For years, inflation was primarily a priority for rising markets, the place unstable currencies and financial instability made rising costs a persistent problem. Nevertheless, within the wake of the COVID-19 pandemic, inflation turned a worldwide problem. As soon as-stable economies with traditionally low inflation had been immediately grappling with hovering prices, prompting traders to rethink find out how to protect their wealth.

Whereas gold and actual property have lengthy been hailed as safe-haven belongings, Bitcoin’s supporters argue that its mounted provide and decentralized nature make it the final word protect in opposition to inflation. However does the theory maintain up?

The reply could rely largely on the place one lives.

Bitcoin advocates emphasize its strict provide restrict of 21 million coins as a key benefit in combating inflationary financial insurance policies. Not like fiat currencies, which central banks can print in limitless portions, Bitcoin’s provide is predetermined by an algorithm, stopping any type of synthetic growth. This shortage, they argue, makes Bitcoin akin to “digital gold” and a extra dependable retailer of worth than conventional government-issued cash.

A number of corporations and even sovereign nations have embraced the thought, adding Bitcoin to their treasuries to hedge against fiat currency risk and inflation. Essentially the most notable instance is El Salvador, which made international headlines in 2021 by turning into the primary nation to undertake Bitcoin as authorized tender. The federal government has since been steadily accumulating Bitcoin, making it a key part of its financial technique. Firms like Strategy within the US and Metaplanet in Japan have adopted swimsuit, and now the USA is within the course of of creating its personal Strategic Bitcoin Reserve.

A Bitcoin funding technique has paid off to date

To this point, the company and authorities Bitcoin funding technique has paid off as BTC outperformed the S&P 500 and gold futures because the early 2020s earlier than inflation surged in the USA.

Extra lately, nonetheless, that sturdy efficiency has proven indicators of moderation. Bitcoin stays a robust performer over the previous 12 months, and whereas BTC’s good points outpace client inflation, economists warning that previous efficiency is not any assure of future outcomes. Certainly, some research recommend a correlation between cryptocurrency returns and adjustments in inflation expectations is much from constant over time.

Returns over the previous 12 months. Supply: Truflation.

Bitcoin's position as an inflation hedge stays unsure

Not like conventional inflation hedges resembling gold, Bitcoin continues to be a comparatively new asset. Its position as a hedge stays unsure, particularly contemplating that widespread adoption has solely gained traction lately.

Regardless of excessive inflation lately, Bitcoin’s worth has fluctuated wildly, usually correlating extra with threat belongings like tech shares than with conventional inflation hedges like gold.

A latest study printed within the Journal of Economics and Enterprise discovered that Bitcoin’s skill to hedge inflation has weakened over time, notably as institutional adoption grew. In 2022, when US inflation hit a 40-year excessive, Bitcoin misplaced greater than 60% of its worth, whereas gold, a conventional inflation hedge, remained comparatively secure.

For that reason, some analysts say that Bitcoin’s worth could also be pushed extra by investor sentiment and liquidity circumstances than by macroeconomic fundamentals like inflation. When the chance urge for food is robust, Bitcoin rallies. However when markets are fearful, Bitcoin usually crashes alongside shares.

In a Journal of Economics and Enterprise research, authors Harold Rodriguez and Jefferson Colombo stated,

“Primarily based on month-to-month information between August 2010 and January 2023, the outcomes point out that Bitcoin returns enhance considerably after a constructive inflationary shock, corroborating empirical proof that Bitcoin can act as an inflation hedge.”

Nevertheless, they famous that Bitcoin’s inflationary hedging property was stronger within the early days when institutional adoption of BTC was not as prevalent. Each researchers agreed that “[…]Bitcoin’s inflation-hedging property is context-specific and certain diminishes because it achieves broader adoption and turns into extra built-in into mainstream monetary markets.”

