What's crypto cash laundering?

Crypto cash laundering includes concealing illegally obtained funds by funneling them by way of cryptocurrency transactions to obscure their origin. Criminals might function offchain however transfer funds onchain to facilitate laundering.

Historically, illicit cash was moved utilizing couriers or informal networks like Hawala. Nevertheless, with the rise of digital belongings, unhealthy actors now exploit blockchain technology to switch giant quantities of cash. With evolving methods and rising regulation, authorities proceed working to trace and mitigate the misuse of cryptocurrencies for cash laundering.

Thanks to classy applied sciences like cryptocurrencies, criminals discover shifting giant quantities of cash easier. As cryptocurrency adoption has grown, so has illicit exercise inside the area. In 2023, crypto wallets linked to illegal actions transferred $22.2 billion, whereas in 2022, this determine stood at $31.5 billion.

Levels of crypto cash laundering

Crypto cash laundering follows a structured course of designed to cover the supply of illicit funds. Criminals use subtle strategies to bypass regulatory oversight and Anti-Cash Laundering (AML) measures. The method unfolds in a number of levels:

- Step 1 — Gathering funds: Step one includes gathering funds obtained illegally, typically from organized crime or fraudulent actions. These illicit earnings must be moved discreetly to keep away from detection by regulatory authorities.

- Step 2 — Shifting funds into the crypto ecosystem: Criminals now transfer illicit funds into the monetary system by buying cryptocurrencies. The modus operandi is to purchase cryptocurrencies by way of a number of transactions throughout crypto exchanges, significantly these with weak AML compliance. To make monitoring extra complicated, they might convert funds into completely different digital belongings like Ether (ETH), Polkadot (DOT) or Tether’s USDt (USDT).

- Step 3 — Juggling of funds: At this stage, the criminals cover the funds’ possession. For this goal, they transfer their crypto belongings by way of a collection of transactions throughout completely different platforms, exchanging one cryptocurrency for one more. Typically, funds are transferred between offshore and onshore accounts to additional complicate tracing.

- Step 4 — Reintroducing cleaned cash into the system: The ultimate step includes reintroducing the cleaned cash into the financial system, which they do by way of a community of brokers and sellers. They now make investments the cash in companies, actual property or luxurious belongings with out elevating suspicion.

Do you know? Taiwan’s Monetary Supervisory Fee has mandated that every one native digital asset service suppliers (VASPs) should adhere to new AML rules by 2025.

Varied strategies criminals use to launder cryptocurrencies

Criminals make use of a number of strategies to launder illicitly obtained digital belongings. From non-compliant exchanges to on-line playing platforms, they use varied methods to hide the transaction path.

Under is a few temporary details about the strategies criminals use.

Non-compliant centralized exchanges

Criminals use non-compliant centralized exchanges or peer-to-peer (P2P) platforms to transform cryptocurrency to money. Earlier than being transformed into fiat, the cryptocurrency is processed by way of middleman providers like mixers, bridges or decentralized finance (DeFi) protocols to obscure its origins.

Regardless of compliance measures, centralized exchanges (CEXs) dealt with virtually half of those funds. In 2022, practically $23.8 billion in illicit cryptocurrency was exchanged, a 68% surge from 2021.

Decentralized exchanges (DEXs)

DEXs operate on a decentralized, peer-to-peer foundation, which means transactions happen straight between customers utilizing smart contracts quite than by way of a CEX. These exchanges are presently largely unregulated, which criminals use for swapping cryptocurrencies and making investigations more durable.

The absence of conventional Know Your Customer (KYC) and AML procedures on many DEXs permits for nameless transactions.

Mixing providers

Cryptocurrency mixers, additionally known as tumblers, improve anonymity by pooling digital belongings from quite a few sources and redistributing them to new addresses randomly. They obscure the funds’ origins earlier than they're despatched to authentic channels.

A well known instance of criminals utilizing crypto mixers is Twister Money, which was used to launder over $7 billion from 2019 till 2022. The developer of the mixer was arrested by Dutch authorities.

