Bitcoin managed to outperform the opposite main world property, such because the inventory market, equities, treasuries and valuable metals, regardless of the latest crypto market correction coinciding with the two-month debt suspension interval in america.

Bitcoin’s (BTC) worth is at present down 23% from its all-time excessive of over $109,000 recorded on Jan. 20, on the day of US President Donald Trump’s inauguration, Cointelegraph Markets Pro information exhibits.

Regardless of the latest decline, Bitcoin nonetheless outperformed all main world market segments, together with the inventory market, equities, US treasuries, actual property and valuable metals, in line with Bloomberg information shared by Thomas Fahrer, the co-founder of Apollo Sats.

BTC/USD, 1-year chart. Supply: Cointelegraph

“Even with the pullback, Bitcoin nonetheless outperforming each different asset publish election,” wrote Fahrer in a March 18 X post.

Asset efficiency post-Trump administration takeover. Supply: Thomas Fahrer

Regardless of issues over the untimely arrival of the bear market cycle, Bitcoin’s retracement to $76,000 stays a part of an natural “correction inside a bull market,” in line with Aurelie Barthere, principal analysis analyst on the Nansen crypto intelligence platform.

“We're nonetheless in a correction inside a bull market: Shares and crypto have realized and are pricing in a interval of tariff uncertainty and financial cuts, no Fed put. Recession fears are popping up,” the analyst advised Cointelegraph.

Associated: Bitcoin experiencing ‘shakeout,’ not end of 4-year cycle: Analysts

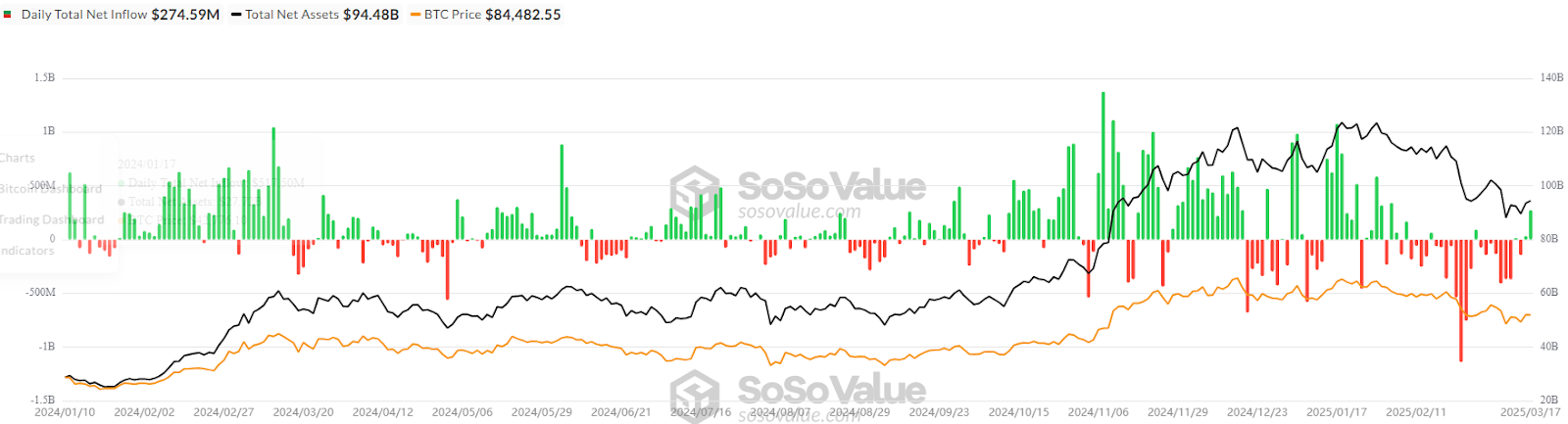

Bitcoin ETFs log largest each day inflows since February

The US spot Bitcoin exchange-traded funds (ETFs) are beginning to see constructive internet each day inflows, which can convey extra upside momentum for the world’s first cryptocurrency.

Spot Bitcoin ETF internet inflows. Supply: Sosovalue

The US Bitcoin ETFs recorded over $274 million value of cumulative internet inflows on March 17, marking the very best day of investments since Feb. 4, when Bitcoin was buying and selling above $98,652, Sosovalue information exhibits.

ETF investments played a major role in Bitcoin’s 2024 rally, contributing roughly 75% of latest funding as Bitcoin recaptured the $50,000 mark on Feb. 15.

Associated: Rising $219B stablecoin supply signals mid-bull cycle, not market top

Whereas Bitcoin may even see extra draw back volatility because of world commerce struggle issues, it's unlikely to see a major decline beneath the present ranges, in line with Gracy Chen, CEO of Bitget.

Chen advised Cointelegraph:

“I do not see BTC falling beneath 70k, probably $73k - $78k which is a strong time to enter for any patrons on the fence. Within the subsequent 1-2 years, BTC at $200k isn’t as far-fetched as most would assume.”

Different trade leaders are additionally optimistic about Bitcoin’s worth trajectory for the remainder of 2025, with worth predictions ranging from $160,000 to above $180,000.

Journal: SCB ideas $500K BTC, SEC delays Ether ETF choices, and extra: Hodler’s Digest, Feb. 23 – March 1