Stablecoin developer Ethena Labs and real-world asset (RWA) tokenization firm Securitize are launching a brand new blockchain for retail and institutional buyers looking for entry to the DeFi and tokenization economies.

In keeping with a March 17 announcement, the forthcoming Converge blockchain is an Ethereum Digital Machine that can present retail buyers with entry to “commonplace DeFi functions.” It is going to additionally specialise in institutional-grade choices that can assist bridge conventional finance with DeFi alternatives.

The Converge blockchain is introduced on the Tokenize NYC convention on March 17. Supply: Cointelegraph

Converge will launch with varied product choices, together with Ethereal, Morpho, Maple Labs, Pendle and Aave Labs’ Horizon.

Converge’s RWA infrastructure will profit from Securitize’s rising presence within the tokenization market, with practically $2 billion minted throughout varied blockchains. The corporate just lately introduced that BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has surpassed $1 billion in web belongings one yr after launch.

The Converge blockchain will obtain custodial assist from Anchorage and Copper in addition to custodial assist from Securitize’s latest partner, RedStone.

On the DeFi aspect, Converge will enable customers to stake Ethena’s native governance token, ENA. Ethena’s USDe (USDE) and USDtb stablecoins will function the community’s fuel tokens.

Associated: BlackRock CEO wants SEC to ‘rapidly approve’ tokenization of bonds, stocks: What it means for crypto

Institutional DeFi on the rise

Institutional DeFi — when conventional monetary establishments undertake regulatory-compliant DeFi techniques — seems to be gaining traction as corporations look to optimize their operations and entry new yield alternatives.

Even JPMorgan, as soon as a blockchain and Bitcoin (BTC) skeptic, mentioned institutional DeFi “has the potential for progress and transformative affect.”

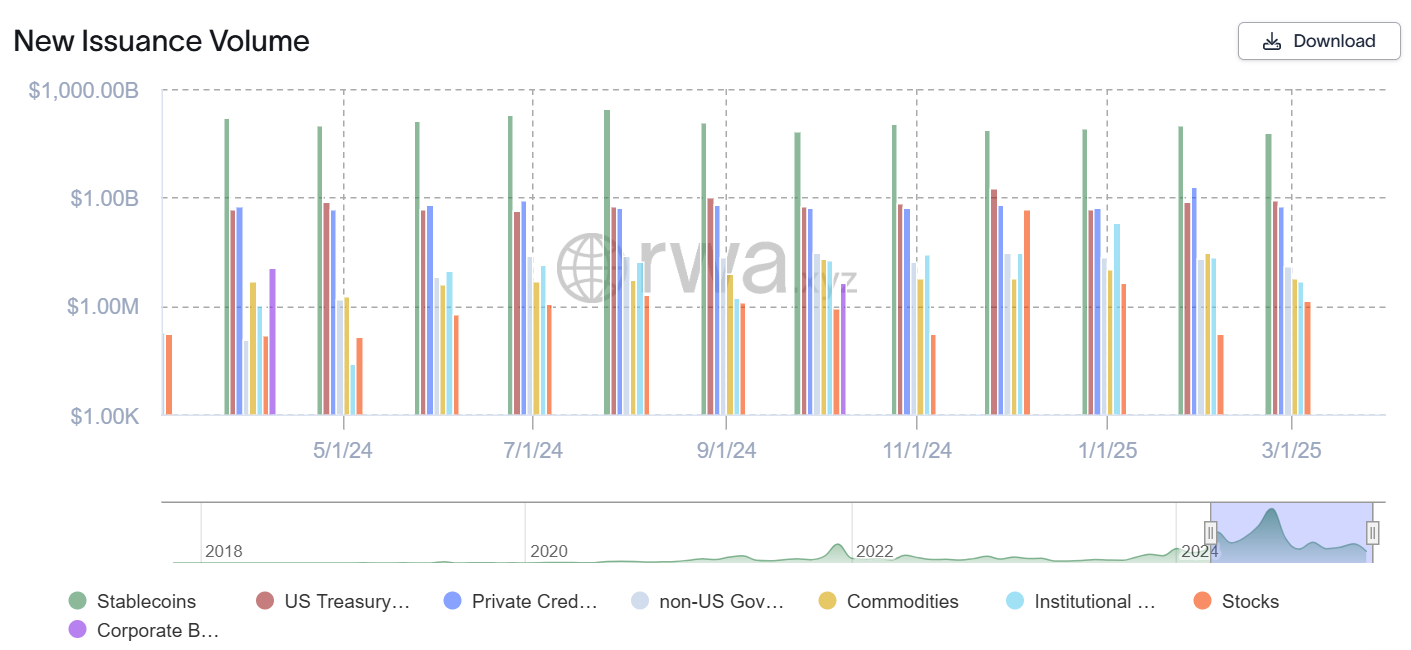

RWAs are accelerating this trend, with the likes of McKinsey forecasting a $2 trillion tokenization market by 2030.

As Neoclassic Capital co-founder Michael Bucella famous in an interview with Cointelegraph, RWAs are attracting massive buyers as a result of they deal with “pricing inefficiencies” in each conventional and digital belongings.

“To TradFi, that's mispriced credit score amenities (i.e., price of capital) or publicity to underpriced quantity. To crypto-native, that's low-volume, safe belongings,” mentioned Bucella.

Together with stablecoins, that are onchain representations of fiat currencies, the whole RWA market has exceeded $240 billion, based on trade knowledge.

Excluding stablecoins, the whole worth of RWAs onchain is quick approaching $20 billion throughout greater than 90,500 holders, based on RWA.xyz.

The brand new issuance quantity of RWA reveals a major progress in stablecoins, US Treasury and personal credit score debt. Supply: RWA.xyz

Associated: Bitwise makes first institutional DeFi allocation