Bitcoin’s (BTC) worth failed one other try at breaking above resistance at $85,000 on March 17. Since March 12, BTC worth fashioned each day candle highs between $84,000 and $85,200, however has been unable to shut above $84,600.

Bitcoin 1-hour chart. Supply: Cointelegraph/TradingView

Bitcoin stays in “no man’s land” on the decrease time-frame (LTF) of the 1-hour chart. This time period in buying and selling markets is outlined as a worth vary the place actions are characterised by uncertainty, important danger, and dynamic pressure as a result of exterior occasions and conflicting market sentiment.

With the Federal Open Market Committee (FOMC) assembly set to take place on March 18-19, markets may see risky worth swings towards key BTC worth ranges over the subsequent few days. The vital announcement on the rate of interest might be made on March 19 at 2 pm ET.

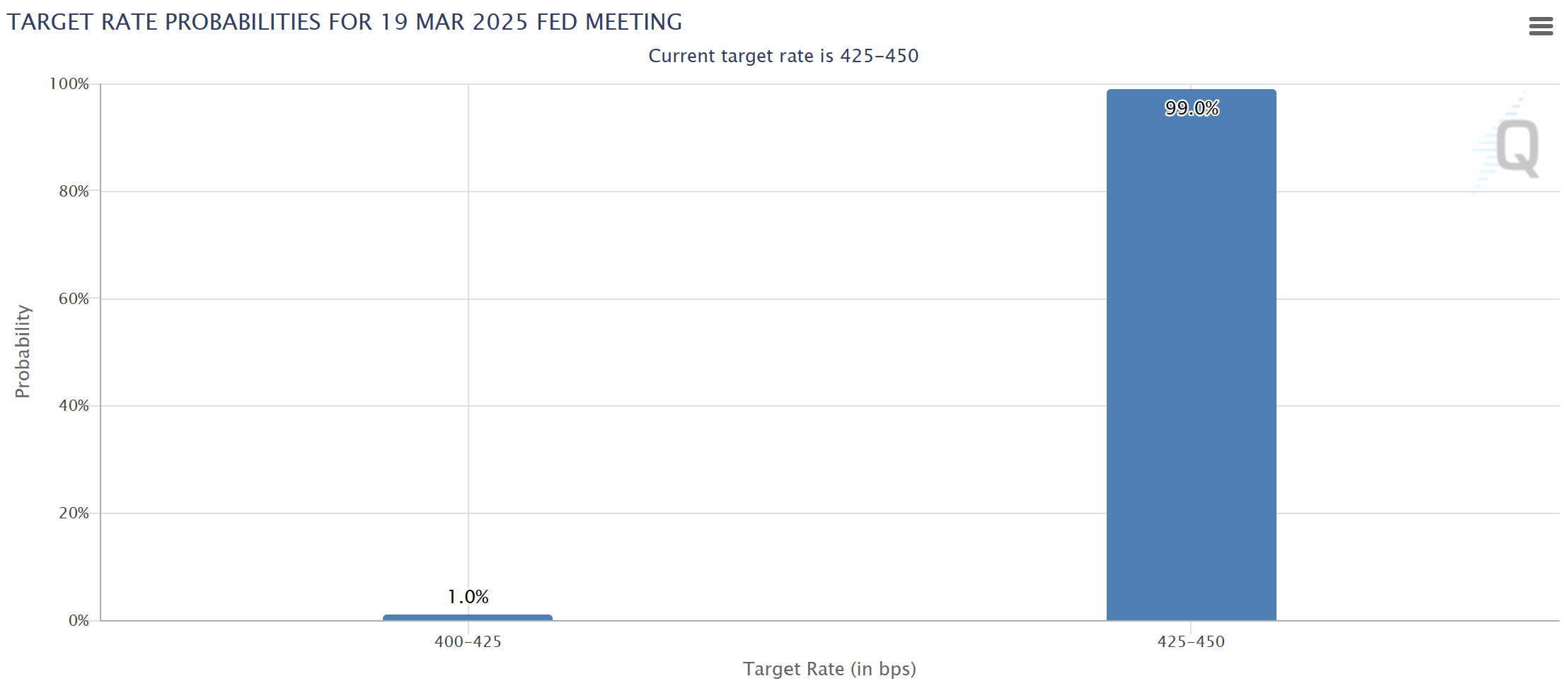

99% likelihood rates of interest received’t change

Based on CME’s FedWatch tool, there's a 99% likelihood that the present rates of interest will stay between 4.25% and 4.50%, leaving only a 1% likelihood of a 0.25% charge reduce.

CME’s FedWatchtool rate of interest expectations. Supply: CME Group

Nonetheless, a typical market perception is that any bearish worth motion from unchanged rates of interest is already priced in.

Related: Bitcoin price fails to go parabolic as the US Dollar Index (DXY) falls — Why?

Due to this fact, the market is targeted on Jerome Powell, the US Fed chair’s speech throughout the FOMC speech. With respect to the latest knowledge, Powell’s stance is more likely to be hawkish. The evaluation relies on the next factors:

-

Shopper Value Index (CPI) stays at 2.8%, which remains to be above the Fed’s 2% main goal and the Private Consumption Expenditures (PCE) worth index stood at 2.5%-2.6%. Whereas CPI got here in decrease than anticipated final week, it doesn't encourage instant charge cuts.

-

Unemployment knowledge stays low at 4.1%, with an annual GDP development of two.3% in This autumn 2024, indicating the financial system doesn't want instant stimulus.

In the meantime, Polymarket now says there’s a 100% chance that the US Federal Reserve will conclude quantitative tightening (QT) by April 30, which might enhance the chances of a charge reduce as early as this summer time.

Key Bitcoin worth ranges to look at

Bitcoin should flip the $85,000 resistance degree into help to focus on larger highs at $90,000.

For this to occur, BTC/USD should first regain its place above the 200-day exponential shifting common (orange line) on the 1-day chart. BTC worth dropped under the 200-day EMA on March 9 for the primary time since August 2024.

Bitcoin 1-day chart. Supply: Cointelegraph/TradingView

One optimistic catalyst for the bulls may very well be renewed demand from spot Bitcoin ETFs. On March 17, Bitcoin ETFs registered $274 million in inflows, the biggest since Feb. 4.

The bears, in the meantime, will try and hold $85,000 resistance in place, rising the chance of latest lows beneath $78,000. The instant goal under earlier vary lows lies at $74,000, i.e., the earlier all-time excessive from early 2024.

Bitcoin 1-day chart. Supply: Cointelegraph/TradingView

Beneath $74,000, the subsequent key space of curiosity stays between $70,530 and $66,810, with a each day order block. Reaching $69,272 could be a retest of the US election day worth, erasing the entire “Trump pump” features.

SuperBitcoinBro, an nameless BTC analyst, highlights that the “worst case” situation for Bitcoin lies at $71,300 and $73,800, which could be a potential help in each timeframe from each day to quarterly.

Bitcoin 1-day chart evaluation by Nebraskangooner. Supply: X.com

Equally, Nebraskangooner, one other common Bitcoin analyst, says that the FOMC is a wildcard, explaining that BTC should reclaim $86,250 to verify the bullish situation on the decrease time-frame.

Related: ‘Bitcoin bull cycle is over,' CryptoQuant CEO warns, citing onchain metrics

Nonetheless, as illustrated within the charts, he expects a doable retest close to the $70,000 degree over the subsequent few weeks.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.