Bridge protocols

Crosschain bridges, designed to transfer assets between blockchains, are exploited for cash laundering. Criminals use these bridges to obscure the origin of illicit funds by shifting them throughout a number of blockchains, making it more durable for authorities to trace transactions.

By changing belongings from clear networks to privacy-enhanced blockchains, criminals evade scrutiny and cut back the chance of detection. The dearth of uniform regulatory oversight throughout completely different chains facilitates illicit exercise.

On-line playing platforms

Cryptocurrency cash launderers often exploit playing platforms. They deposit funds from each traceable and nameless sources, then both withdraw them straight or use collusive betting to obscure the funds’ origin. This course of successfully “legitimizes” the cash.

The Monetary Motion Process Pressure (FATF), in its September 2020 report, recognized playing providers as a cash laundering threat, particularly highlighting suspicious fund flows to and from these platforms, particularly when linked to recognized illicit sources.

Nested providers

Nested providers embody a variety of providers that perform inside a number of exchanges, utilizing addresses offered by these exchanges. Some platforms have lenient compliance requirements for nested providers, creating alternatives for unhealthy actors.

On the blockchain ledger, transactions involving nested providers seem as in the event that they have been performed by the exchanges themselves quite than by the nested providers or particular person customers behind them.

Over-the-counter (OTC) brokers: A generally used nested service for cash laundering

OTC brokers are essentially the most prevalent nested service criminals use for crypto cash laundering as a result of they permit them to conduct giant cryptocurrency transactions securely and effectively with a level of anonymity.

Transactions might contain completely different cryptocurrencies, corresponding to Bitcoin (BTC) and ETH, or facilitate conversions between crypto and fiat currencies, like BTC and euros. Whereas OTC brokers match consumers and sellers in trade for a fee, they don't take part within the negotiation course of. As soon as the phrases are set, the dealer oversees the switch of belongings between events.

To fight North Korean cybercrime, the US authorities has taken sturdy motion in opposition to the Lazarus Group’s money laundering activities. In August 2020, the US Division of Justice (DOJ) sought to seize 280 cryptocurrency addresses tied to $28.7 million in stolen funds following an investigation right into a $250-million trade heist.

Additional, in April 2023, the Workplace of Overseas Belongings Management (OFAC) sanctioned three people, together with two OTC merchants, for aiding Lazarus Group in laundering illicit funds, highlighting the group’s continued reliance on OTC brokers.

Do you know? Microsoft Risk Intelligence identifies Sapphire Sleet, a North Korean hacking group, as a key actor in crypto theft and company espionage.

