The memecoin frenzy on Pump.enjoyable is hitting a wall, with the platform’s “commencement price” sinking under 1% for a fourth straight week.

“Commencement price” is the memecoin launchpad’s time period for tokens that make it by way of the incubation section and turn into absolutely tradable on a Solana decentralized alternate (DEX). To graduate, a token should meet particular liquidity and buying and selling necessities.

Over the previous 4 weeks, beginning Feb. 17, Pump.enjoyable’s commencement price has remained under 1% for the primary time, Dune Analytics knowledge reveals.

Pump.enjoyable’s tanking token success price. Supply: Dune Analytics

Pump.enjoyable’s commencement price has never been particularly high. The platform’s best-performing week was in November 2024 when 1.67% of memecoins moved on to the open market. Nonetheless, the sheer quantity of tokens launched on the platform on the time made this share extra vital than it's now. Throughout the week beginning Nov. 11, 323,000 tokens had been created on Pump.enjoyable, that means the 1.67% commencement price translated to roughly 5,400 tokens getting into Solana’s DeFi financial system in a single week.

Associated: Pump.fun’s memecoin freak show may result in criminal charges: Expert

With token creation quantity declining on both Pump.fun and Solana, weekly token graduations have plummeted to a four-week common of round 1,500 tokens on the time of writing, based on Dune.

Memecoins are dying, and so they’re not responding to constructive market indicators

Pump.enjoyable’s dropping commencement price displays waning investor urge for food for memecoins, which have developed a reputation as degenerate lottery tickets or quick cash grabs for his or her creators.

A number of political figures have launched their own memecoins as well, together with US President Donald Trump. His token is down 84% from its all-time excessive set on Jan. 19, based on CoinGecko.

Associated: Argentine lawyer requests Interpol red notice for LIBRA creator: Report

Memecoins’ struggles persist regardless of bettering liquidity, based on Matrixport. In February, Matrixport analysts famous that a strengthening US dollar had pressured Bitcoin prices by tightening dollar-denominated liquidity.

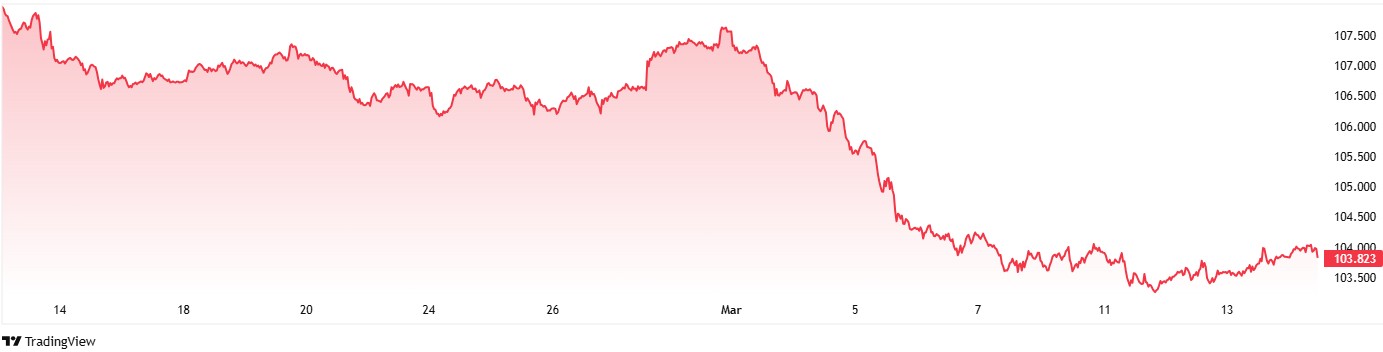

Since then, the US greenback has weakened. Over the previous month, the US Greenback Index (DXY), which measures the greenback towards a basket of main currencies, peaked at 107.61 on Feb. 28 earlier than dropping to 103.95 on March 14.

DXY efficiency prior to now month reveals the US greenback weakening. Supply: TradingView

“The US greenback has just lately weakened, resulting in a rebound in liquidity indicators and a few marginal enhancements in inflation knowledge. Regardless of these constructive shifts, memecoins — beforehand one of many strongest narratives throughout this bull market — proceed to battle considerably, with no obvious restoration,” Matrixport stated in its report.

Bitcoin caught in memecoin aftershocks

The struggling memecoin market has contributed to a $1 trillion wipeout in crypto market capitalization, based on Matrixport.

“This redistribution of wealth could lead buyers to stay cautious about deploying additional capital, inflicting rebounds — even these triggered by better-than-expected inflation knowledge — to be restricted,” the report famous.

Matrixport analysts warn that this might result in additional Bitcoin declines, with a possible retracement to as little as $73,000 — a stage they imagine would supply “robust help.”

Journal: Ridiculous ‘Chinese Mint’ crypto scam, Japan dives into stablecoins: Asia Express