Hong Kong anticipates the continued progress of its fintech ecosystem, with blockchain, digital property, distributed ledger expertise (DLT) and synthetic intelligence taking part in a central position in shaping its future.

Hong Kong is house to over 1,100 fintech corporations, which embrace 175 blockchain software or software program companies and 111 digital asset and cryptocurrency corporations, marking a 250% and 30% improve, respectively, since 2022, according to the Hong Kong Fintech Ecosystem report by InvestHK, a authorities division overseeing Overseas Direct Investments.

Contributors of the Hong Kong Fintech Ecosystem. Supply: InvestHK

Exploring deeper fintech income streams

The expansive progress of Hong Kong’s Web3 trade is attributed to proactive authorities insurance policies and an energetic licensing regime for crypto exchanges or digital asset buying and selling platforms.

“The income for the Hong Kong fintech market is projected to succeed in US$606 billion by 2032, with an anticipated annual progress price of 28.5% from 2024 to 2032,” the report acknowledged.

InvestHK, together with different Hong Kong authorities, surveyed 130 fintech corporations working in Hong Kong and recognized expertise scarcity as the highest concern within the area, cited by 58.8% of respondents, adopted by entry to capital (43.9%).

Associated: Coinbase to add 1,000 more US jobs in 2025, thanks to Trump — Brian Armstrong

Addressing these hurdles might be crucial to sustaining Hong Kong’s momentum to change into the highest monetary hub.

Over 73% of the surveyed fintech corporations function within the AI subsector, far exceeding the 41.5% centered on digital property and cryptocurrency.

China’s “one nation, two programs” coverage at play

The InvestHK report highlighted Hong Kong’s benefit in adopting China’s “one nation, two programs” coverage, permitting it to keep up a free-market financial system, unrestricted capital movement, and powerful international commerce relations whereas benefiting from its proximity to mainland China.

Consequently, the Hong Kong authorities was capable of roll out a number of Web3 improvements, together with a licensing regime, spot Bitcoin (BTC) and Ether (ETH) exchange-traded funds, the Hong Kong Financial Authority’s stablecoin sandbox and tokenized finance and AI integration.

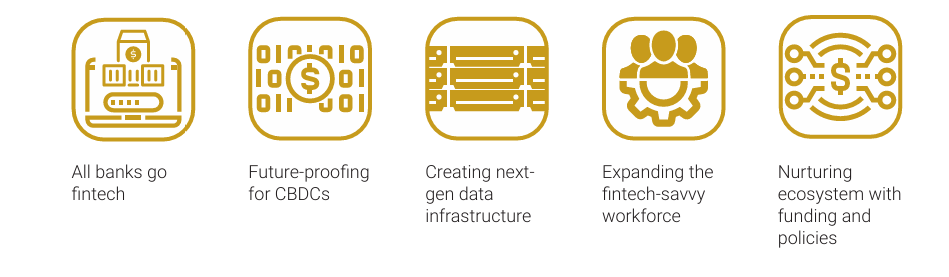

Hong Kong Financial Authority’s five-step “Fintech 2025” technique. Supply: HKMA

In 2021, the HKMA unveiled a method to establish itself as a financial hub by 2025.

The technique included encouraging fintech adoption amongst banks, growing Hong Kong’s readiness in issuing central financial institution digital currencies at each wholesale and retail ranges, enhancing the town’s present information infrastructure and constructing new ones, growing the provision of fintech expertise and formulating supportive insurance policies for the Hong Kong fintech ecosystem.

Journal: Vitalik on AI apocalypse, LA Times both-sides KKK, LLM grooming: AI Eye