The decentralized finance (DeFi) panorama continues to evolve, and Bitcoin-centric options are gaining momentum. BTCFi is an rising sector that transforms Bitcoin (BTC) from a passive retailer of worth into an actively utilized asset in DeFi.

A brand new report by Cointelegraph Research and Elastos delves into how Bitcoin’s safety helps to create trustless, scalable monetary ecosystems.

Bitcoin’s increasing position in DeFi

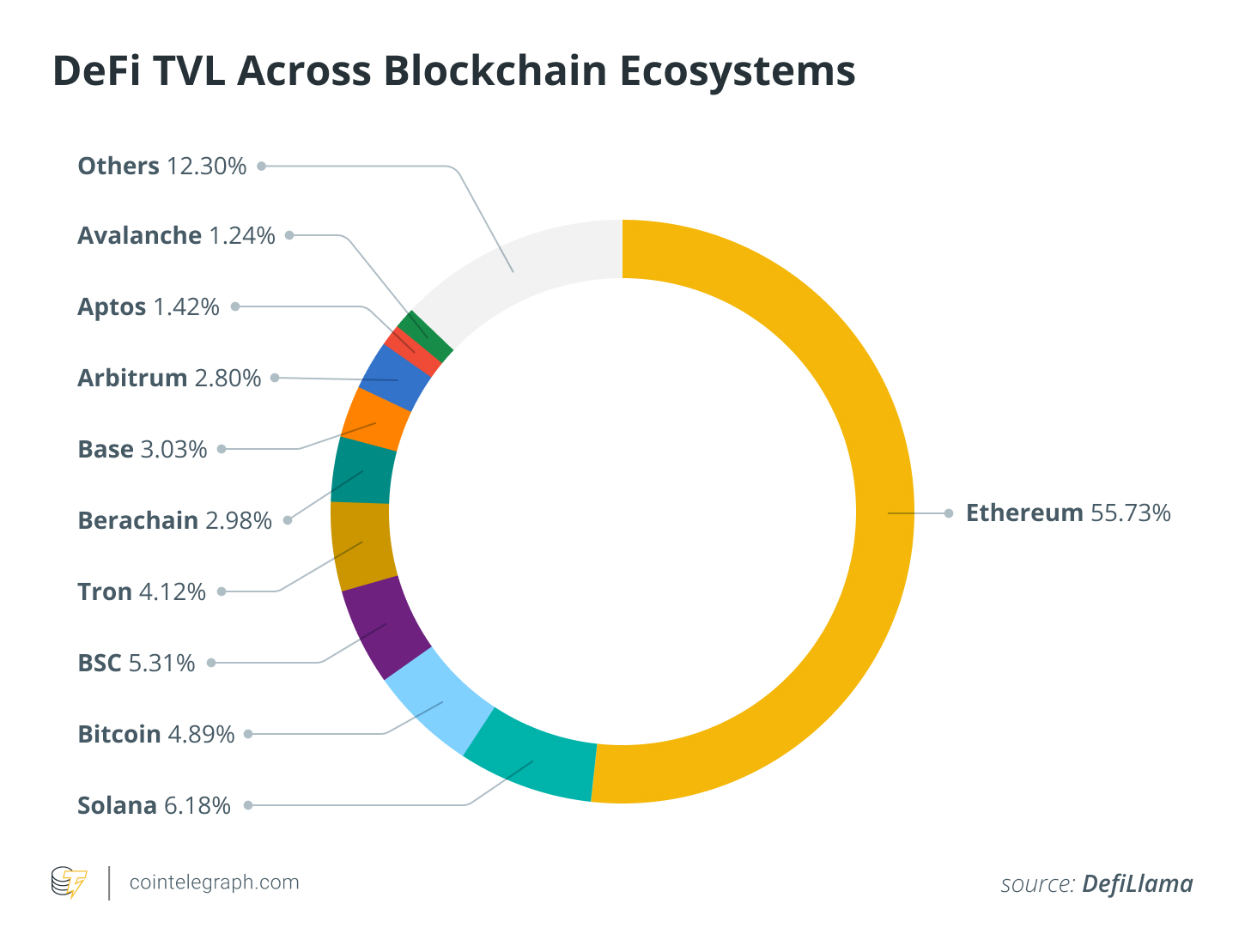

DeFi has historically been dominated by Ethereum, which accounts for over 50% of the sector’s whole $175 billion whole worth locked (TVL). Nevertheless, Bitcoin’s sturdy safety and liquidity make it a beautiful basis for DeFi innovation.

