The BNB Chain-based memecoin launch platform 4.Meme has resumed operations after being hit with a sandwich assault that exploited it for round $120,000.

4.Meme said in a March 18 X publish that its launch operate was again after inspecting and addressing a safety concern. It had earlier suspended the operate to research it, saying it was “underneath assault.”

“The launch operate has now been resumed after a radical safety inspection. Our staff has addressed the difficulty and strengthened system safety. Compensation for affected customers is underway,” the 4.Meme staff mentioned.

Supply: Four.Meme

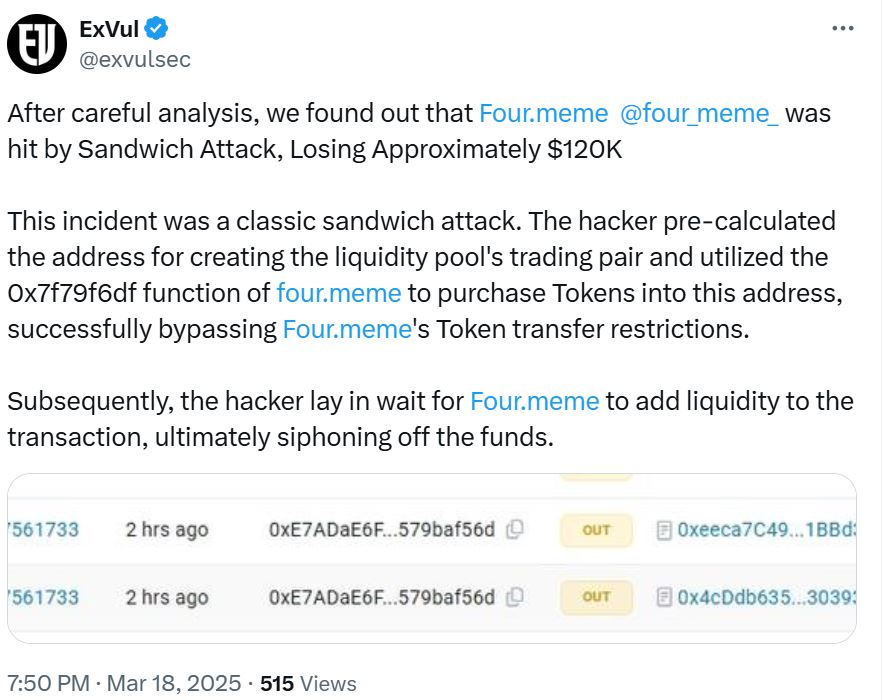

Web3 safety agency ExVul said in a March 18 X publish that the exploit seemed to be a market manipulation method known as a sandwich attack that netted the attacker $120,000.

It mentioned the attacker “pre-calculated the deal with for creating the liquidity pool’s buying and selling pair” and utilized one of many platform’s capabilities to buy tokens, which efficiently bypassed 4.Meme’s token switch restrictions.

“Subsequently, the hacker lay in watch for 4.Meme so as to add liquidity to the transaction, finally siphoning off the funds,” ExVul added.

Supply: ExVul

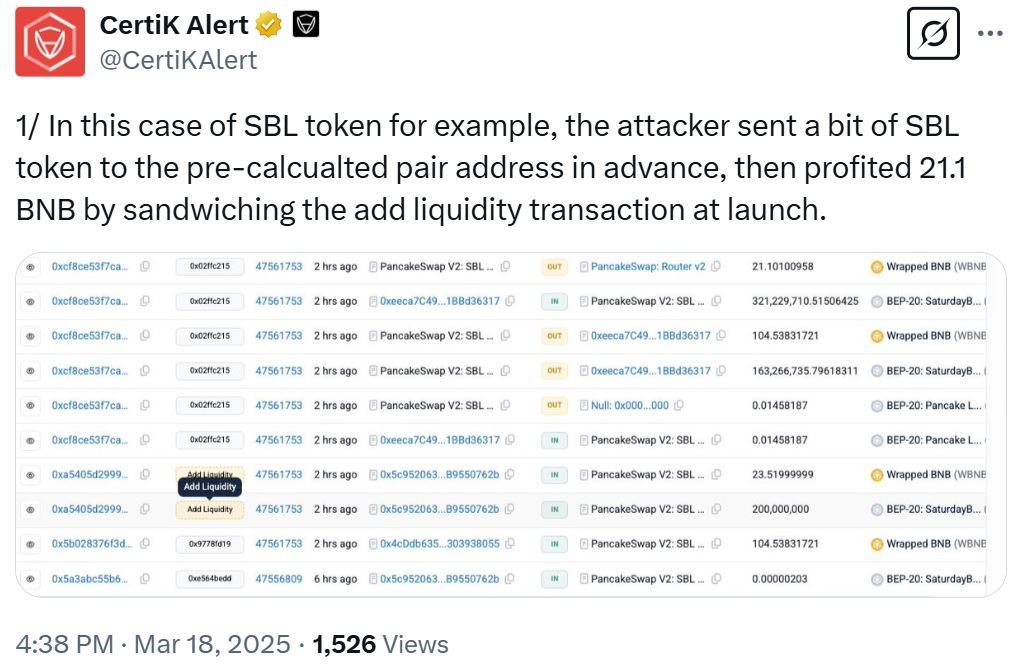

Blockchain safety agency CertiK got here to an analogous conclusion and said the attacker transferred an imbalanced quantity of un-launched tokens to pair addresses earlier than the pair was created, then manipulated the worth at launch to promote them afterward for revenue.

“On this case of SBL token, for instance, the attacker despatched a little bit of SBL token to the pre-calculated pair deal with prematurely, then profited 21.1 BNB by sandwiching the add liquidity transaction at launch,” CertiK mentioned.

Supply: CertiK

The tactic noticed the attacker go away with at the very least 192 BNB (BNB), price about $120,000, which they despatched to the decentralized crypto change FixedFloat, based on CertiK.

Associated: Pump.fun memecoins are dying at record rates, less than 1% survive

It’s the second time that 4.Meme has been attacked in as many months, with a Feb. 11 exploit resulting in the loss of about $183,000 price of digital property.

Throughout the broader crypto trade, February noticed $1.53 billion in losses to scams, exploits and hacks, with the $1.4 billion Bybit hack accounting for the lion’s share.

Blockchain analytics agency Chainalysis says the past year saw $51 billion in illicit transaction volume, partly resulting from crypto crime getting into a professionalized period dominated by AI-driven scams, stablecoin laundering, and environment friendly cyber syndicates.

Journal: Memecoins will die and DeFi will rise again — Sasha Ivanov