Bitcoin (BTC) is buying and selling at $82,645, down over 1% within the final 24 hours, however merchants are intently watching a possible quick squeeze. A $521 million quick place on the decentralized change Hyperliquid is now a goal, with merchants making an attempt to set off a compelled liquidation.

If profitable, this might push BTC’s worth increased because the whale behind the quick is compelled to purchase again BTC at a loss.

Whale’s Brief Place at Threat of Liquidation

A crypto whale has opened a 40x leveraged quick place worth $521 million, betting on BTC’s decline. Nevertheless, merchants led by the pseudonymous Cbb0fe are trying to set off a liquidation by driving BTC’s worth increased.

If BTC rises simply 1.75% to $85,591, the quick place shall be liquidated. This could drive the whale to purchase again BTC at a better worth, doubtlessly fueling a fast surge.

This battle between quick sellers and merchants attempting to set off the squeeze is intensifying market volatility. If the liquidation happens, the inflow of compelled shopping for might push BTC towards new resistance ranges, whereas failure to interrupt increased might embolden bears.

Key takeaways:

- A $521 million quick place is prone to liquidation.

- Merchants want BTC to rise 1.75% to $85,591 to set off the squeeze.

- A liquidation might create large shopping for strain and gas a worth rally.

Bitcoin Faces Uncertainty as Fed Resolution Looms

Past the battle over the quick place, macroeconomic elements are additionally weighing on BTC’s trajectory. Merchants are awaiting alerts from the Federal Reserve, with hypothesis round a number of charge cuts later in 2025.

- In keeping with the CME FedWatch Software, there may be solely a 1% likelihood of a charge minimize within the upcoming assembly.

- BTC ETPs noticed $1.7 billion in outflows final week, persevering with a streak of unfavourable flows which have eroded BTC’s year-to-date positive factors.

With low buying and selling quantity and cautious sentiment, BTC stays range-bound for now.

Bitcoin Drops Beneath Key Assist as Triangle Breakout Indicators Additional Draw back

BTC has damaged beneath a essential symmetrical triangle on the 2-hour chart, signaling elevated promoting strain. BTC has slipped beneath $82,000, now buying and selling close to $81,500, with the breakdown opening the door to additional declines.

The 50-period EMA at $83,200 acted as sturdy resistance earlier than the drop, reinforcing the bearish outlook. If BTC fails to reclaim $82,500, the following key helps lie at $80,000 and $78,300. A failure to carry these ranges might see BTC retreat additional to $76,500.

For a bullish reversal, BTC should break above $85,000. Till then, the market stays prone to additional draw back, with merchants intently monitoring quantity and key worth ranges.

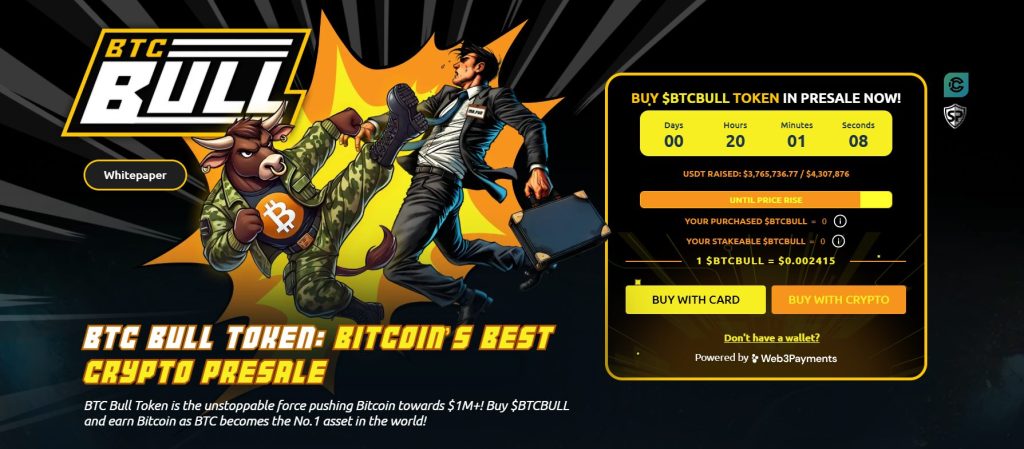

BTC Bull: Earn Bitcoin Rewards with the Hottest Crypto Presale

BTC Bull ($BTCBULL) is making waves as a community-driven token that robotically rewards holders with actual Bitcoin when BTC hits key worth milestones. Not like conventional meme tokens, BTCBULL is constructed for long-term traders, providing actual incentives by means of airdropped BTC rewards and staking alternatives.

Staking & Passive Earnings Alternatives

BTC Bull affords a high-yield staking program with a powerful 119% APY, permitting customers to generate passive revenue. The staking pool has already attracted 882.5 million BTCBULL tokens, highlighting sturdy neighborhood participation.

Newest Presale Updates:

- Present Presale Value: $0.002415 per BTCBULL

- Whole Raised: $3.7M / $4.3M goal

With demand surging, this presale gives a possibility to accumulate BTCBULL at early-stage pricing earlier than the following worth enhance.

The submit Is a $521M Short About to Get Liquidated? Bitcoin Traders Smell Blood appeared first on Cryptonews.