Bitcoin (BTC) has largely stayed above $80,000 since March 11, indicating that the bulls aren't ready for a deeper correction to purchase. Nevertheless, the failure to propel the value above $86,000 exhibits that the bears haven't given up and proceed to promote on rallies.

CoinShares’ weekly report exhibits that cryptocurrency exchange-traded merchandise (ETPs) witnessed $1.7 billion in outflows last week. That takes the entire five-week outflows to $6.4 billion. Moreover, the streak of outflows has reached 17 days, marking the longest destructive streak since CoinShares data started in 2015.

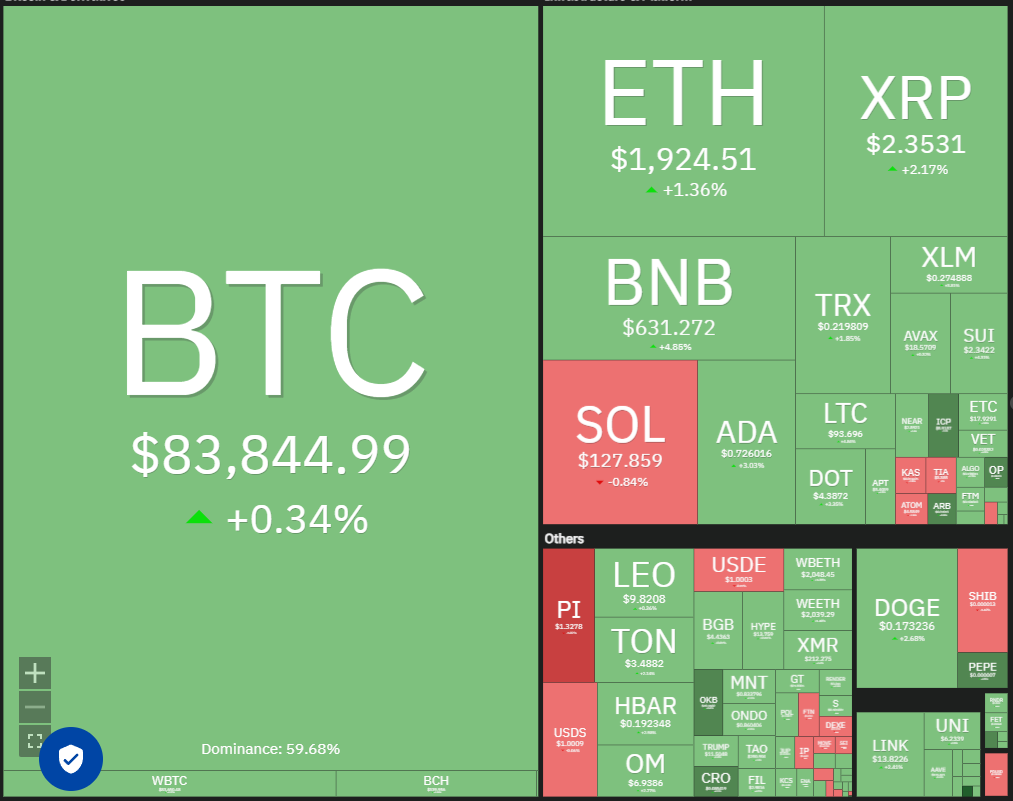

Every day cryptocurrency market efficiency. Supply: Coin360

It’s not all gloom and doom for the long-term buyers. CryptoQuant contributor ShayanBTC stated that buyers who bought Bitcoin between three and 6 months in the past are showing an accumulation pattern. Traditionally, related conduct has “performed an important function in forming market bottoms and igniting new uptrends.”

Will consumers achieve catapulting Bitcoin above the overhead resistance ranges? How are the altcoins positioned? Let’s analyze the charts to search out out.

S&P 500 Index value evaluation

The S&P 500 Index (SPX) is in a powerful corrective section. The autumn to five,504 on March 13 despatched the relative energy index (RSI) into the oversold territory, signaling a attainable reduction rally within the close to time period.

SPX day by day chart. Supply: Cointelegraph/TradingView

The bears will attempt to halt the restoration within the 5,670 to five,773 resistance zone. In the event that they succeed, it'll sign that the sentiment stays destructive and merchants are promoting on rallies. That heightens the chance of a fall to five,400. The bulls are anticipated to defend the 5,400 degree with all their would possibly as a result of a drop beneath it might sink the index to five,100.

On the upside, a break and shut above the 20-day exponential shifting common (5,780) will sign energy. The index might then climb to the 50-day easy shifting common (5,938).

US Greenback Index value evaluation

The weak rebound off the 103.37 help within the US Greenback Index (DXY) means that the bears have stored up the stress.

DXY day by day chart. Supply: Cointelegraph/TradingView

Sellers try to sink the index beneath 103.37. If they'll pull it off, the decline may prolong to 102 and thereafter to 101.

Conversely, if the value turns up from the present degree and breaks above 104, it'll sign that consumers try to make a comeback. The index may rise to the 20-day EMA (105), which is prone to appeal to sellers. If consumers don't cede a lot floor to the bears, the prospects of a break above the 20-day EMA enhance. The index may then rally to the 50-day SMA (107).

Bitcoin value evaluation

Bitcoin has been attempting to type a better low within the close to time period, constructing energy to cross above the 200-day SMA ($84,112).