The evolving panorama of crypto cash laundering, defined

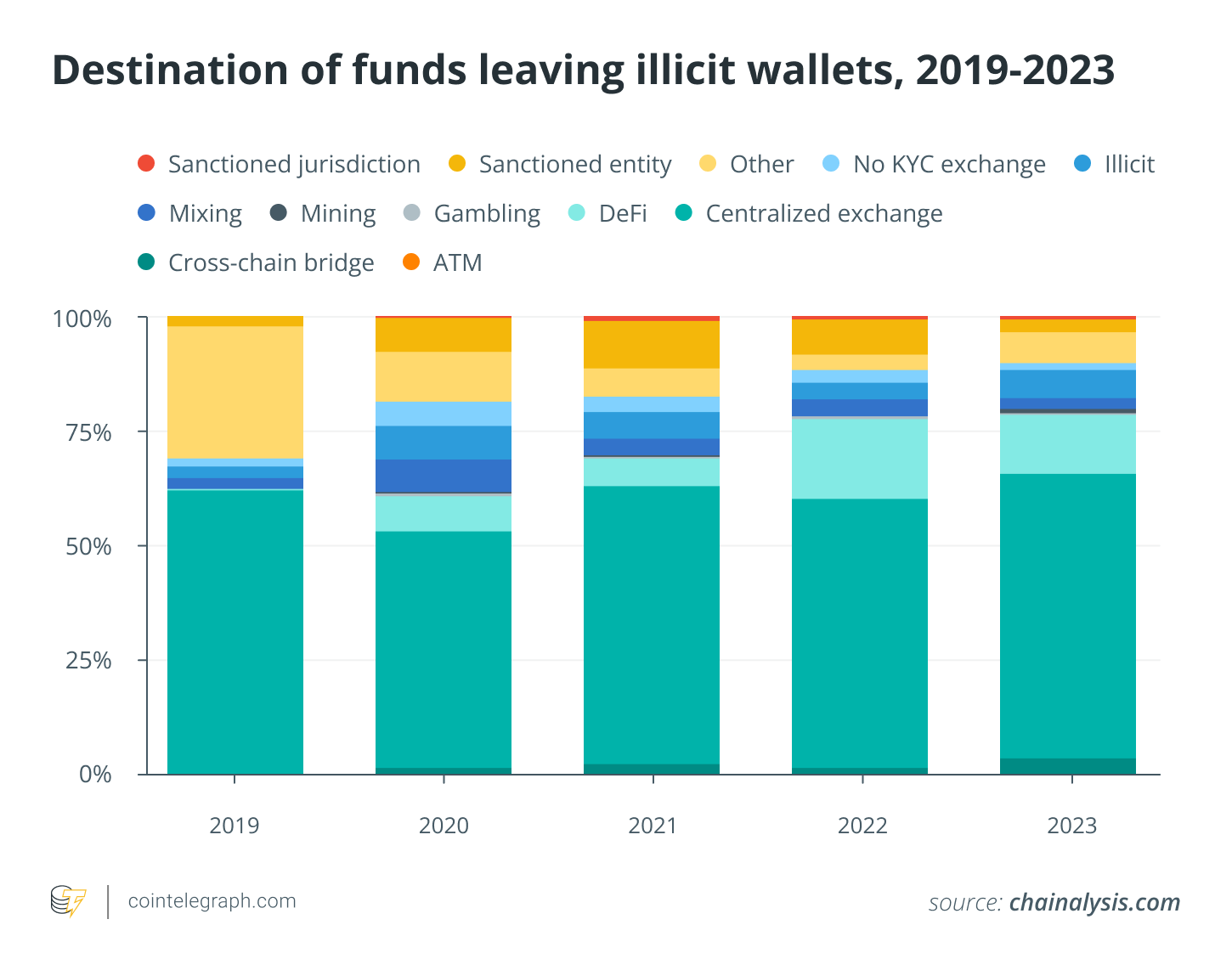

The complicated panorama of crypto cash laundering includes a twin infrastructure. Whereas CEXs stay major conduits for illicit funds, shifts are evident. Crosschain bridges and playing platforms are witnessing elevated utilization, reflecting evolving felony ways. Evaluation of deposit handle concentrations and crime-specific patterns highlights vulnerabilities.

Crypto cash laundering infrastructure

Broadly, crypto cash laundering infrastructure may be categorized into middleman providers and wallets. Middleman providers embody mixers, bridge protocols, decentralized finance (DeFi) protocols and different such providers. Then again, fiat off-ramping services embody any service that may assist one convert crypto into fiat forex.

Whereas centralized exchanges are extra generally used for this goal, criminals may additionally use P2P exchanges, playing providers and crypto ATMs. Crypto criminals use middleman providers to cover the origin of funds by concealing the onchain hyperlink between the supply handle and the present handle.

Key channels used for crypto cash laundering

Completely different monetary providers differ of their skill to fight cash laundering. Centralized exchanges, for instance, possess extra management over transactions and have the authority to freeze belongings linked to illicit or suspicious sources. Nevertheless, DeFi protocols function autonomously and don't maintain person funds, making such interventions impractical.

The transparency of blockchain know-how permits analysts to trace funds passing by way of DeFi platforms, which is usually tougher with centralized providers. Centralized exchanges proceed to be the first vacation spot for belongings originating from illicit sources, with a comparatively steady pattern between 2019 and 2023. There was a major uptick in ransomware proceeds being funneled to gambling platforms and a rise in ransomware wallets sending funds to bridges.

