On March 2, President Donald Trump mentioned Cardano’s ADA (ADA) token among the many cryptocurrencies to be included within the US strategic crypto reserve. Trump’s March 6 executive order clarified that altcoins could be a part of the Digital Asset Stockpile (DAS) below the “accountable stewardship” of the Treasury.

ADA’s potential inclusion in a government-managed portfolio sparked industry-wide shock and, at occasions, harsh criticism. Though it has loyal buyers who've supported it for years, many within the crypto neighborhood questioned why the token was included within the digital asset stockpile.

Let’s analyze the blockchain to see if ADA’s fundamentals and utility help its place within the US Digital Asset Stockpile.

The case for ADA within the US Digital Asset Stockpile

Launched in 2017 through an ICO, Cardano is likely one of the oldest good contract platforms. It differs from others by way of its research-driven design strategy and its use of a delegated proof-of-stake mechanism mixed with an prolonged UTXO accounting mannequin.

Cardano’s ambition as a sensible contract platform is nicely captured by X ‘Cardano_whale,’ who outlined the blockchain’s “non-negligible charges, voting energy, decentralized consensus, all native token buying and selling paired with it.”

The X put up emphasizes ADA’s utility (one thing “most VC cash lack”) together with Cardano’s decentralized governance as key benefits.

Certainly, Cardano’s Mission Catalyst is likely one of the largest decentralized funding initiatives in crypto. By it, treasury funds from transaction charges and inflation are allotted democratically to neighborhood proposals. Additionally, in contrast to the Ethereum community, which nonetheless depends on offchain governance for main upgrades, Cardano goals to transition completely to onchain governance.

The Plomin hard fork that happened on Jan. 29 marked the transition to “full decentralized governance,” in accordance with the Cardano Basis. It grants ADA holders “actual voting energy—on parameter modifications, treasury withdrawals, laborious forks, and the blockchain’s future.”

Cardano’s native coin, ADA, is used for community charges, staking, and governance. Its most provide is 45 billion, with 31 billion initially distributed—26 billion bought within the public sale and 5 billion allotted to IOHK, Emurgo, and the Cardano Basis.

The remaining 14 billion ADA have been reserved for gradual launch by way of minting. With 0.3% of ADA reserves distributed as rewards each 5 days, ADA inflation declines as reserves deplete. The present inflation price is roughly 4%, with a circulating provide of 35.95 billion ADA.

Whereas a capped provide can help a coin’s worth and justify its inclusion within the DAS, different ADA metrics, corresponding to charges and staking yields, lag far behind rivals.

Ought to Cardano’s lagging exercise increase issues?

Regardless of its years within the good contract ecosystem, Cardano has struggled to generate sufficient exercise to ascertain itself among the many leaders. In consequence, ADA’s restricted utilization inside the crypto ecosystem raises issues about its long-term worth.

Based on Messari’s This fall 2024 State of Cardano report, the blockchain processed a mean of 71,500 every day transactions, with 42,900 every day energetic addresses. Quarterly charges totaled $1.8 million, a stark distinction to Ethereum’s $552 million in charges over the identical interval, in accordance with CoinGecko.

Cardano’s annualized actual staking yield, adjusted for inflation, was roughly 0.7% in This fall, in comparison with Ethereum’s 2.73%.

Cardano key metrics overview, This fall 2024. Supply: Messari

Associated: Crypto fans are obsessed with longevity and biohacking: Here’s why

Different blockchain exercise metrics reinforce the priority about including ADA right into a authorities portfolio:

-

With 449 builders engaged on the blockchain, Cardano ranks twelfth amongst blockchains in developer depend, in accordance with Electrical Capital’s report.

-

Its stablecoins’ share is simply 0.01% of the whole $224 billion stablecoin market cap, per DefiLlama.

-

Cardano’s DeFi ecosystem is underdeveloped, accounting for simply 0.3% of the whole $169 billion DeFi sector. Nevertheless, if we embody its core staking, which doesn't require locking and due to this fact is just not counted within the TVL, Cardano’s share will develop to 12%.

