Crypto whale monitoring on the Hyperliquid blockchain has enabled merchants to focus on whales with outstanding leveraged positions in a “democratized” try to liquidate them, in keeping with the top of 10x Analysis.

Hyperliquid, a blockchain network specializing in buying and selling, permits merchants to publicly observe what kind of positions a whale is holding, and since these positions are leveraged, the market can assess the liquidation ranges except a further margin is added, Markus Thielen stated in a March 17 report.

Supply: 10x Research

“This transparency opens the door for coordinated efforts, the place teams of merchants may deliberately goal these cease ranges to set off liquidations,” he stated.

It’s a standard perception within the crypto market that whales with substantial holdings can influence the market through their trading techniques, similar to stop-loss hunting, to intentionally set off different merchants’ stop-loss orders and liquidate their positions.

Thielen says the current actions from merchants present this steadiness of energy may very well be shifting.

“In impact, stop-hunting is being ‘democratized,’ with ad-hoc teams now enjoying a task as soon as reserved primarily for market-making desks, or treasury groups, at exchanges earlier than tighter regulatory scrutiny,” Thielen added.

Thielen instructed Cointelegraph that it’s nonetheless “unclear if any such exercise will turn into widespread onchain, however as all the time, transparency can lower each methods.”

Why are merchants attempting to liquidate whales?

This isn’t the primary time smaller merchants have tried to take down bigger entities by way of coordinated buying and selling techniques.

Thielen says crypto merchants attempting to liquidate whales have echoes of the GameStop short squeeze, which noticed small merchants flip the desk on Wall Road short-sellers by shopping for GameStop’s inventory, sending it to all-time highs of over $81 to liquid their positions.

“This jogs my memory of the dynamics we noticed throughout the GameStop saga in 2020/2021, the place aggressive quick squeezes drove fast worth spikes,” he stated.

Associated: Bybit CEO on ‘brutal’ $4M Hyperliquid loss: Lower leverage as positions grow

“When cease ranges get triggered, costs typically speed up in that route, offering liquidity for others to cowl. We’ve seen comparable techniques from market makers and exchanges within the crypto area over time.”

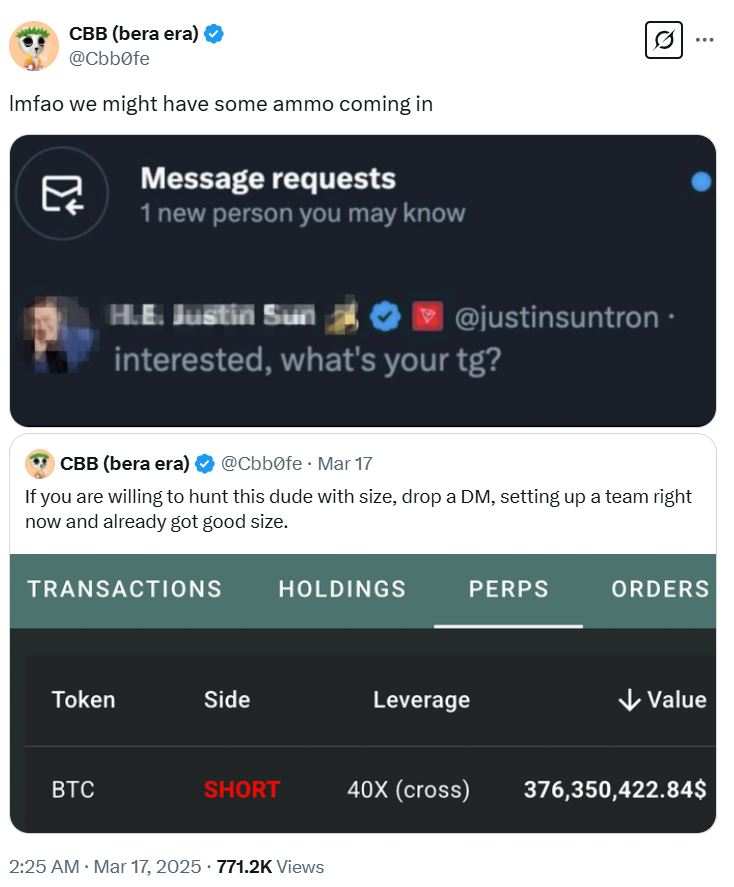

Hunt continues to be on for 40x leveraged Bitcoin short-seller

On March 16, a crypto whale recognized for putting giant, extremely leveraged positions on Hyperliquid opened a 40x leveraged short position at $84,043 for over 4,442 Bitcoin (BTC), price over $368 million on March 16, going through liquidation if Bitcoin’s worth surpassed $85,592.

The transfer didn’t go unnoticed, and pseudonymous dealer CBB sent out the decision on X to collect a staff of merchants with sufficient funds to liquidate the whale’s place.

Supply: CBB

Thielen stated within the 10x report that on March 16, Bitcoin surged by 2.5% inside minutes, partly due to a coordinated effort to liquidate a whale’s quick place on Bitcoin perpetual through Hyperliquid.

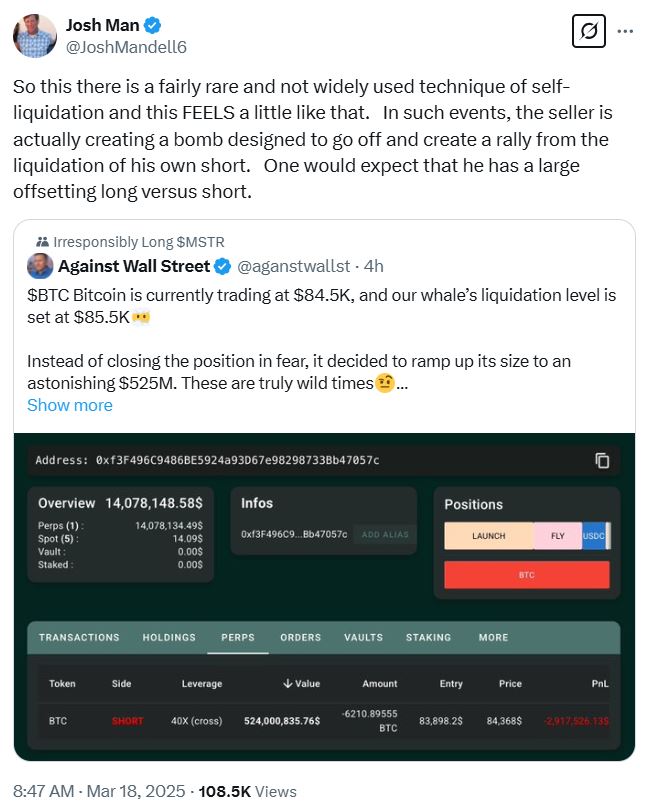

The whale has since increased their place to $524 million, and at one level, the whale hunters practically acquired their want when the value of Bitcoin hit $84,583.84, according to CoinGecko.

Supply: CRG

Nonetheless, some speculate the uncovered quick place may very well be intentional.

Hedge fund dealer Josh Man said in a March 17 publish to X that the whale is likely to be purposefully attempting to get liquidated.

“So this there's a pretty uncommon and never broadly used strategy of self-liquidation and this FEELS slightly like that,” he stated.

“In such occasions, the vendor is definitely making a bomb designed to go off and create a rally from the liquidation of his personal quick. One would anticipate that he has a big offsetting lengthy versus quick.”

Supply: Josh Man

Journal: Crypto fans are obsessed with longevity and biohacking: Here’s why