At first of the week, Bitcoin (BTC) value succumbed to strain from sellers, declining from $84,500 on March 17, to $81,300 on the time of writing. This downward motion was probably a sell-off associated to the Federal Open Market Committee’s (FOMC) two-day assembly, which takes place on March 18-19.

Federal Open Market Committee (FOMC) conferences are inclined to act as market resets. Every time the FOMC meets to deliberate on US financial coverage, crypto markets brace for impression.

Traditionally, merchants de-risk and scale back leverage forward of the announcement, and after the assembly and press convention from Federal Reserve Chair Jerome Powell the markets could be equally reactive.

The press launch of the present FOMC assembly scheduled for Wednesday, March 19, at 2:30 pm ET, and it might set off main actions within the Bitcoin market. Analyzing market conduct resulting in its launch might supply clues about Bitcoin’s subsequent transfer.

To merchants, FOMC means volatility

Merchants are carefully monitoring the FOMC minutes for any shifts within the Fed’s stance on inflation and rates of interest.

After the FOMC announcement, Bitcoin value tends to react sharply. Because the starting of 2024, BTC costs principally declined after the FOMC determined to keep up charges, as could be seen on the chart under.

The notable exception was the pre-halving rally of February 2024, which additionally coincided with the launch of the primary spot BTC ETFs. When US rates of interest have been lower on September, 18, 2024 and November 7, 2024, Bitcoin rallied.

Nonetheless, the third lower on December 18, 2024, didn't yield the identical end result. The modest lower by 25 foundation factors to the 4.50%–4.75% vary marked the native Bitcoin value prime at $108,000.

BTC/USD 1-day chart with FOMC dates. Souce: Marie Poteriaieva, TradingView

Markets deleverage earlier than FOMC, besides this time

A key indicator that gives perception into market sentiment is Bitcoin open curiosity—the full variety of by-product contracts, principally $1 perpetual futures, that haven't been settled.

Traditionally, Bitcoin open curiosity falls earlier than FOMC conferences, displaying that merchants are lowering leverage and danger publicity, as per the graph based mostly on CoinGlass knowledge.

Bitcoin futures open curiosity and FOMC dates. Supply: Marie Poteriaieva, CoinGlass

Nonetheless, this month one other sample has emerged. Regardless of Bitcoin’s $12 billion open interest shakeout earlier this month, within the days previous the FOMC there was no noticeable lower in Bitcoin’s open curiosity. BTC value, nevertheless, declined, which is uncommon and will point out a robust directional guess.

This may be an indication that merchants really feel much less anxiousness in regards to the Fed’s resolution, presumably anticipating a impartial consequence. Supporting this view, CME Group’s FedWatch software signifies a 99% likelihood that the Fed will preserve charges at 4.25%–4.50%.

If the charges stay unchanged, it's doable that Bitcoin value will proceed its present downtrend. This can be precisely what the HyperLiquid whale hoped for when it opened a 40x leveraged short position value over $500 million at its peak. Nonetheless, this place is now closed.

Associated: Bitcoin stalls under $85K— Key BTC price levels to watch ahead of FOMC

How are the spot Bitcoin ETFs reacting?

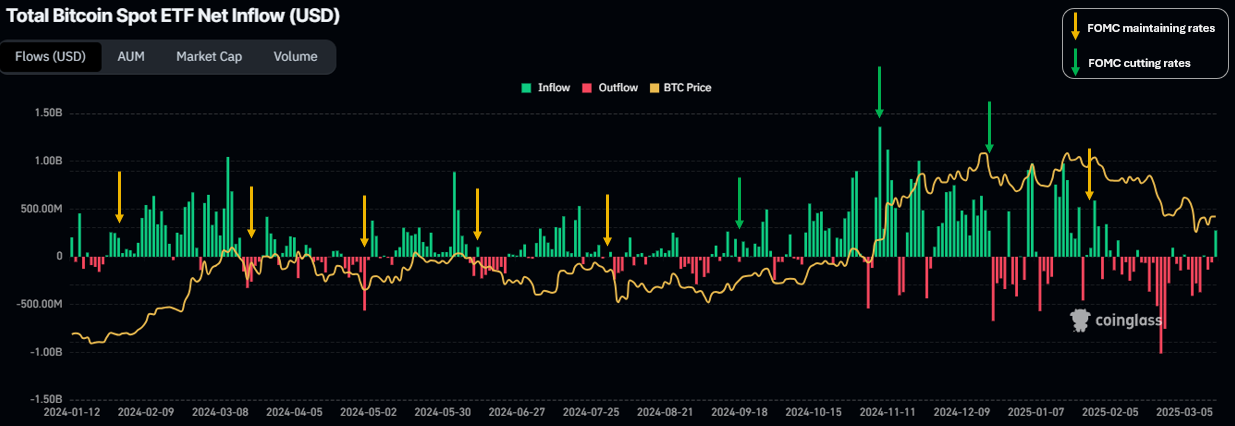

Not like Bitcoin whales, traders within the spot Bitcoin ETFs have traditionally offloaded BTC holdings earlier than FOMC conferences.

Because the spot BTC ETFs launched in January 2024, most FOMC occasions have coincided with ETF outflows or, at greatest, modest inflows, in accordance with CoinGlass knowledge. The notable exception was the earlier all-time excessive of January 2025, when even the spot Bitcoin ETF traders couldn’t resist the urge to purchase.

Bitcoin spot ETF web inflows and FOMC dates. Supply: Marie Poteriaieva, CoinGlass

On March 17, the spot Bitcoin ETFs noticed $275 million in web inflows, marking a shift from a month of outflows. This will likely sign a shift in investor sentiment and expectations concerning the Fed’s coverage selections.

If spot ETF inflows are rising earlier than the FOMC, traders is likely to be anticipating a extra dovish stance from the Fed, corresponding to signaling future fee cuts or sustaining liquidity-friendly insurance policies.

Buyers may be loading up on Bitcoin as a hedge towards uncertainty. This means that some institutional traders imagine Bitcoin will carry out nicely whatever the Fed’s resolution.

Buyers may be anticipating a doable brief squeeze. If merchants have been anticipating Bitcoin to drop and positioned brief, a sudden improve in ETF inflows might play a job in merchants’ behaviors and set off a brief squeeze.

Following the FOMC, BTC’s value motion, together with onchain knowledge and spot ETF flows will present whether or not the latest exercise was a part of a long-term accumulation development or simply speculative positioning.

Nonetheless, one factor that many merchants agree on now's that BTC might expertise a major value motion after the FOMC announcement. As crypto dealer Grasp of Crypto put it in a latest X post:

“The FOMC is tomorrow, and a Massive Transfer is anticipated.”

Even with out fee cuts, the possibility of the Fed issuing dovish statements might raise markets, whereas the absence of them might drive costs decrease.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.