-

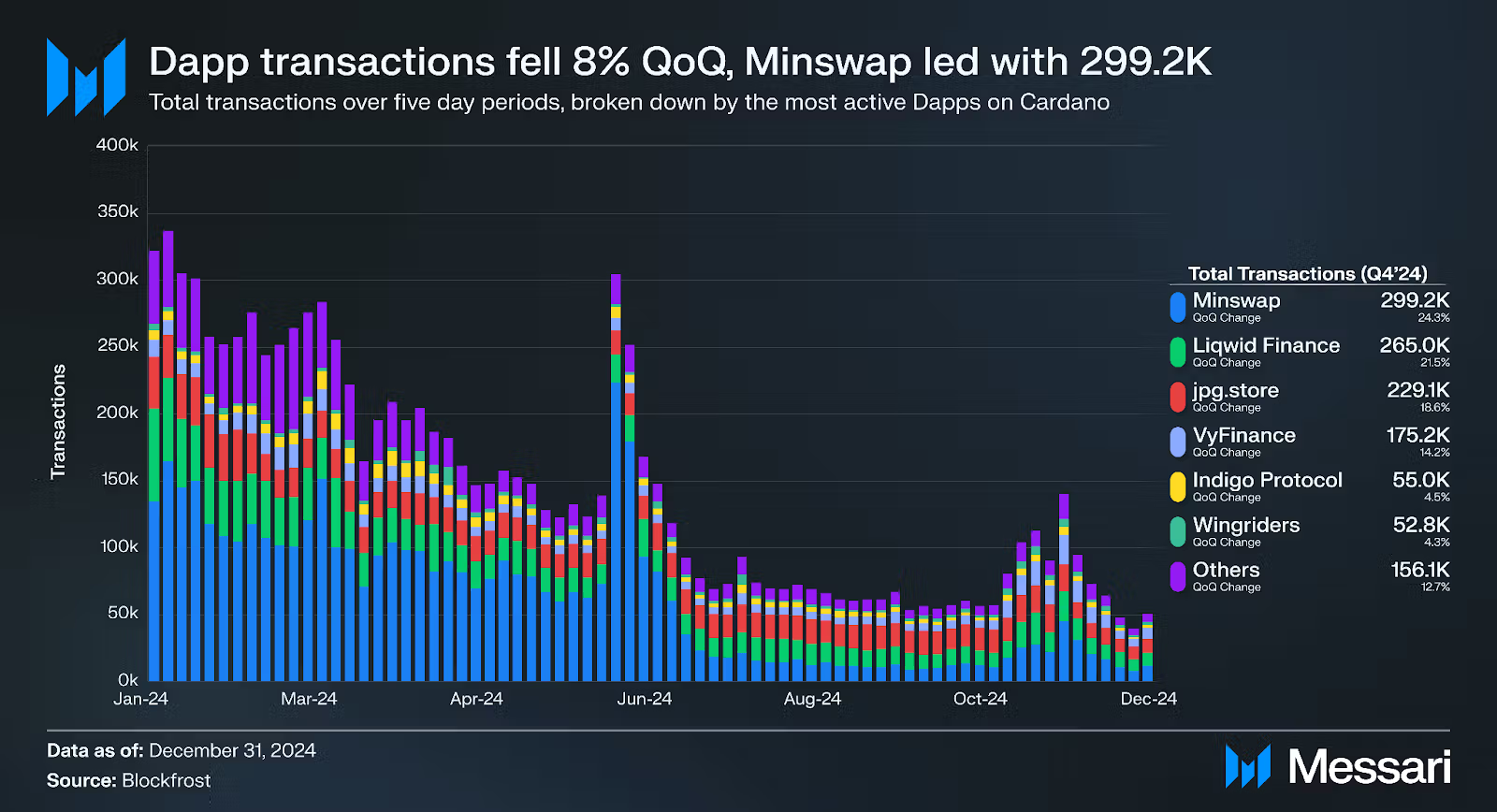

Cardano’s DApp exercise stays low in comparison with different good contract platforms. In This fall, it averaged simply 14,300 every day DApp transactions—nicely exterior the highest 25 and a fraction of Solana’s 22 million. Much more regarding is its 73% decline from This fall 2023, when Cardano recorded 52,700 every day transactions. Such a pointy drop alerts a troubling pattern for a blockchain that's nonetheless in its development section.

Cardano DApp transactions, This fall 2024. Supply: Messari

Is ADA’s potential sufficient to justify a US authorities funding?

The case for ADA within the strategic crypto reserve is much much less clear than for Ethereum and Solana, that are main blockchains in many alternative classes. Cardano’s low exercise, restricted adoption, and weak staking incentives increase severe doubts about ADA’s suitability for a government-managed asset pool.

Then again, ADA’s capped provide and Cardano’s deal with decentralization give it a novel edge over rivals. They may result in higher adoption and relevance in the long term.

Moreover, initiatives like those by Atrium Lab are exploring Cardano’s native compatibility with Bitcoin by way of the eUTXO system, which may probably unlock a brand new framework for DeFi on Bitcoin and drive exercise to Cardano.

Might this chance be sufficient to justify ADA’s place within the digital asset stockpile?

As David Nage, the portfolio supervisor of the enterprise capital agency Arca, put it,

“Like the remainder of crypto, the Cardano ecosystem wants to search out and help builders to create merchandise and functions that hundreds of thousands of individuals take pleasure in and rely upon. Then, they want good storytellers to solidify the narrative behind it to construct mass, sustainable audiences. In any case that, placing ADA right into a US nationwide reserve begins to make extra sense, for my part. It may be achieved.”

This text is for common info functions and isn't supposed to be and shouldn't be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the writer’s alone and don't essentially mirror or characterize the views and opinions of Cointelegraph.