Whereas most analysts count on the crypto bull cycle to proceed till the tip of 2025, considerations over an financial recession in the US, together with crypto’s “round” economic system, should threaten crypto valuations.

Regardless of the latest market correction, most crypto analysts count on the bull cycle to peak after the third quarter of 2025, with Bitcoin (BTC) worth predictions ranging from $160,000 to above $180,000.

Past exterior considerations, reminiscent of a possible recession on the earth’s largest economic system, crypto’s greatest industry-specific danger is the “round” nature of its economic system, in keeping with Arthur Breitman, the co-founder of Tezos.

“Inside the {industry}, the primary danger is that the {industry} continues to be very a lot seeking grounding. It’s all nonetheless very round,” Breitman informed Cointelegraph.

“If you happen to have a look at DeFi, for instance, the purpose of finance is to finance one thing [...], but when the one factor that DeFi funds is extra DeFi, then that’s round,” stated Breitman, including:

“If the one cause folks need to purchase your token is as a result of they really feel different folks will need to purchase this token, that is round.”

That is in stark distinction to the inventory market, which is “constructed on revenue-generating companies,” making the crypto {industry}’s “lack of grounding” one of many fundamental {industry} threats, Breitman added.

Different {industry} insiders have additionally criticized the state of the crypto economic system, particularly associated to the newest memecoin meltdowns, that are siphoning liquidity from extra established cryptocurrencies.

Solana outflows. Supply: deBridge, Binance Analysis

Solana was hit by over $485 million price of outflows in February after the latest wave of memecoin rug pulls triggered an investor flight to “security,” with among the capital flowing into memecoins on the BNB Chain, reminiscent of the Broccoli memecoin, impressed by the Changpeng Zhao’s canine.

Associated: Rising $219B stablecoin supply signals mid-bull cycle, not market top

US recession fears are crypto’s greatest exterior danger: Tezos co-founder

Past industry-specific occasions, bigger macroeconomic considerations, together with a possible US recession, threaten conventional and cryptocurrency markets.

“By way of macro occasions, I nonetheless assume we might see a recession,” stated Breitman, including:

“There's quite a lot of bullish winds for the market, however there's additionally quite a lot of conventional recession indicators which have been flashing for some time now. So I do not assume you may rule it out.”

Cryptocurrency markets nonetheless commerce in vital correlation with tech shares, which means {that a} recession will trigger a widespread sell-off, he added.

Associated: Libra, Melania creator’s ‘Wolf of Wall Street’ memecoin crashes 99%

The present commerce conflict considerations, pushed by US President Donald Trump’s import tariffs and continued retaliatory measures, have reignited considerations over a possible recession.

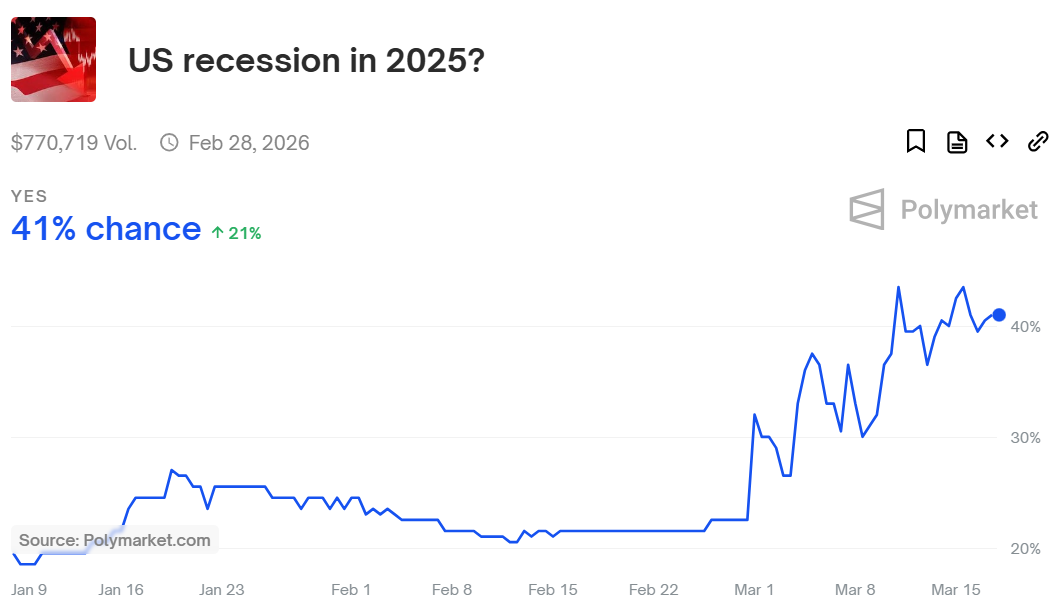

Supply: Polymarket

Over 40% of market members count on a recession within the US this yr, up from simply 22% a month in the past on Feb. 17, in keeping with the biggest decentralized predictions market, Polymarket.

Journal: Crypto fans are obsessed with longevity and biohacking: Here’s why