ARK Make investments CEO Cathie Wooden believes the White Home is underestimating the recession threat dealing with the US financial system stemming from US President Donald Trump’s tariff insurance policies — an oversight that can ultimately power the president and Federal Reserve to enact pro-growth insurance policies.

Talking just about on the Digital Asset Summit in New York on March 18, Wooden stated US Treasury Secretary Scott Bessent isn’t nervous a few recession.

Nevertheless, Wooden stated, “We're nervous a few recession,” including, “We expect the rate of cash is slowing down dramatically.”

Cathie Wooden speaks just about on the Digital Asset Summit. Supply: Cointelegraph

A slowdown within the velocity of cash means capital is altering arms much less regularly, which is often related to a recession, as shoppers and companies spend and make investments much less cash.

“I feel what’s taking place, although, is that if we do have a recession, declining GDP, that that is going to offer the president and the Fed many extra levels of freedom to do what they need when it comes to tax cuts and financial coverage,” stated Wooden.

Traders consider the primary domino may fall within the coming months when the Fed places an finish to its quantitative tightening program — one thing bettors on Polymarket believe is 100% sure to occur earlier than Might.

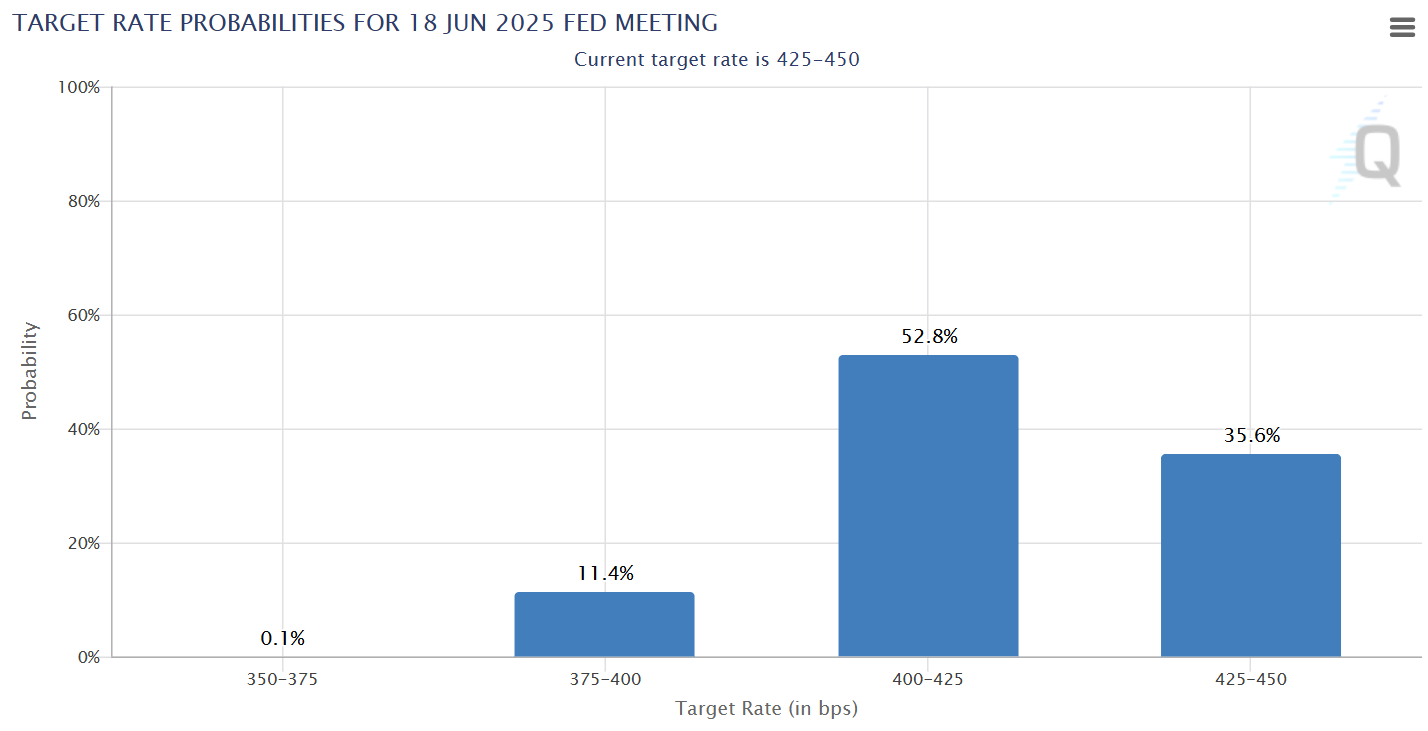

In the meantime, expectations for a number of charge cuts by the Fed within the second half of the yr are rising, in line with CME Group’s Fed Fund futures costs.

