In the beginning of the week, Bitcoin (BTC) worth succumbed to stress from sellers, declining from $84,500 on March 17, to $81,300 on the time of writing. This downward motion was more than likely a sell-off associated to the Federal Open Market Committee’s (FOMC) two-day assembly, which takes place on March 18-19.

Federal Open Market Committee (FOMC) conferences are inclined to act as market resets. Every time the FOMC meets to deliberate on US financial coverage, crypto markets brace for influence.

Traditionally, merchants de-risk and cut back leverage forward of the announcement, and after the assembly and press convention from Federal Reserve Chair Jerome Powell the markets could be equally reactive.

The press launch of the present FOMC assembly scheduled for Wednesday, March 19, at 2:30 pm ET, and it might set off main actions within the Bitcoin market. Analyzing market habits resulting in its launch might supply clues about Bitcoin’s subsequent transfer.

To merchants, FOMC means volatility

Merchants are intently monitoring the FOMC minutes for any shifts within the Fed’s stance on inflation and rates of interest.

After the FOMC announcement, Bitcoin worth tends to react sharply. For the reason that starting of 2024, BTC costs largely declined after the FOMC determined to take care of charges, as could be seen on the chart under.

The notable exception was the pre-halving rally of February 2024, which additionally coincided with the launch of the primary spot BTC ETFs. When US rates of interest had been minimize on September, 18, 2024 and November 7, 2024, Bitcoin rallied.

Nevertheless, the third minimize on December 18, 2024, didn't yield the identical consequence. The modest lower by 25 foundation factors to the 4.50%–4.75% vary marked the native Bitcoin worth prime at $108,000.

BTC/USD 1-day chart with FOMC dates. Souce: Marie Poteriaieva, TradingView

Markets deleverage earlier than FOMC, besides this time

A key indicator that gives perception into market sentiment is Bitcoin open curiosity—the full variety of by-product contracts, largely $1 perpetual futures, that haven't been settled.

Traditionally, Bitcoin open curiosity falls earlier than FOMC conferences, displaying that merchants are decreasing leverage and threat publicity, as per the graph primarily based on CoinGlass knowledge.

Bitcoin futures open curiosity and FOMC dates. Supply: Marie Poteriaieva, CoinGlass

Nevertheless, this month one other sample has emerged. Regardless of Bitcoin’s $12 billion open interest shakeout earlier this month, within the days previous the FOMC there was no noticeable lower in Bitcoin’s open curiosity. BTC worth, nevertheless, declined, which is uncommon and will point out a robust directional wager.

This may be an indication that merchants really feel much less nervousness in regards to the Fed’s choice, presumably anticipating a impartial end result. Supporting this view, CME Group’s FedWatch instrument signifies a 99% likelihood that the Fed will keep charges at 4.25%–4.50%.

If the charges stay unchanged, it's potential that Bitcoin worth will proceed its present downtrend. This can be precisely what the HyperLiquid whale hoped for when it opened a 40x leveraged short position value over $500 million at its peak. Nevertheless, this place is now closed.

Associated: Bitcoin stalls under $85K— Key BTC price levels to watch ahead of FOMC

How are the spot Bitcoin ETFs reacting?

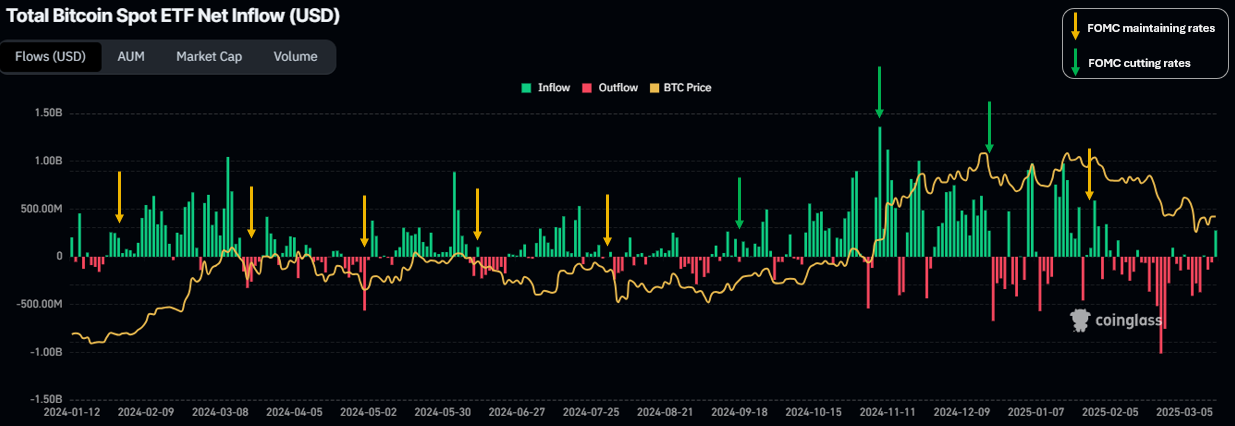

Not like Bitcoin whales, traders within the spot Bitcoin ETFs have traditionally offloaded BTC holdings earlier than FOMC conferences.

For the reason that spot BTC ETFs launched in January 2024, most FOMC occasions have coincided with ETF outflows or, at greatest, modest inflows, based on CoinGlass knowledge. The notable exception was the earlier all-time excessive of January 2025, when even the spot Bitcoin ETF traders couldn’t resist the urge to purchase.

Bitcoin spot ETF web inflows and FOMC dates. Supply: Marie Poteriaieva, CoinGlass

On March 17, the spot Bitcoin ETFs noticed $275 million in web inflows, marking a shift from a month of outflows. This may increasingly sign a shift in investor sentiment and expectations concerning the Fed’s coverage choices.

If spot ETF inflows are rising earlier than the FOMC, traders is likely to be anticipating a extra dovish stance from the Fed, comparable to signaling future charge cuts or sustaining liquidity-friendly insurance policies.

Buyers may be loading up on Bitcoin as a hedge towards uncertainty. This means that some institutional traders consider Bitcoin will carry out properly whatever the Fed’s choice.

Buyers may be anticipating a potential brief squeeze. If merchants had been anticipating Bitcoin to drop and positioned brief, a sudden enhance in ETF inflows might play a task in merchants’ behaviors and set off a brief squeeze.

Following the FOMC, BTC’s worth motion, together with onchain knowledge and spot ETF flows will present whether or not the latest exercise was a part of a long-term accumulation development or simply speculative positioning.

Nevertheless, one factor that many merchants agree on now could be that BTC might expertise a major worth motion after the FOMC announcement. As crypto dealer Grasp of Crypto put it in a latest X post:

“The FOMC is tomorrow, and a Large Transfer is predicted.”

Even with out charge cuts, the possibility of the Fed issuing dovish statements might raise markets, whereas the absence of them might drive costs decrease.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.