Monitoring illicit funds by way of deposit addresses

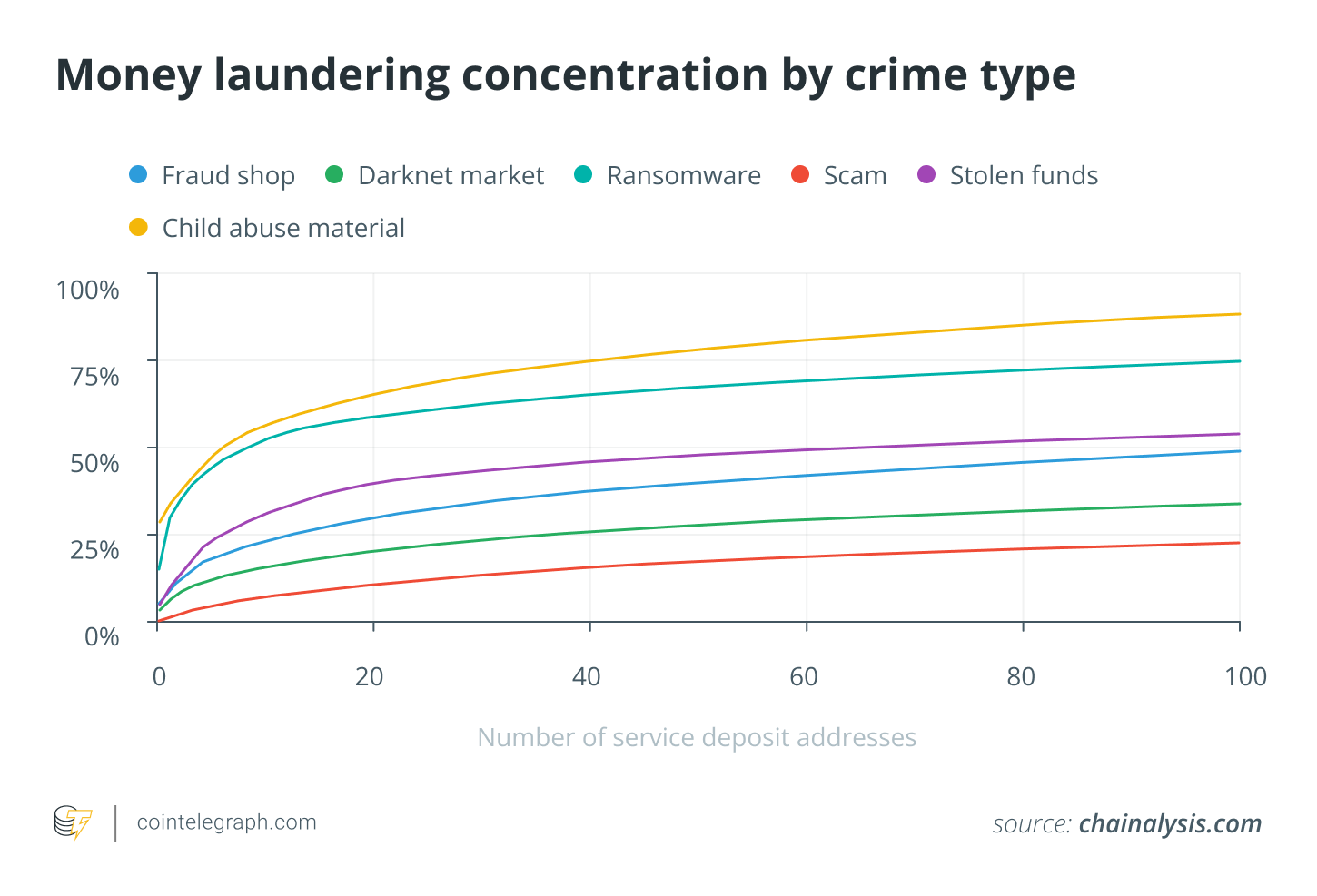

Deposit addresses, which perform equally to financial institution accounts on centralized platforms, reveal how monetary flows are concentrated. In 2023, a complete of 109 trade deposit addresses every acquired over $10 million in illicit crypto, collectively accounting for $3.4 billion. Comparatively, in 2022, solely 40 addresses surpassed the $10 million mark, accumulating a mixed whole of slightly below $2 billion.