The likelihood of charges being decrease than they're now by the Fed’s June 18 assembly is almost 65%. Supply: CME Group

Associated: As Trump tanks Bitcoin, PMI offers a roadmap of what comes next

Focus stays long run

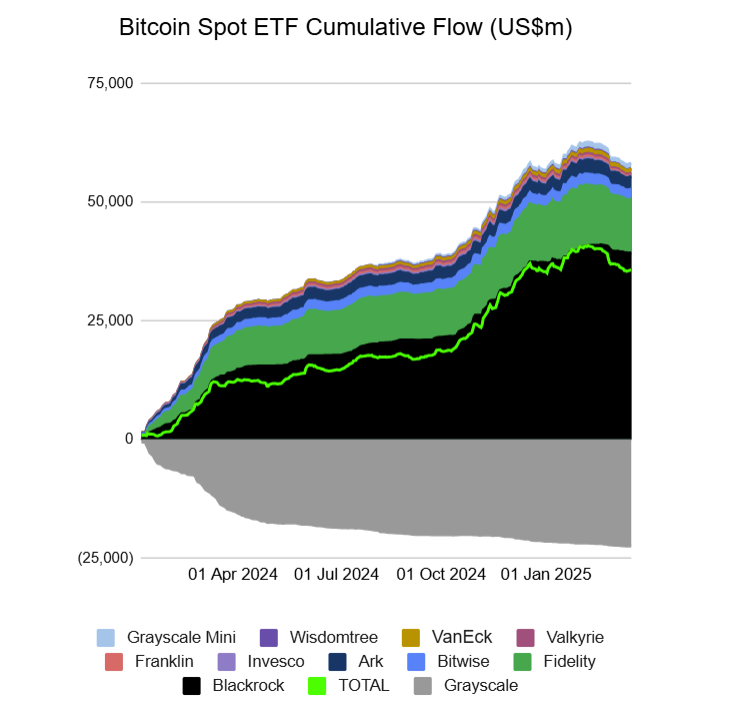

ARK and Cathie Wooden have been lively cryptocurrency traders for a few years. ARK and 21Shares’ spot Bitcoin (BTC) exchange-traded fund (ETF) was permitted on Jan. 11, 2024, and presently has greater than $3.9 billion in internet property, in line with Yahoo Finance knowledge.

Spot Bitcoin ETFs have recorded heavy outflows in current weeks, however the total development reveals traders are holding their positions. Supply: Farside

ARK additionally gives crypto portfolio options to wealth managers by way of its partnership with Eaglebrook Advisors.

Wooden instructed the New York Digital Asset Summit that “long-term innovation wins as we undergo these trials and tribulations,” referring to the current market correction.

When requested if crypto property stay an “investable arc” over the long run, Wooden stated this technique was the cornerstone of ARK’s funding method.

“[W]e’ve constructed out positions in additional than simply the massive three,” she stated, referring to Bitcoin, Ether (ETH) and Solana (SOL).

This long-term arc is being supported by favorable laws, which have improved the funding panorama dramatically.

Pro-crypto policy changes are “giving establishments the inexperienced gentle, and for those who have a look at our research as way back as 2016, we wrote a paper known as ‘Bitcoin: Ringing the Bell for a New Asset Class,’ and, but many establishments simply dismissed it out of hand,” stated Wooden.

Now, establishments are taking a look at ARK’s research and saying they “have a fiduciary duty to reveal [their] purchasers to a brand new asset class.”

Journal: Bitcoin ETFs make Coinbase a ‘honeypot’ for hackers and governments — Trezor CEO