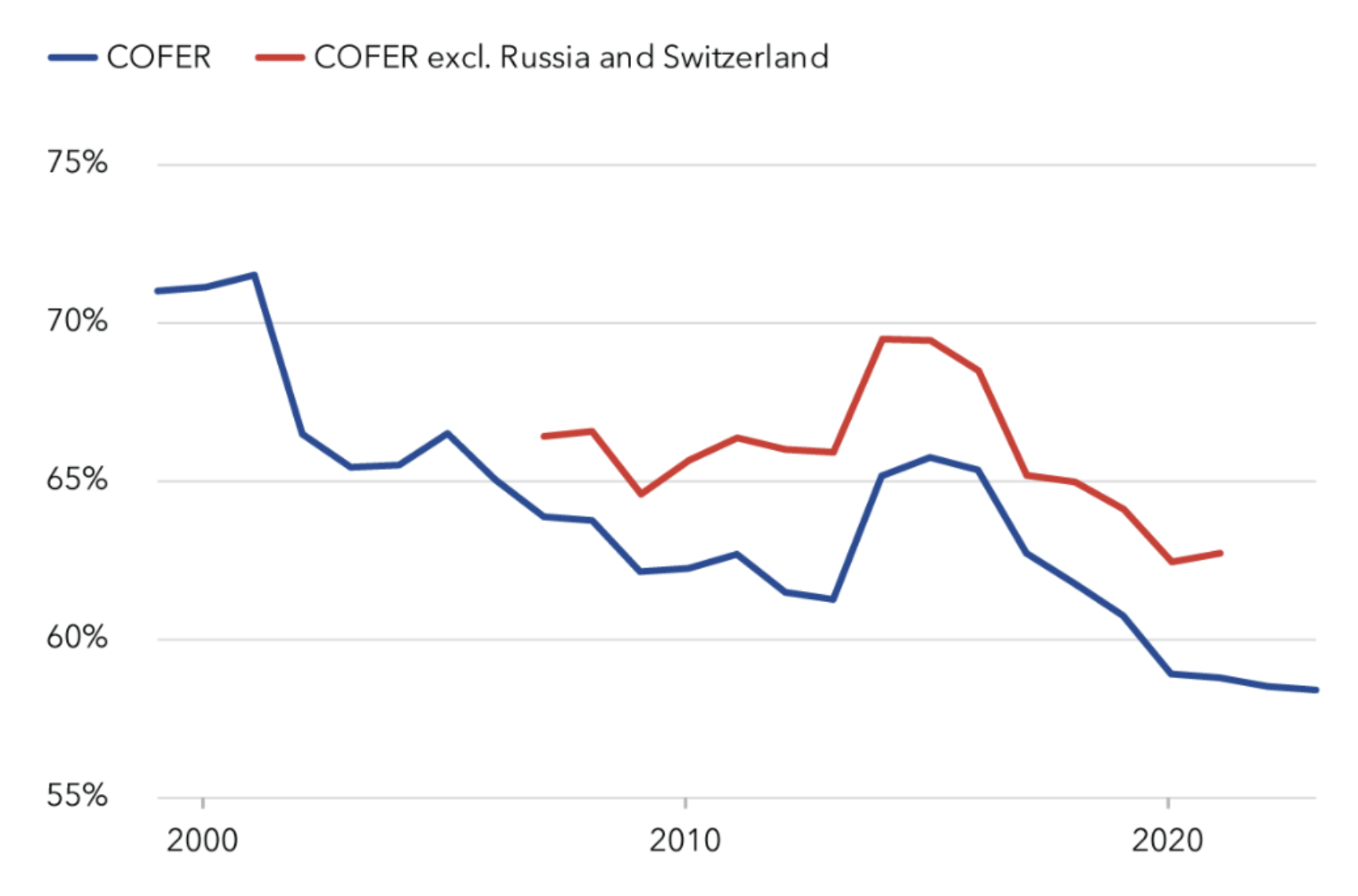

Whereas the US greenback stays the dominant world forex on account of its stability, widespread acceptance in worldwide commerce and finance, and standing as a key reserve asset for central banks, there are indicators that its reign could also be waning. The percentage of global foreign reserves held in {dollars} has diminished from over 70% within the early 2000s to under 60%.

Proportion of worldwide FX reserves held in US {dollars}. Supply: Worldwide Financial Fund

The turning level got here after February 2022 when the US froze $300 billion of Russia’s liquid overseas alternate reserves held within the US and NATO international locations. Whereas many US allies backed the transfer, it additionally despatched shockwaves by world markets, highlighting the chance that Washington may weaponize the greenback towards not simply adversaries however doubtlessly allies whose insurance policies conflict with American pursuits.

Citing using sanctions and the way sanctioned international locations react, an Worldwide Financial Fund blog post in 2024 stated,

“We now have discovered that monetary sanctions when imposed previously, induced central banks to shift their reserve portfolios modestly away from currencies, that are susceptible to being frozen and redeployed, in favor of gold, which may be warehoused within the nation and thus is freed from sanctions threat.”

Do stablecoins really reinforce dollarization?

Regardless of efforts by BRICS+ nations to counteract US greenback dominance, the greenback’s worth has remained sturdy in recent times. The US Greenback Index is up roughly 8% over the previous 5 years.

Within the crypto sector, stablecoins have emerged as a few of the fastest-growing digital belongings, usually cited as a possible answer for cross-border transactions. Nonetheless, most stablecoins are nonetheless pegged to the US greenback.

At the moment, the stablecoin market cap stands at $233 billion, with US-pegged stablecoins similar to Tether’s USDT dominating 97% of the sector, in keeping with CoinGecko knowledge.

This overwhelming reliance on USD-backed stablecoins means that quite than undermining greenback dominance, digital belongings may very well reinforce it. “With USD-linked stablecoins on the core of this digital ecosystem, we now have a singular probability to increase US monetary affect globally—if policymakers act now,” Cody Carbone, president of Digital Chamber, a US-based blockchain advocacy affiliation, said on X.

The emergence and widespread adoption of central financial institution digital currencies (CBDCs) may disrupt some cryptocurrencies, significantly stablecoins, by offering environment friendly and low-cost digital cost options.

“A broadly accessible digital greenback would undercut the case for privately issued stablecoins, although stablecoins issued by main companies may nonetheless have traction,” stated Prasad.

Nonetheless, Prasad emphasised that no viable different is poised to displace the US greenback because the dominant world reserve forex.

“The greenback’s strengths lie not simply within the depth and liquidity of US monetary markets but in addition within the institutional framework that underpins its standing as a protected haven.”

This text is for normal info functions and isn't supposed to be and shouldn't be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the writer’s alone and don't essentially replicate or symbolize the views and opinions of Cointelegraph.