Minnesota state Senator Jeremy Miller has launched the Minnesota Bitcoin Act, which he drafted after fully altering his stance on Bitcoin.

“As I do extra analysis on cryptocurrency and listen to from increasingly more constituents, I’ve gone from being extremely skeptical to studying extra about it, to believing in Bitcoin and different cryptocurrencies,” Miller said in a March 18 assertion.

Miller mentioned the invoice goals to “promote prosperity” for Minnesotans by permitting the Minnesota State Board of Funding to take a position state belongings in Bitcoin (BTC) and different cryptocurrencies, simply because it invests in conventional belongings.

A number of different US states have launched related Bitcoin-buying payments, with 23 states having launched laws to create a Bitcoin reserve, according to Bitcoin Legal guidelines.

A complete of 39 completely different payments associated to state investments in Bitcoin have been launched throughout 23 US states. Supply: Bitcoin Laws

Beneath Miller’s invoice, Minnesota state workers would be capable of add Bitcoin and different cryptocurrencies to their retirement accounts.

It will additionally give residents the choice to pay state taxes and costs with Bitcoin. Colorado and Utah already settle for crypto for tax funds, whereas Louisiana permits it for state companies.

Funding positive factors from Bitcoin and different cryptocurrencies would even be exempt from state revenue taxes. Within the US, as much as $10,000 paid to the state might be deducted from federal taxes beneath the state and native tax deduction, however any quantity past that's topic to each state and federal tax obligations.

Associated: SEC could axe proposed Biden-era crypto custody rule, says acting chief

The rising variety of US states proposing Bitcoin reserve payments follows Senator Cynthia Lummis’ July Strategic Bitcoin Reserve Act, which directs the federal authorities to purchase 200,000 Bitcoin yearly over 5 years, totaling 1 million Bitcoin.

Nevertheless, on March 12, Lummis proposed a newly reintroduced BITCOIN Act, permitting the federal government to probably maintain greater than 1 million Bitcoin as a part of its newly established reserve.

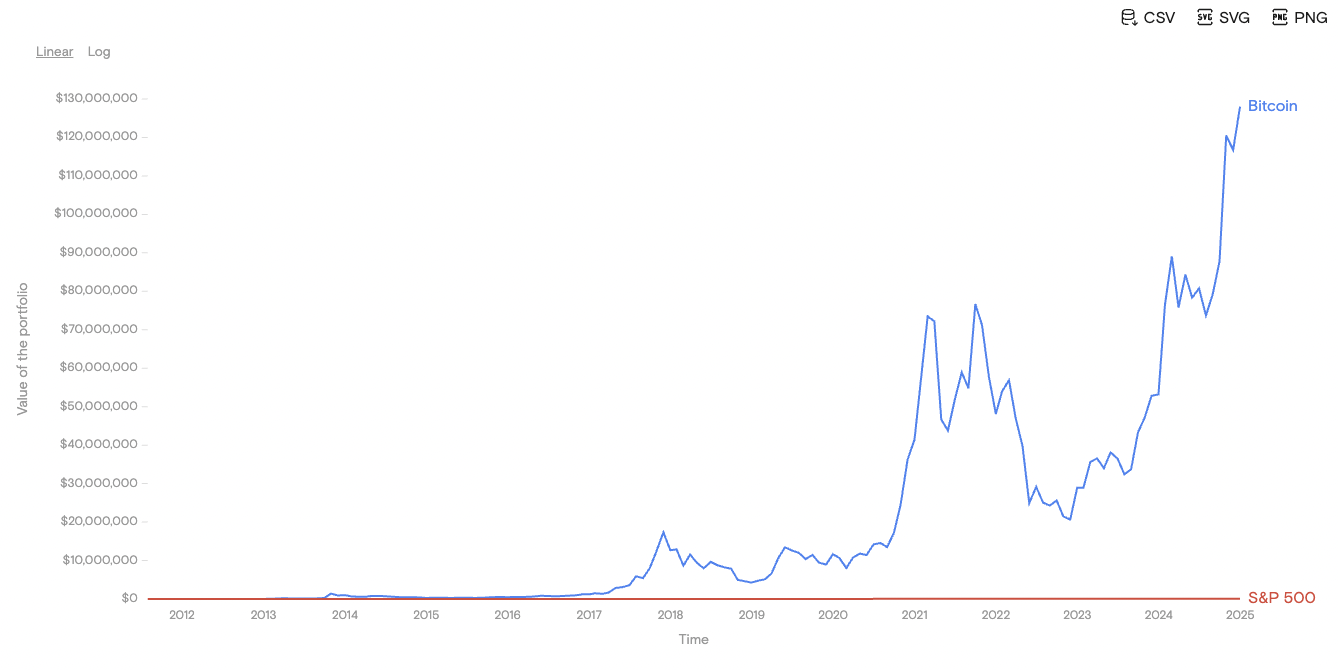

Bitcoin has proven vital positive factors in comparison with conventional belongings lately. From August 2011 to January 2025, Bitcoin posted a compound annual progress fee of 102.36%, in comparison with the S&P 500’s 14.83%, according to Curvo information.

Bitcoin’s compound annual progress fee is considerably larger than the S&P 500s. Supply: Curvo

Journal: Crypto fans are obsessed with longevity and biohacking: Here’s why