The crypto neighborhood was not too long ago rocked by surprising claims from blockchain investigator ZachXBT, who revealed that the so-called “Hyperliquid Whale,” a dealer who made a fortune utilizing excessive leverage, was not a monetary genius however somewhat a cybercriminal playing with stolen funds.

This revelation has ignited intense discussions throughout Crypto Twitter, with many calling for extra transparency within the business.

The controversy started when a dealer posted a couple of main quick place on Bitcoin, leading to a staggering $9 million revenue.

The crypto neighborhood speculated in regards to the whale’s identification, assuming it was a seasoned investor with deep data of market developments.

Nonetheless, ZachXBT swiftly dismissed these assumptions, stating:

“It’s humorous watching CT speculate on the ‘Hyperliquid whale’ when in actuality it’s only a cybercriminal playing with stolen funds.”

The alternate took a dramatic flip when different customers demanded that ZachXBT reveal the person’s identification, with some suggesting hyperlinks to North Korea’s infamous hacking group, Lazarus.

Nonetheless, ZachXBT denied these claims whereas expressing frustration over the declining high quality of investigative discussions on social media.

A Excessive-Stakes Brief Wager: Taking advantage of Bitcoin’s Decline

The whale’s buying and selling technique revolved round a highly leveraged short position on Bitcoin, strategically positioned forward of the Federal Open Market Committee (FOMC) assembly.

Data exhibits that the dealer positioned a 40x leverage quick place on 6,210 Bitcoin, price over $516 million, with an entry worth of $84,043.

The place would have been liquidated if Bitcoin’s worth exceeded $85,592, however as an alternative, the whale exited the commerce inside hours, strolling away with a $9.46 million revenue.

Leveraged buying and selling amplifies each features and losses and on this case, the whale had so as to add $5 million to the place to forestall liquidation.

A bunch of retail merchants even tried to pressure a liquidation, however their efforts failed.

Blockchain analytics agency Lookonchain documented these movements, noting how the whale rapidly shifted from shorting Bitcoin to accumulating Ether with the income and buying over 3,200 ETH for $6.1 million.

The commerce was notably important because it coincided with the market’s anticipation of the FOMC assembly, which might affect Bitcoin’s trajectory primarily based on rate of interest selections.

Analysts recommend that easing inflation issues might help Bitcoin’s upward motion, however sudden hawkish alerts from the Fed might set off additional volatility.

The Darkish Facet of Crypto: ZachXBT’s Disturbing Revelations

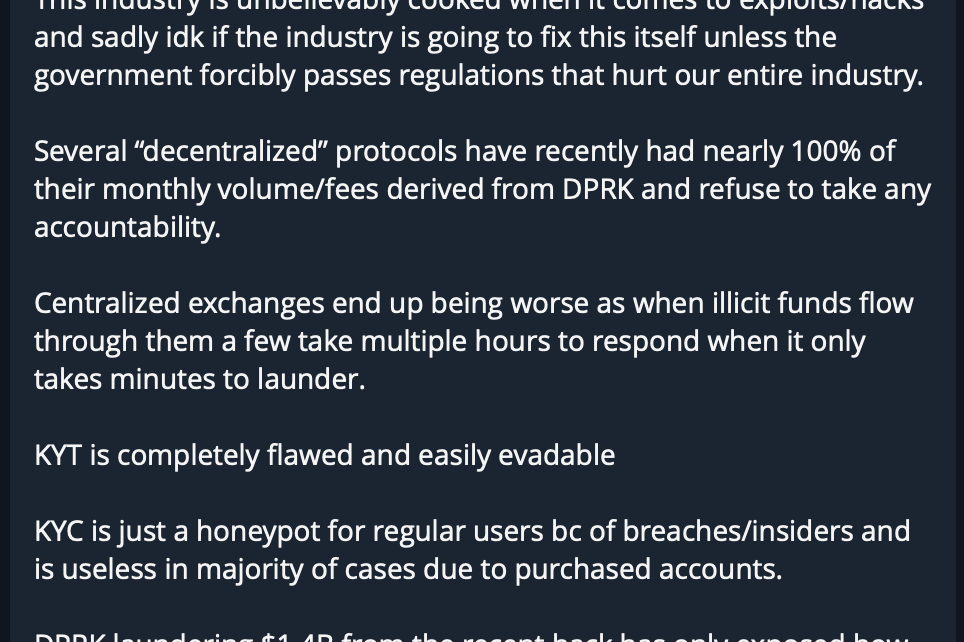

Past the Hyperliquid Whale case, ZachXBT has been vocal in regards to the rampant illicit exercise within the crypto area, notably in relation to hacks and cash laundering.

In a latest message shared on his Telegram channel, he detailed his involvement in serving to freeze funds from the Bybit hack, which he described as an “eye-opening” expertise.

In keeping with ZachXBT, many so-called “decentralized” protocols are deeply compromised, with some seeing almost 100% of their transaction quantity originating from North Korean cybercriminals.

He additionally criticized centralized exchanges for his or her gradual response to illicit funds flowing via their platforms, stating that it typically takes solely minutes for criminals to launder cash, whereas some exchanges take hours to behave.

His most alarming declare was that North Korean hackers had laundered roughly $1.4 billion from a latest exploit, additional exposing the deep flaws within the present crypto safety panorama.

He additionally questioned the effectiveness of Know Your Buyer (KYC) and Know Your Transaction (KYT) protocols, arguing that they typically function mere bureaucratic obstacles for official customers whereas doing little to discourage precise criminals.

Because it stands now, the Hyperliquid Whale controversy remains to be ongoing until ZachXBT reveals his investigations.

Whereas some argue that regulatory oversight might assist curb illicit exercise, others concern heavy-handed intervention might stifle innovation and impose undue restrictions on official merchants.

Nonetheless, clearly, with out some type of intervention, the business dangers changing into a haven for cybercriminals, additional damaging its fame.

The submit ‘Hyperliquid 50x Leverage Whale’ Is a Cybercriminal Using Stolen Funds— ZachXBT appeared first on Cryptonews.