Bitcoin (BTC) is dealing with mounting resistance under $84,000, struggling to interrupt above $85,000 as market volatility rises. A key purpose for this sluggish value motion is the continued sell-off in Bitcoin spot ETFs, which have seen outflows exceeding $945 million in latest weeks. This marks the fifth consecutive week of institutional promoting, including stress on BTC.

Investor sentiment stays weak, as mirrored within the Crypto Concern & Greed Index, which at present stands at 22 (Concern). The uncertainty stems from a number of elements, together with fears of U.S. recession dangers, Trump’s commerce insurance policies, and regulatory uncertainty within the crypto sector.

Regardless of these headwinds, Bitcoin briefly rebounded by 4.33%, pushed by optimism round Senator Cynthia Lummis’ Bitcoin Act, which means that the U.S. authorities ought to accumulate BTC as a strategic reserve asset.

Key Market Insights:

- Bitcoin struggles under $84K as ETF outflows hit $945M.

- Market sentiment stays fearful, conserving buyers cautious.

- BTC rebounds 4.33% on U.S. authorities Bitcoin reserve hypothesis.

Fed’s Price Choice & Geopolitical Tensions May Drive BTC’s Subsequent Transfer

Bitcoin’s subsequent main value transfer could possibly be decided by the Federal Reserve’s coverage choice on March 19. Buyers are intently watching U.S. Retail Gross sales information and the FOMC assembly, as any alerts of a dovish stance may enhance Bitcoin.

A price minimize would enhance liquidity, probably fueling BTC’s subsequent rally. Nevertheless, if the Fed maintains a strict stance, it may set off a recent wave of promoting stress, particularly amid Nasdaq’s continued weak spot.

- Traditionally, Bitcoin follows Nasdaq’s pattern. When the Nasdaq falls, BTC tends to drop at a better magnitude (typically 2x).

- Tech shares and Bitcoin are each thought-about high-risk belongings, that means institutional buyers typically deal with them equally.

Geopolitical tensions are additionally in focus. Trump’s tariff insurance policies and potential commerce restrictions may additional affect market sentiment. Any escalation in U.S. financial insurance policies might affect the Fed’s subsequent transfer, immediately affecting Bitcoin’s trajectory.

What to Watch:

- FOMC assembly final result – A dovish stance may drive BTC larger.

- Nasdaq correlation – Inventory market weak spot may result in BTC declines.

- Geopolitical dangers – Commerce wars and world uncertainty might gas volatility.

Bitcoin’s Correlation With Nasdaq Poses Draw back Dangers

Bitcoin’s value stays intently tied to U.S. inventory market efficiency, notably the Nasdaq index, which has dropped 12% in latest weeks. Traditionally, BTC tends to say no twice as a lot as Nasdaq, implying a possible 24% BTC drop to $65,000 if the tech index extends its slide.

If Nasdaq declines additional by 20%, Bitcoin may fall to $55,000, whereas a full-blown bear market in shares—probably a 40% Nasdaq crash—may ship BTC tumbling towards $20,000, in keeping with economist Peter Schiff. Bloomberg analyst Mike McGlone warns that BTC may even drop to $10,000 if gold continues to outperform.

In the meantime, gold costs have surged 13% since December 2023, strengthening its place as a safe-haven asset. Schiff predicts that if Nasdaq crashes by 40%, gold may climb above $3,800 per ounce, drawing extra institutional buyers away from Bitcoin.

Key Takeaways:

- Nasdaq’s 12% decline hints at potential BTC drop to $65K.

- Economists warn of Bitcoin falling to $20K–$10K in a bear market.

- Gold’s 13% rally challenges BTC’s store-of-value enchantment.

Bitcoin Consolidates Close to $83K – Breakout or Breakdown Forward?

Bitcoin (BTC/USD) is buying and selling close to $83,200, consolidating inside a symmetrical triangle on the 2-hour chart. The 50-period EMA at $83,490 is performing as fast resistance, whereas the trendline assist close to $82,050 is conserving costs steady. A breakout from this formation is imminent, with key resistance at $85,038—a break above this might push BTC towards $87,400 and $90,295.

On the draw back, $82,050 stays an important assist degree. If BTC breaks under this degree, the following key helps are $79,050 and $76,600.

Bitcoin stays indecisive forward of the FOMC assembly on March 19, with merchants looking forward to a breakout. A volume-backed transfer above $85,000 may affirm bullish momentum, whereas failure to carry assist might result in a sharper correction.

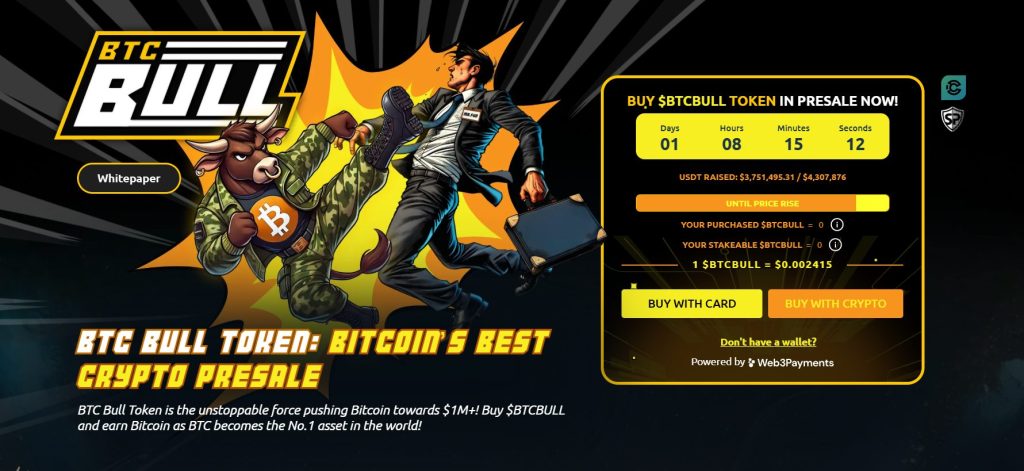

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that robotically rewards holders with actual Bitcoin when BTC hits key value milestones. In contrast to conventional meme tokens, BTCBULL is constructed for long-term buyers, providing actual incentives via airdropped BTC rewards and staking alternatives.

Staking & Passive Earnings Alternatives

BTC Bull gives a high-yield staking program with a formidable 119% APY, permitting customers to generate passive revenue. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting robust group participation.

Newest Presale Updates:

- Present Presale Worth: $0.002415 per BTCBULL

- Whole Raised: $3.7M / $4.3M goal

With demand surging, this presale gives a possibility to amass BTCBULL at early-stage pricing earlier than the following value enhance.

The submit Bitcoin Whales Exit $945M in ETFs – Can BTC Break Above $85K? appeared first on Cryptonews.

Key Factors to Watch in This Week’s FOMC Assembly

Key Factors to Watch in This Week’s FOMC Assembly