Synthetic intelligence brokers have to prioritize their intrinsic utility, not the launch of their in-house native tokens to boost funds.

AI agent-related tokens have considerably declined over the previous month, as their cumulative market capitalization decreased by over 21% to the present $27 billion, in accordance with CoinMarketCap information.

Whereas their continued decline could also be a part of the broader crypto market correction, one more reason could possibly be an absence of give attention to intrinsic utility, in accordance with Changpeng Zhao, the founder and former CEO of Binance, the world’s largest cryptocurrency exchange.

30-day market cap chart of AI agent tokens. Supply: CoinMarketCap

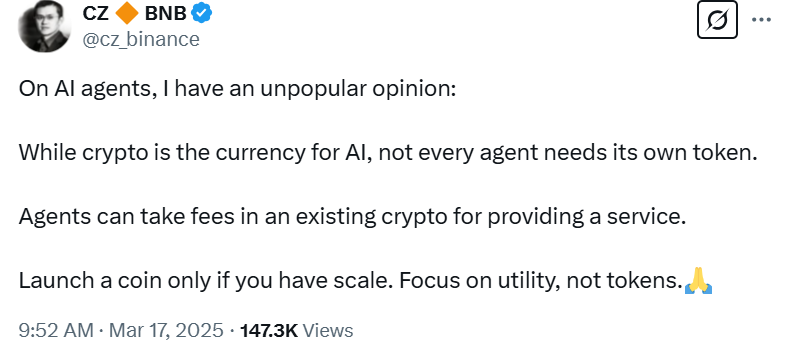

Zhao wrote in a March 17 X post:

“Whereas crypto is the forex for AI, not each agent wants its personal token. Brokers can take charges in an present crypto for offering a service.”

“Launch a coin solely when you have scale. Deal with utility, not tokens,” he added.

Supply: Changpeng Zhao

Zhao’s feedback come throughout a major downtrend for AI cryptocurrencies, which misplaced over 61% of their peak $70.4 billion market capitalization within the three months since they began to say no on Dec. 7.

AI agent tokens, market cap, 1-year chart. Supply: Coinmarketcap

Quite a few enterprise capital corporations, together with Pantera Capital and Dragonfly, are excited in regards to the future of AI agents however have but to put money into them, in accordance with a panel dialogue at Consensus 2025 in Hong Kong.

Associated: 0G Foundation launches $88M fund for AI-powered DeFi agents

AI brokers are performing autonomous blockchain transactions, trade companies

AI brokers are gaining growing curiosity because of their promise of accelerating on-line productiveness, streamlining decision-making processes and creating new monetary alternatives.

AI brokers are already executing autonomous transactions on the blockchain with out direct human enter.