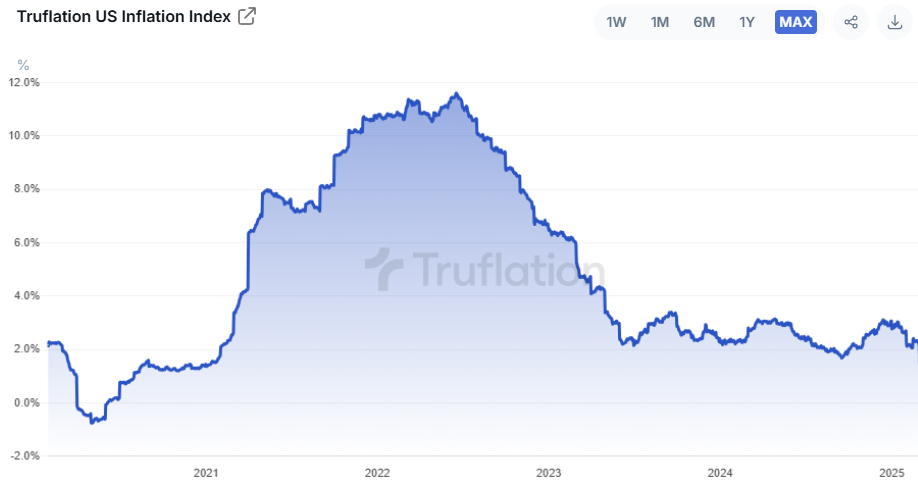

US inflation index since 2020. Supply. Truflation

“To this point, it has acted as an inflation hedge—nevertheless it’s not a black-and-white case. It’s extra of a cyclical (phenomenon),” Robert Walden, head of buying and selling at Abra, advised Cointelegraph.

Walden stated,

“For Bitcoin to be a real inflation hedge, it could must persistently outpace inflation yr after yr with its returns. Nevertheless, attributable to its parabolic nature, its efficiency tends to be extremely uneven over time.”

Bitcoin’s motion proper now, Walden stated, is extra about market positioning than inflation hedging—it’s about capital flows and rates of interest."

Argentina and Turkey search monetary refuge in crypto

In economies affected by runaway inflation and strict capital controls, Bitcoin has confirmed to be a useful device for preserving wealth. Argentina and Turkey, two nations with persistent inflation all through latest a long time, illustrate this dynamic nicely.

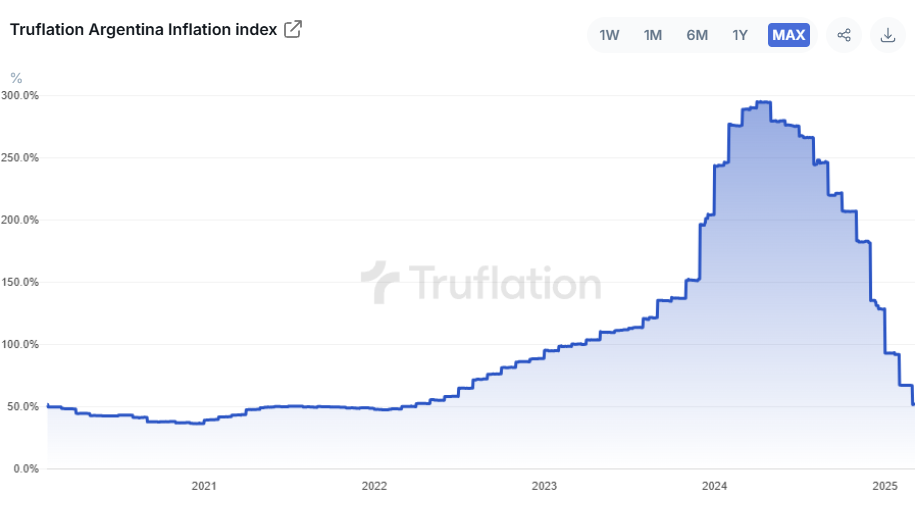

Argentina has lengthy grappled with recurring monetary crises and hovering inflation. Whereas inflation has proven indicators of enchancment very lately, locals have traditionally turned to cryptocurrency as a method to bypass monetary restrictions and shield their wealth from foreign money depreciation.

