Bitcoin’s corrective part set a four-month low at $76,600 on March 11. Regardless of this decline, long-term holders have continued to carry massive quantities of BTC, suggesting a “distinctive market dynamic shifting ahead,” new analysis says.

“Lengthy-Time period Holder exercise stays largely subdued, with a notable decline of their sell-side stress,” Glassnode said in a March 18 markets report.

Lengthy-term holders present indicators of bullishness

Bitcoin’s restoration comes as promoting stress amongst Lengthy-Time period Holders (LTHs) — wallets which have held Bitcoin for at the least 155 days — begins to wane.

The Binary Spending Indicator, a metric used to find out when LTHs are spending a major proportion of their holdings in a sustained method, exhibits a slowdown (see chart beneath) whereas the LTH provide can be starting to rebound after a number of months of decline.

“This means that there's a higher willingness to carry than to spend cash amongst this cohort,” Glassnode famous, including:

“This maybe represents a shift in sentiment, with Lengthy-Time period Holder conduct shifting away from sell-side distribution."

Bitcoin: LTH spending binary indicator. Supply: Glassnode

Bull market tops are sometimes marked by intense sell-side stress and robust profit-taking amongst LTHs, which alerts a whole shift to bearish conduct.

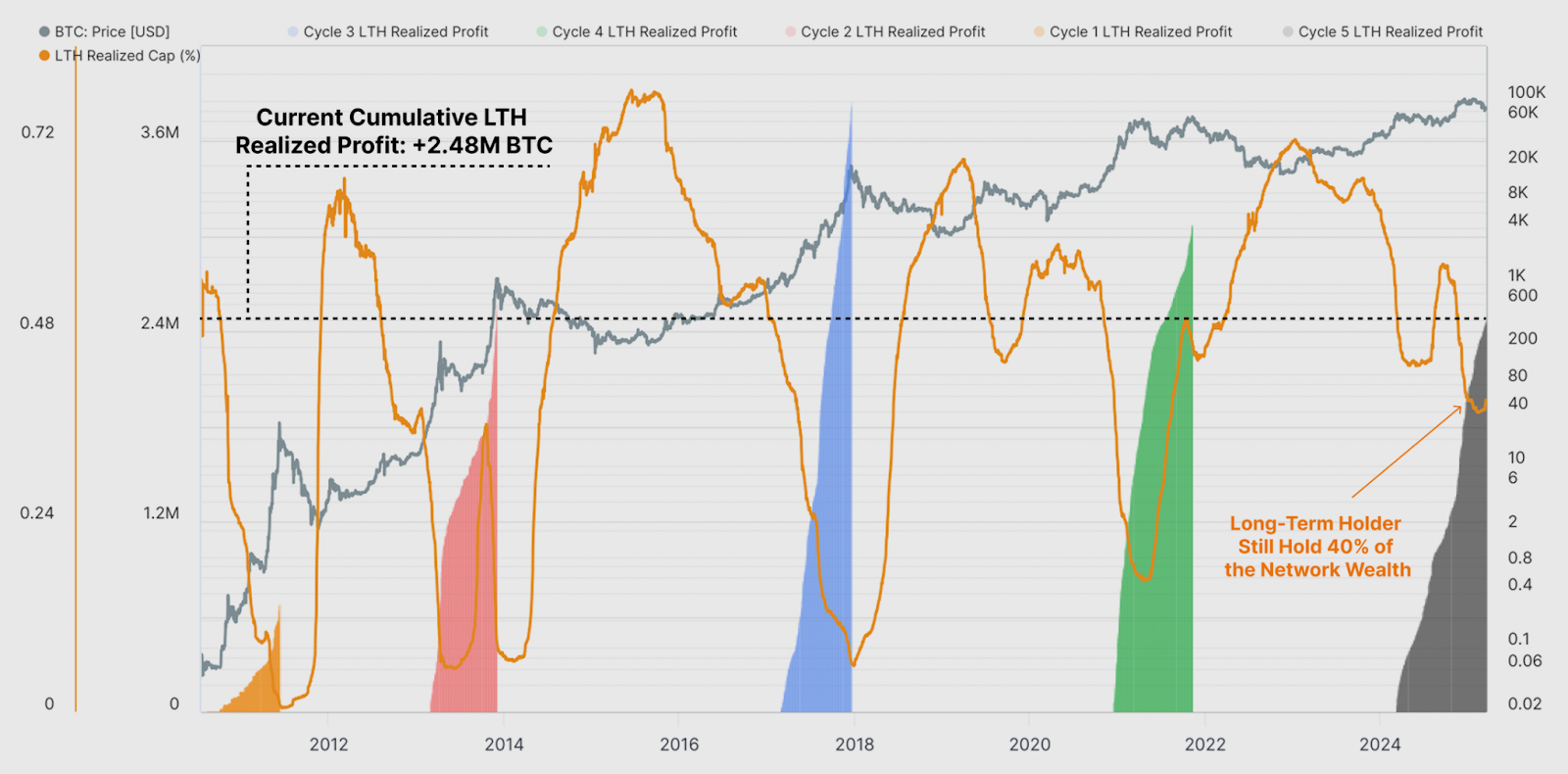

Nonetheless, regardless of Bitcoin's drawdown in latest weeks, this investor cohort continues to carry a big portion of their earnings, particularly for this later stage of the cycle, Glassnode mentioned.

This might counsel that long-term holders should still expect extra BTC worth upside later within the yr.

“This fascinating statement could point out a extra distinctive market dynamic shifting ahead.”

Bitcoin: Cumulative LTH realized revenue. Supply: Glassnode

New Bitcoin whale accumulation reshapes markets

New Bitcoin whales, addresses holding at the least 1,000 BTC, the place every coin has a median acquisition age of lower than six months, are aggressively accumulating, in accordance with CryptoQuant information.

This alerts sturdy conviction in Bitcoin’s long-term outlook among the many new massive traders.

These wallets have collectively acquired over 1 million BTC since November 2024, “positioning themselves as probably the most influential market members,” said CryptoQuant impartial analyst Onchained in a March 7 evaluation.

The chart beneath exhibits that their tempo has accelerated notably in latest weeks, “accumulating greater than 200,000 BTC simply this month.”

“This sustained influx highlights a shift in market dynamics, suggesting elevated institutional or high-net-worth participation. ”

Bitcoin provide held by new whales. Supply: CryptoQuant

In the meantime, a number of crypto executives have told Cointelegraph that Bitcoin’s latest worth drop was a “regular correction,” with the market simply ready for a brand new narrative and a cycle prime but to come back.

However not everybody agrees. For example, CryptoQuant founder and CEO Ki Younger Ju said that the Bitcoin bull cycle is over. He added:

“Anticipating 6-12 months of bearish or sideways worth motion.”

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.