Regardless of its strengths, Bitcoin’s lack of native sensible contract performance has traditionally restricted its position in decentralized finance. The emergence of Bitcoin-centric DeFi solutions goals to bridge this hole and allow Bitcoin holders to take part in lending, stablecoin issuance and crosschain interoperability with out custodial dangers.

Elastos: Leveraging Bitcoin’s safety for decentralized purposes

Elastos stands out as one of many main gamers on this evolution by incorporating merged mining, a technique that permits secondary blockchains to inherit Bitcoin’s safety.

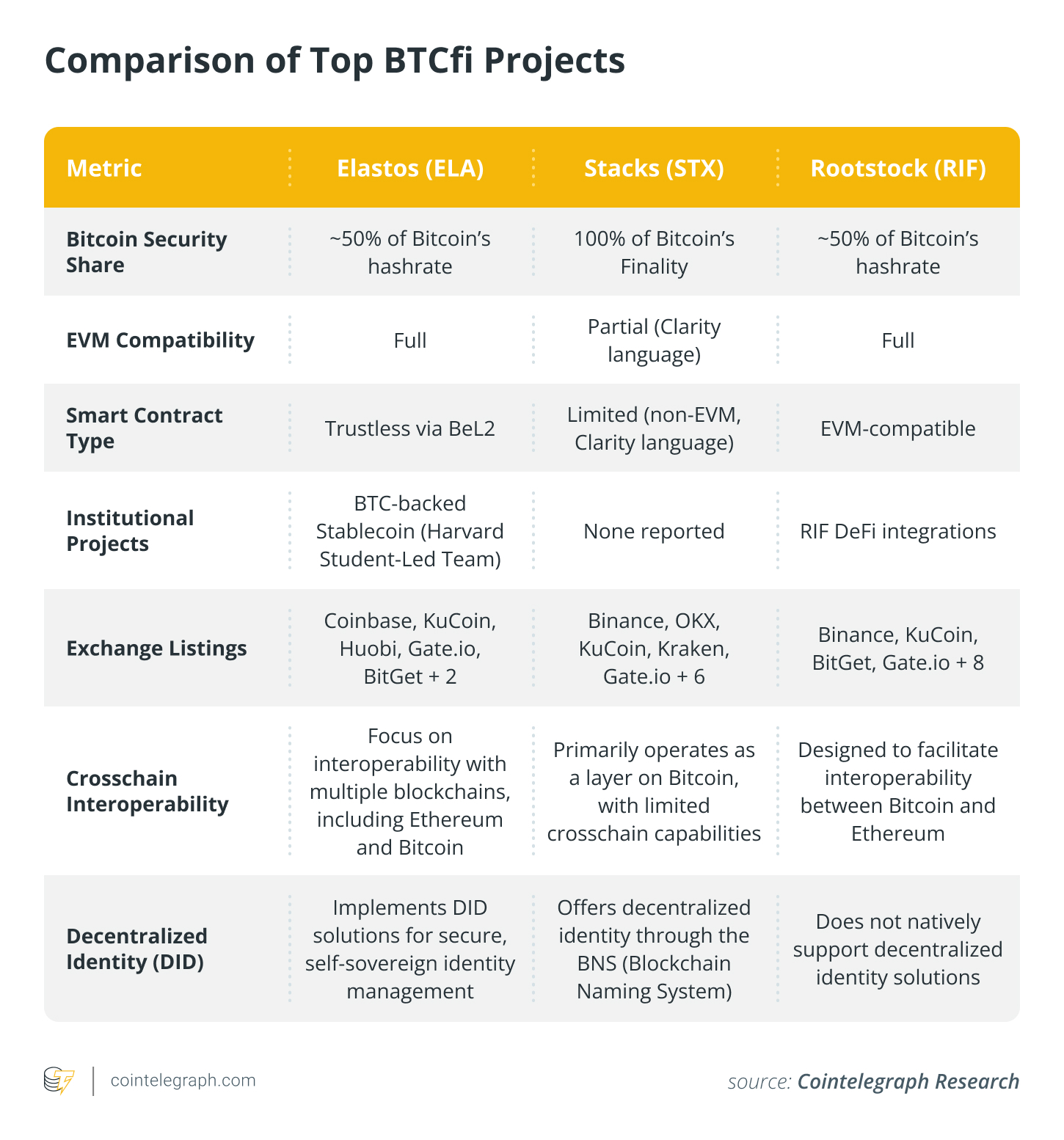

As a result of roughly 50% of Bitcoin’s whole 800 EH/s hashrate secures Elastos, the platform is positioned as one of the crucial computationally sturdy Bitcoin-linked networks. This ensures that monetary purposes constructed on Elastos keep a stage of safety akin to that of Bitcoin itself.

On the core of Elastos’ infrastructure is its Elastic Consensus mannequin, a hybrid mechanism that integrates auxiliary proof-of-work, bonded proof-of-stake, and proof-of-integrity.

This multi-layered strategy permits Elastos to offer safe, scalable monetary providers and enhances its attraction for DeFi purposes. The Elastos Smart Chain, an Ethereum Digital Machine-compatible sidechain, facilitates the event of decentralized purposes (DApps) to make sure seamless integration with the broader DeFi ecosystem.

BeL2: A breakthrough for BTCFi

A serious spotlight of the report is the BeL2 Arbiter Community, designed to deliver trustless Bitcoin transactions into DeFi. BeL2 leverages zero-knowledge proofs (ZKPs) to confirm Bitcoin transactions on the Elastos and Ethereum networks with out counting on centralized custodians.

This mechanism permits Bitcoin for use in DeFi protocols with out synthetic assets or intermediaries and addresses a long-standing problem in BTCFi.

This mannequin has already attracted institutional curiosity. An initiative led by college students and alumni of Harvard College is creating a BTC-backed stablecoin utilizing BeL2. The platform additionally helps decentralized lending that permits Bitcoin holders to collateralize loans in stablecoins whereas retaining publicity to BTC’s worth appreciation.