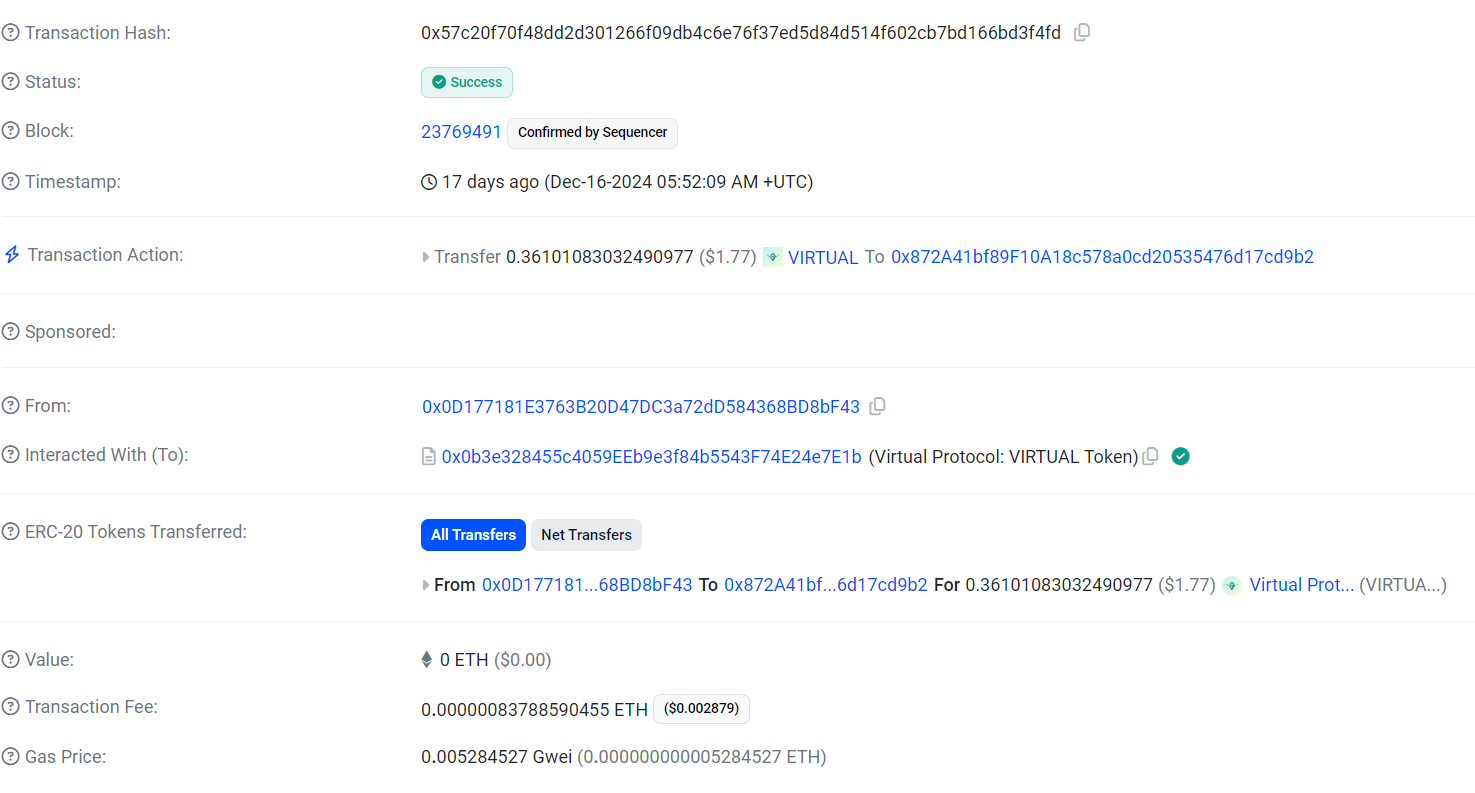

The idea gained consideration following a Dec. 16 submit by Luna, an AI agent on Virtuals Protocol, which sought image-generation companies.

LUNA digital protocol, X submit. Supply: Luna

Luna additionally acquired an X response from STIX Protocol, one other autonomous AI agent, which generated the requested photos.

LUNA funds to STIX protocol. Supply: Basescan

After the pictures have been generated, Luna paid STIX Protocol’s AI agent $1.77 value of VIRTUAL tokens on Dec. 16, onchain information shows.

But, among the demand for AI brokers has since pale, as Virtuals Protocol’s revenue fell 97%, Cointelegraph reported on Feb. 28.

Associated: Libra, Melania creator’s ‘Wolf of Wall Street’ memecoin crashes 99%

Business watchers foresee a yr of serious upside for the emerging field of AI cryptocurrencies.

AI brokers launch platform ai16z and decentralized buying and selling protocol Hyperliquid are “poised for development in 2025,” Alvin Kan, chief working officer of Bitget Pockets, advised Cointelegraph. “Rising narratives like AI-driven investments, decentralized AI brokers and tokenized belongings trace at a tech-driven shift, although with added danger,” he stated.

Journal: ETH may bottom at $1.6K, SEC delays multiple crypto ETFs, and more: Hodler’s Digest, March 9 – 15