Ethereum’s native token, Ether (ETH), continues to consolidate beneath $2,000, which some merchants view as a psychological degree. Ether worth slipped beneath this vary on March 10, and the altcoin continues to commerce at its lowest worth since October 2023.

Ethereum 4-hour chart. Supply: Cointelegraph/TradingView

Ether worth has additionally misplaced market worth with respect to different main altcoins, with XRP worth reaching its highest degree in opposition to ETH in 5 years on March 15.

The actual query amongst buyers is whether or not ETH is able to recapturing a portion of its latest losses or whether or not merchants will capitulate if the worth falls beneath $1,900.

Ethereum merchants may leap ship if worth falls beneath $1,900

Based on data from IntoTheBlock, an information analytics platform, Ethereum holders gathered 3.56 million ETH between $1,900 and $1,843, with a mean worth of $1,871. Due to this fact, the present accumulation worth presently stands at $6.65 billion. This means that ETH’s worth has a powerful assist degree between $1,900 and $1,843, which might doubtlessly act because the bullish reversal zone.

Ethereum In/Out of the Cash chart. Supply: X.com

Nonetheless, if Ether drops beneath $1,843, knowledge factors to the potential for rising capitulation fears. Capitulation is a market sentiment the place buyers are inclined to panic, promoting their positions at a loss throughout a pointy market correction. If ETH consolidates for a protracted interval beneath $1,843, the chance of a deeper correction will increase exponentially.

Beneath $1,843, the dimensions and quantity of ETH accumulation are considerably decrease, which additional illustrates the significance of the $1,900 to $1,843 assist vary.