The focus of cash laundering exercise additionally varies by crime kind. For example, ransomware operators and distributors of unlawful content material exhibit a excessive diploma of centralization. Seven key deposit addresses accounted for 51% of all funds from exchanges from unlawful content material distributors, whereas 9 addresses dealt with 50.3% of ransomware proceeds.

Criminals’ shift to crosschain and mixing providers

Subtle criminals are more and more turning to crosschain bridges and mixing providers to obfuscate their monetary transactions. Illicit crypto transfers by way of bridge protocols surged to $743.8 million in 2023, greater than doubling from the $312.2 million recorded in 2022. There was a pointy rise in funds transferred to crosschain bridges from addresses linked to stolen belongings.

Cybercriminal organizations with superior laundering methods, corresponding to North Korean hacking teams like Lazarus Group, leverage a various vary of crypto providers. Over time, they've tailored their methods in response to enforcement actions. The shutdown of the Sinbad mixer in late 2023, for instance, led these teams to shift towards different mixing providers like YoMix, which operates on the darknet.

Nationwide and worldwide frameworks for crypto AML

Governments worldwide have applied legal guidelines and pointers to stop crypto cash laundering. Varied nationwide jurisdictions have put in place regulatory frameworks to make sure compliance.

United States

The Monetary Crimes Enforcement Community (FinCEN) regulates crypto asset service suppliers to stop cash laundering within the US. Crypto exchanges perform underneath the Financial institution Secrecy Act, which requires the exchanges to register with FinCEN and implement AML and Counter-Terrorist Financing packages. They've to take care of correct information and submit studies to authorities.

Canada

Canada was the primary nation to introduce crypto-specific laws in opposition to cash laundering by way of Invoice C-31 in 2014. Transactions involving digital belongings fall underneath the Proceeds of Crime (Cash Laundering) and Terrorist Financing Act (PCMLTFA) and associated rules, requiring compliance from entities dealing in digital currencies.

European Union

The Markets in Crypto-Assets (MiCA) Regulation goals to safeguard shoppers from crypto-related monetary dangers. The EU-wide Anti-Money Laundering Authority (AMLA) has additionally been arrange. Crypto Asset Service Suppliers (CASPs) should gather and share transaction knowledge to make sure traceability, which aligns with international requirements.

Singapore

Singapore enforces strict AML rules by way of the Cost Providers Act, which governs digital cost token providers. Corporations should conduct buyer due diligence and adjust to AML and Countering the Financing of Terrorism (CFT) measures to function legally.

Japan

Japan regulates cryptocurrency underneath the Act on Punishment of Organized Crimes and the Act on Prevention of Switch of Legal Proceeds, making certain strict oversight to fight illicit monetary actions.

International locations additionally collaborate globally to discourage crypto cash laundering, forming organizations just like the FATF. They're working collectively for regulatory alignment, info sharing and strengthening AML frameworks.

Token issuers additionally play an important position in tackling illicit actions. Notably, stablecoins corresponding to Tether’s USDt (USDT) and USDC (USDC), have built-in mechanisms that enable them to dam funds related to felony actions, stopping additional misuse.

stop crypto cash laundering

Crypto cash laundering is evolving and is forcing authorities to undertake superior blockchain analytics to trace illicit transactions. Thus, legislation enforcement companies should use subtle instruments to detect suspicious exercise and dismantle felony networks.

Regulation enforcement has turn into more proficient at tracing illicit transactions, as demonstrated in circumstances like Silk Street, the place blockchain evaluation helped uncover felony operations. Nevertheless, by working with international our bodies just like the FATF and the European Fee, authorities can assess high-risk jurisdictions and mitigate threats to the monetary system.

For crypto service platforms, stringent KYC and AML protocols should be adopted, particularly for transactions from high-risk areas. Platforms ought to commonly audit transactions, monitor for suspicious patterns, and collaborate with legislation enforcement to reply rapidly to potential laundering actions.

Customers additionally play a task by avoiding transactions with entities working in high-risk areas and reporting suspicious actions. Familiarizing themselves with secure wallet practices and making certain their very own transactions are traceable (if required) by protecting information may help stop unintended involvement in unlawful actions. Sturdy cooperation throughout all events is essential to curbing crypto cash laundering.