Elastos’ market place and future potential

Elastos’ BTCFi strategy competes with established Bitcoin DeFi options comparable to Stacks and Rootstock. Stacks primarily advantages from Bitcoin finality, and Rootstock focuses on EVM compatibility, whereas Elastos distinguishes itself by combining excessive safety (through merged mining) and crosschain interoperability. This positions Elastos as a formidable participant within the BTCFi panorama.

Nevertheless, the report additionally identifies some challenges, comparable to regulatory uncertainties, ecosystem consciousness and a few technical complexities. Regardless of these hurdles, Elastos’ mixture of Bitcoin safety, trustless sensible contract execution and institutional backing positions it for potential development within the evolving BTCFi sector.

Challenges and alternatives in Bitcoin DeFi adoption

Because the blockchain business shifts towards crosschain interoperability and decentralized governance, Bitcoin-secured property are anticipated to play an necessary position in reshaping each conventional and decentralized finance.

Elastos’ improvements, notably by way of BeL2 and its decentralized identification (DID) framework, goal to reinforce the safety, scalability and institutional adoption of Bitcoin in DeFi.

With Bitcoin-secured finance projected to develop considerably, Elastos’ infrastructure offers a sturdy basis for the following wave of decentralized monetary purposes.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.

This text is for basic data functions and isn't meant to be and shouldn't be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don't essentially mirror or characterize the views and opinions of Cointelegraph.

Cointelegraph doesn't endorse the content material of this text nor any product talked about herein. Readers ought to do their very own analysis earlier than taking any motion associated to any product or firm talked about and carry full duty for his or her choices.