[ad_1] Coinbase alternate’s inventory value has acquired an optimistic value prediction from a Bernstein analyst, citing bettering crypto regulatory readability on this planet’s largest economic system.Gautam Chhugani, an analyst at international asset administration agency Bernstein, initiated protection of Nasdaq-listed Coinbase (COIN) inventory with an outperform ranking and a value goal of over $310.The analyst expects bettering mainstream cryptocurrency adoption, pushed by US President Donald Trump’s administration, which intends to make

[ad_1] Coinbase trade’s inventory value has acquired an optimistic value prediction from a Bernstein analyst, citing enhancing crypto regulatory readability on the planet’s largest economic system.Gautam Chhugani, an analyst at world asset administration agency Bernstein, initiated protection of Nasdaq-listed Coinbase (COIN) inventory with an outperform ranking and a value goal of over $310.The analyst expects enhancing mainstream cryptocurrency adoption, pushed by US President Donald Trump’s administration, which intends to make

[ad_1] Enterprise intelligence agency and Bitcoin investor Technique plans to supply 5 million shares of the corporate’s Collection A Perpetual Strife Most popular Inventory and use the proceeds to buy extra Bitcoin. In an announcement, the corporate said it intends to make use of the proceeds for basic functions. This consists of its working capital and “acquisition of Bitcoin.” Nonetheless, the corporate mentioned that is nonetheless topic to market and different

[ad_1] Xapo Financial institution, a worldwide cryptocurrency-friendly financial institution headquartered in Gibraltar, is betting on crypto lending revival by launching Bitcoin-backed US greenback loans.Qualifying Xapo Financial institution shoppers can now entry Bitcoin (BTC) loans of as much as $1 million, the agency stated in an announcement shared with Cointelegraph on March 18.The brand new lending product is designed for long-term Bitcoin hodlers who need to entry money whereas preserving their

[ad_1] A Bitcoin whale has secured almost $10 million in revenue after closing a 40x leverage brief place value over $516 million, betting in opposition to Bitcoin’s value forward of the upcoming Federal Open Market Committee (FOMC) meeting this week.The investor shorted 6,210 BTC at an entry value of $84,043 per Bitcoin, utilizing borrowed funds to extend the scale of the place.The dealer closed all brief positions inside a number

[ad_1] Bitcoin’s (BTC) worth failed one other try at breaking above resistance at $85,000 on March 17. Since March 12, BTC worth fashioned each day candle highs between $84,000 and $85,200, however has been unable to shut above $84,600.Bitcoin 1-hour chart. Supply: Cointelegraph/TradingViewBitcoin stays in “no man’s land” on the decrease time-frame (LTF) of the 1-hour chart. This time period in buying and selling markets is outlined as a worth

[ad_1] Bitcoin’s (BTC) worth failed one other try at breaking above resistance at $85,000 on March 17. Since March 12, BTC worth fashioned day by day candle highs between $84,000 and $85,200, however has been unable to shut above $84,600.Bitcoin 1-hour chart. Supply: Cointelegraph/TradingViewBitcoin stays in “no man’s land” on the decrease timeframe (LTF) of the 1-hour chart. This time period in buying and selling markets is outlined as a

[ad_1] Bitcoin’s (BTC) value failed one other try at breaking above resistance at $85,000 on March 17. Since March 12, BTC value fashioned each day candle highs between $84,000 and $85,200, however has been unable to shut above $84,600.Bitcoin 1-hour chart. Supply: Cointelegraph/TradingViewBitcoin stays in “no man’s land” on the decrease time-frame (LTF) of the 1-hour chart. This time period in buying and selling markets is outlined as a value

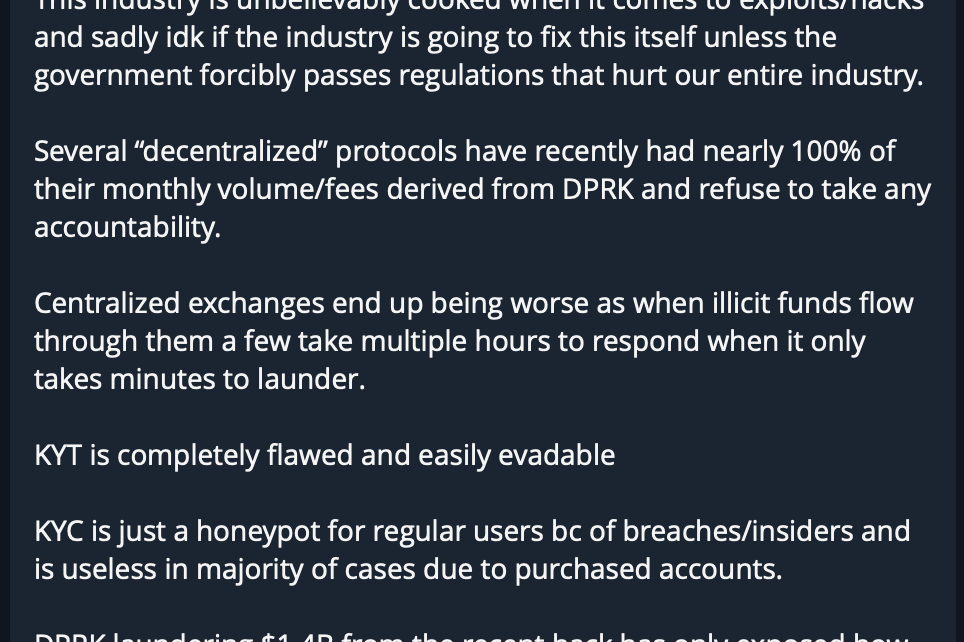

[ad_1] The crypto neighborhood was not too long ago rocked by surprising claims from blockchain investigator ZachXBT, who revealed that the so-called “Hyperliquid Whale,” a dealer who made a fortune utilizing excessive leverage, was not a monetary genius however somewhat a cybercriminal playing with stolen funds. This revelation has ignited intense discussions throughout Crypto Twitter, with many calling for extra transparency within the business.The controversy started when a dealer posted

[ad_1] Dogecoin (DOGE) worth has crashed by over 70% after hitting $0.48 in December 2024. Apparently, the memecoin’s richest holders have amassed in the course of the worth declines, indicating their confidence in a possible rebound within the coming weeks.Dogecoin onchain metrics trace at worth rebound Onchain knowledge from Santiment shows that wallets holding no less than 1 million DOGE have elevated by 1.24% since early February, regardless of declining