A latest Coinbase survey discovered that 87% of Argentinians imagine crypto and blockchain expertise can improve their monetary independence, whereas almost three in 4 respondents see crypto as an answer to challenges like inflation and excessive transaction prices.

Related: Argentina overtakes Brazil in crypto inflows — Chainalysis

With a inhabitants of 45 million, Argentina has turn into a hotbed for crypto adoption, with Coinbase reporting that as many as 5 million Argentinians use digital belongings each day.

“Financial freedom is a cornerstone of prosperity, and we're proud to convey safe, clear, and dependable crypto companies to Argentina,” stated Fabio Plein, Director for the Americas at Coinbase.

“For a lot of Argentinians, crypto isn’t simply an funding, it’s a necessity for regaining management over their monetary futures.”

“Folks in Argentina don’t belief the peso. They're all the time on the lookout for methods to retailer worth outdoors of the native foreign money,” Julián Colombo, a senior director at Bitso, a significant Latin American cryptocurrency change, advised Cointelegraph.

“Bitcoin and stablecoins enable them to bypass capital controls and shield their financial savings from devaluation.”

Argentina inflation index. Supply. Truflation.

Past particular person traders, companies in Argentina are additionally utilizing Bitcoin and stablecoins to guard income and conduct worldwide transactions. Some staff even choose to obtain a part of their salaries in cryptocurrency to safeguard their earnings from inflation.

In line with economist and crypto analyst Natalia Motyl,

“Foreign money restrictions and capital controls imposed lately have made entry to US {dollars} more and more tough amid excessive inflation and a disaster of confidence within the Argentine peso. On this setting, cryptocurrencies have emerged as a viable various for preserving the worth of cash, permitting people and companies to bypass the constraints of the normal monetary system.”

Whereas Bitcoin's effectiveness as an inflation hedge continues to be up for debate, stablecoins have turn into a extra sensible answer in high-inflation economies, notably these pegged to the US greenback.

Relative to its financial dimension, Turkey has emerged as a hotspot for stablecoin transactions. Within the yr main as much as March 2024, purchases alone accounted for 4.3% of GDP. This digital foreign money growth, fueled by years of double-digit inflation—peaking at 85% in 2022—and a greater than 80% plunge within the lira in opposition to the greenback over the previous 5 years, gained momentum through the pandemic.

Turkey’s Bitcoin adoption proves residents drive adoption, not governments

Though Turkey permits its residents to purchase, maintain, and commerce crypto, the usage of digital currencies for funds has been banned since 2021 when the Central Financial institution of the Republic of Turkey prohibited “any direct or oblique utilization of crypto belongings in fee companies and digital cash issuance.” Nonetheless, crypto adoption in Turkey is still evident, with an growing variety of Turkish banks offering crypto services and outlets and ATMs offering crypto change choices.

Excessive inflation charges backed the erosion of the Turkish lira’s worth, which misplaced almost 60% of its buying energy as inflation soared to 85.5% between 2021 and 2023. This led many Turkish residents to show to Bitcoin as a retailer of worth and a medium of change.

Whereas some argue that Bitcoin’s shortage bodes nicely for long-term appreciation, doubtlessly outpacing client inflation, its excessive volatility and recurring correlation with tech-heavy, risk-associated indexes just like the Nasdaq in latest instances recommend that its efficiency as a pure inflation hedge stays combined.

Nevertheless, in inflation-ridden nations like Argentina and Turkey, the place native currencies have collapsed in worth, the “digital gold” has undeniably served as a vital avenue of escape from native currencies, preserving buying energy in methods conventional fiat can not.

Though Bitcoin continues to be a nascent asset, and its effectiveness as a hedge requires additional research, one factor stays clear—to date, it has considerably outperformed client inflation. For Bitcoin fans, that alone is purpose sufficient to have a good time.

This text is for normal data functions and isn't meant to be and shouldn't be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the creator’s alone and don't essentially replicate or symbolize the views and opinions of Cointelegraph.