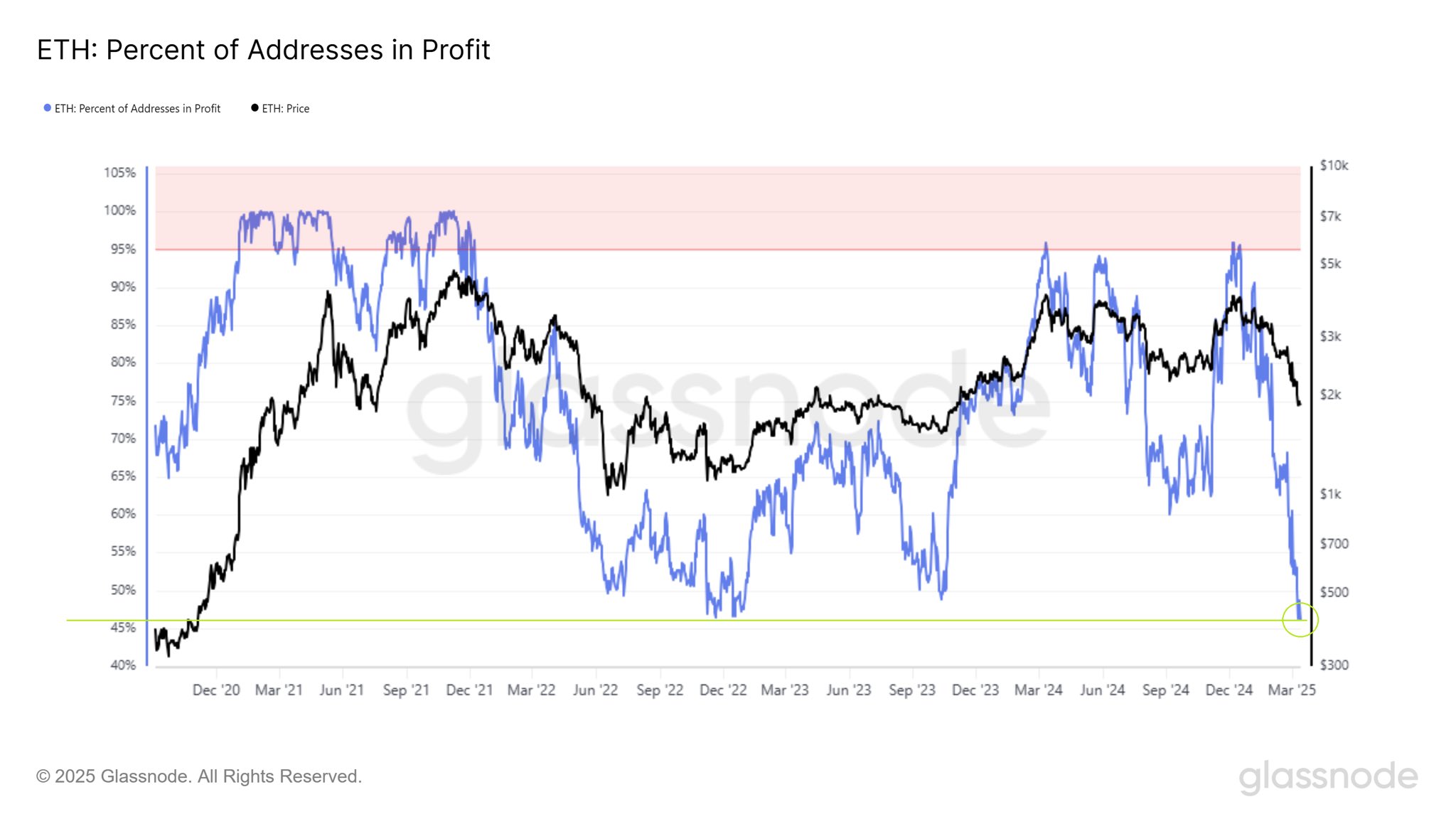

Equally, the share of Ethereum addresses beneath revenue dropped to its lowest degree for the reason that begin of the last decade. It's the lowest worth since December 2022 at just below 46%.

ETH: Proportion of addresses in Revenue. Supply: X

A low share of worthwhile addresses has traditionally indicated a worth backside for Ethereum. Given the excessive ETH accumulation and fewer worthwhile addresses, these elements might act as bullish indicators. Consequently, the chance of Ethereum consolidating beneath $1,843 in the long run is lowering.

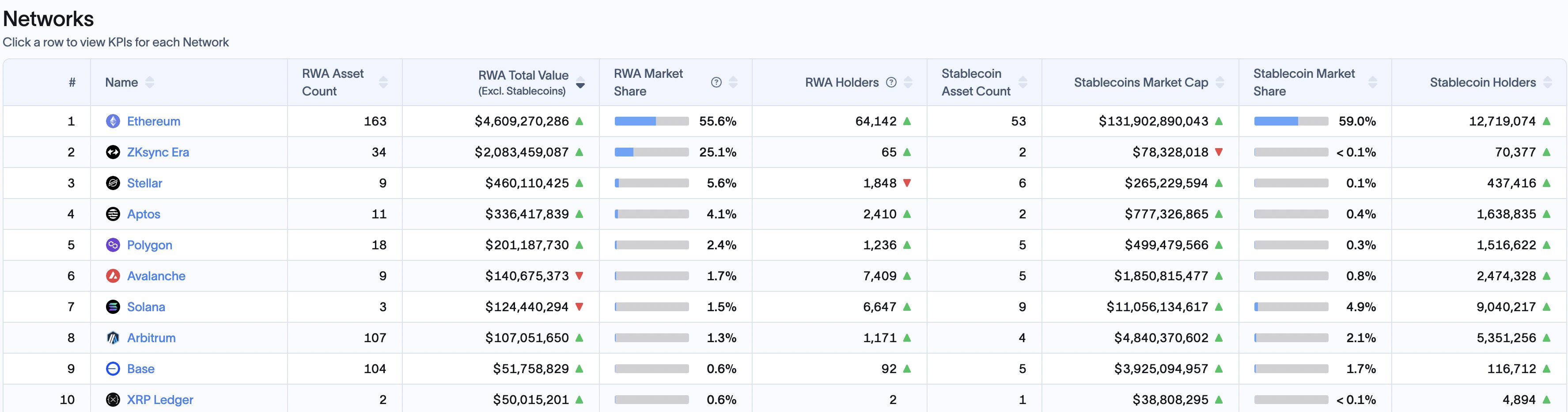

Hitesh Malviya, the founding father of DYOR crypto, said it isn't a “nice time to bearish on ETH.” In an X submit, Malviya highlighted the latest rise of real-world belongings (RWAs) within the business, with a 50.9% improve in progress over the previous 30 days and an 850% yearly improve, with Ethereum and ZKsync capturing greater than 80% of the overall market share.

