Crypto whale monitoring on the Hyperliquid blockchain has enabled merchants to focus on whales with outstanding leveraged positions in a “democratized” try and liquidate them, in keeping with the pinnacle of 10x Analysis.

Hyperliquid, a blockchain network specializing in buying and selling, permits merchants to publicly observe what kind of positions a whale is holding, and since these positions are leveraged, the market can assess the liquidation ranges except an extra margin is added, Markus Thielen stated in a March 17 report.

Supply: 10x Research

“This transparency opens the door for coordinated efforts, the place teams of merchants may deliberately goal these cease ranges to set off liquidations,” he stated.

It’s a typical perception within the crypto market that whales with substantial holdings can influence the market through their trading techniques, equivalent to stop-loss hunting, to intentionally set off different merchants’ stop-loss orders and liquidate their positions.

Thielen says the current actions from merchants present this stability of energy may very well be shifting.

“In impact, stop-hunting is being ‘democratized,’ with ad-hoc teams now enjoying a task as soon as reserved primarily for market-making desks, or treasury groups, at exchanges earlier than tighter regulatory scrutiny,” Thielen added.

Thielen instructed Cointelegraph that it’s nonetheless “unclear if one of these exercise will develop into widespread onchain, however as at all times, transparency can reduce each methods.”

Why are merchants attempting to liquidate whales?

This isn’t the primary time smaller merchants have tried to take down bigger entities via coordinated buying and selling techniques.

Thielen says crypto merchants attempting to liquidate whales have echoes of the GameStop short squeeze, which noticed small merchants flip the desk on Wall Road short-sellers by shopping for GameStop’s inventory, sending it to all-time highs of over $81 to liquid their positions.

“This jogs my memory of the dynamics we noticed through the GameStop saga in 2020/2021, the place aggressive quick squeezes drove speedy worth spikes,” he stated.

Associated: Bybit CEO on ‘brutal’ $4M Hyperliquid loss: Lower leverage as positions grow

“When cease ranges get triggered, costs usually speed up in that path, offering liquidity for others to cowl. We’ve seen comparable techniques from market makers and exchanges within the crypto house over time.”

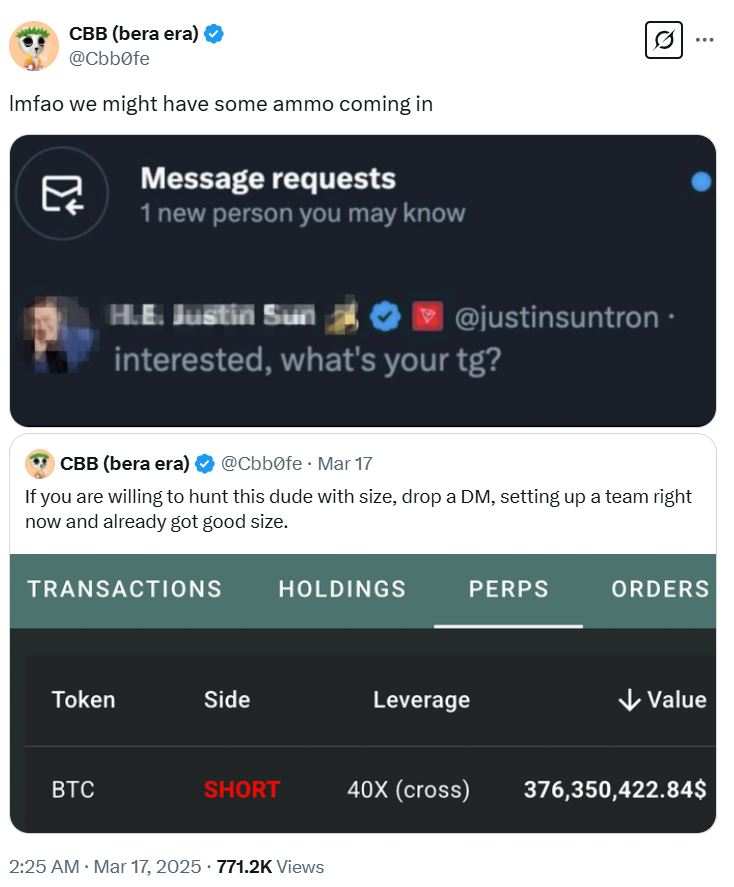

Hunt remains to be on for 40x leveraged Bitcoin short-seller

On March 16, a crypto whale recognized for putting giant, extremely leveraged positions on Hyperliquid opened a 40x leveraged short position at $84,043 for over 4,442 Bitcoin (BTC), price over $368 million on March 16, going through liquidation if Bitcoin’s worth surpassed $85,592.

The transfer didn’t go unnoticed, and pseudonymous dealer CBB sent out the decision on X to assemble a workforce of merchants with sufficient funds to liquidate the whale’s place.

Supply: CBB

Thielen stated within the 10x report that on March 16, Bitcoin surged by 2.5% inside minutes, partly due to a coordinated effort to liquidate a whale’s quick place on Bitcoin perpetual by way of Hyperliquid.

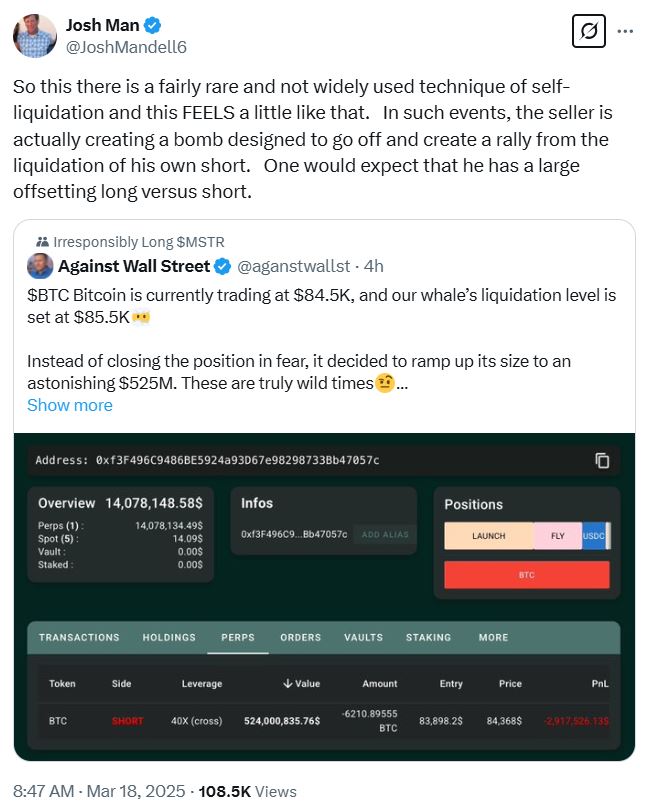

The whale has since increased their place to $524 million, and at one level, the whale hunters almost received their want when the value of Bitcoin hit $84,583.84, according to CoinGecko.

Supply: CRG

Nevertheless, some speculate the uncovered quick place may very well be intentional.

Hedge fund dealer Josh Man said in a March 17 submit to X that the whale may be purposefully attempting to get liquidated.

“So this there's a pretty uncommon and never broadly used strategy of self-liquidation and this FEELS a bit of like that,” he stated.

“In such occasions, the vendor is definitely making a bomb designed to go off and create a rally from the liquidation of his personal quick. One would anticipate that he has a big offsetting lengthy versus quick.”

Supply: Josh Man

Journal: Crypto fans are obsessed with longevity and biohacking: Here’s why