BTC/USDT day by day chart. Supply: Cointelegraph/TradingView

The optimistic divergence on the RSI means that the bearish momentum is weakening. If consumers drive the value above the 20-day EMA ($85,808), the BTC/USDT pair may rise to the 50-day SMA ($92,621).

Opposite to this assumption, if the value turns down sharply from the 200-day SMA, it'll point out that the bears try to flip the extent into resistance. The pair might slide to $80,000 and subsequent to $76,606.

Ether value evaluation

Ether (ETH) has been buying and selling between $1,963 and $1,821, signaling an absence of aggressive shopping for at present ranges.

ETH/USDT day by day chart. Supply: Cointelegraph/TradingView

If the value dips beneath the $1,821 to $1,754 help zone, it'll point out the resumption of the downtrend. The ETH/USDT pair might then nosedive to the following important help at $1,550.

This destructive view can be invalidated within the close to time period if the value turns up and breaks above the 20-day EMA ($2,107). The pair may ascend to the 50-day SMA ($2,514), the place the bears are prone to promote aggressively. Nevertheless, if the bulls pierce the 50-day SMA resistance, the pair might rally to $2,857.

XRP value evaluation

XRP (XRP) turned down from the 50-day SMA ($2.51) on March 15, indicating that the bears are energetic at increased ranges.

XRP/USDT day by day chart. Supply: Cointelegraph/TradingView

The 20-day EMA ($2.34) has flattened out, and the RSI is close to the midpoint, indicating a steadiness between provide and demand. The XRP/USDT pair may stay caught between the 50-day SMA and $2 for a while.

If the value turns up from the present degree and breaks above the 50-day SMA, it'll clear the trail for a possible rally to $3. As an alternative, a break and shut beneath $2 will full a head-and-shoulders sample. The pair might then tumble to $1.28.

BNB value evaluation

BNB (BNB) turned up from the 20-day EMA ($598) and rose above the 50-day SMA ($620), indicating that the correction could also be ending.

BNB/USDT day by day chart. Supply: Cointelegraph/TradingView

The 20-day EMA has began to show up, and the RSI has risen into optimistic territory, indicating a slight benefit to the bulls. If the value sustains above the 50-day SMA, the BNB/USDT pair may rally to $686 and ultimately to $745.

The 20-day EMA is the important help to be careful for on the draw back. A break and shut beneath the 20-day EMA will sign that the bears have seized management. The pair might then descend to the sturdy help at $500.

Solana value evaluation

Solana (SOL) turned down from the 20-day EMA ($139) on March 16, signaling that bears are aggressively defending the extent.

SOL/USDT day by day chart. Supply: Cointelegraph/TradingView

The SOL/USDT pair may drop to $120 after which to $110, the place consumers are anticipated to step in. If the value rebounds off the help zone, the bulls will once more attempt to drive the SOL/USDT pair above the 20-day EMA. In the event that they handle to try this, the pair may climb to $180.

This optimistic view can be invalidated within the close to time period if the value continues decrease and breaks beneath the help zone. Which will begin a downward transfer to $100 and subsequently to $80.

Associated: Ethereum onchain data suggests $2K ETH price is out of reach for now

Dogecoin value evaluation

Dogecoin (DOGE) has been regularly rising towards the 20-day EMA ($0.19), which is a crucial near-term resistance to be careful for.

DOGE/USDT day by day chart. Supply: Cointelegraph/TradingView

If the value turns down sharply from the 20-day EMA, it means that bears are promoting on each minor rally. That heightens the chance of a break beneath the $0.14 help. If that occurs, the DOGE/USDT pair may plunge to $0.10.

Contrarily, a break and shut above the 20-day EMA signifies that the promoting stress is decreasing. The pair may rise to the 50-day SMA ($0.23) and later to $0.29. A break and shut above $0.29 means that consumers are again within the driver’s seat.

Cardano value evaluation

Cardano (ADA) has been buying and selling beneath the 20-day EMA ($0.76) since March 8, however the bears have didn't sink the pair to the uptrend line. This implies that promoting dries up at decrease ranges.

ADA/USDT day by day chart. Supply: Cointelegraph/TradingView

Patrons must drive the value above the shifting averages to start out a sustained restoration. The ADA/USDT pair may climb to $1.02, the place the bears might once more mount a powerful protection.

Opposite to this assumption, if the value turns down from the shifting averages, it'll counsel that bears stay in management. That will increase the probability of a drop beneath the uptrend line. If that occurs, the pair might plummet to $0.50.

Pi value evaluation

Pi (PI) has been regularly sliding towards the $1.23 help, which is prone to appeal to shopping for from the bulls.

PI/USDT day by day chart. Supply: Cointelegraph/TradingView

If the value rebounds off $1.23 with energy, the PI/USDT pair may try a transfer again towards $1.80. Sellers are anticipated to pose a powerful problem at $1.80, but when the bulls prevail, the pair may rally to $2 and thereafter to $2.35.

Contrarily, if the value turns down from $1.80, it'll sign a spread formation. The pair might swing between $1.23 and $1.80 for some time. Sellers will strengthen their place on a break beneath $1.23. The pair might then collapse to the 78.6% retracement degree of $0.72.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.