RWA’s market share on L1s. Supply: X

Associated: Bitcoin 'bullish cross' with 50%-plus common returns flashes once more

Ethereum lengthy/quick ratio signifies a impartial market

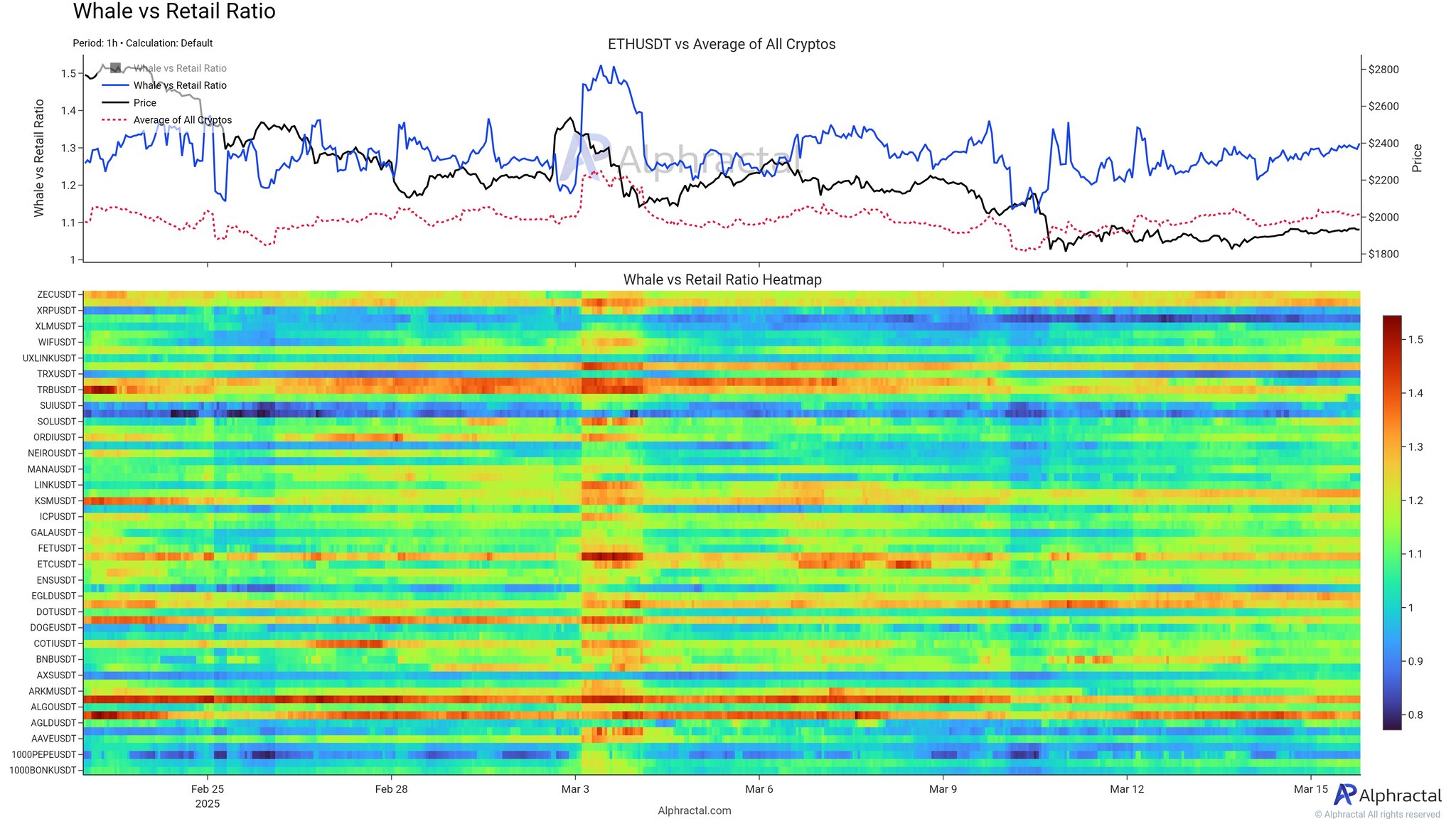

Alphractal, a crypto knowledge evaluation web site, reviewed Ether’s present market sentiment based mostly on the lengthy/quick ratio, a metric to guage the proportion of futures merchants betting for worth will increase (lengthy) versus decreases (shorts).

Whales vs. Retail ratio heatmap. Supply: X

Based on the chart above, the most important buyers are extra inclined towards taking lengthy positions, whereas smaller buyers are within the means of deleveraging. Deleveraging means unwinding dangerous, borrowed positions, which lowers market volatility and curiosity in leveraged buying and selling.

With the present ratio at 1.3, the lengthy/quick ratio signifies a balanced however cautious market. Alphractal added,

“This means that, within the quick time period, Ethereum is experiencing low volatility and low curiosity in leverage, which can depart many merchants exhausted and impatient.”

Related: Ethereum onchain data suggests $2K ETH price is out of reach for now

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.