Bitcoin (BTC) handed $84,000 into the March 19 Wall Road open as markets equipped for the US Federal Reserve interest-rate resolution.

BTC/USD 1-hour chart. Supply: Cointelegraph/TradingView

Bitcoin, risk-assets lack “tailwinds” into FOMC

Knowledge from Cointelegraph Markets Pro and TradingView confirmed native highs of $84,358 on Bitstamp.

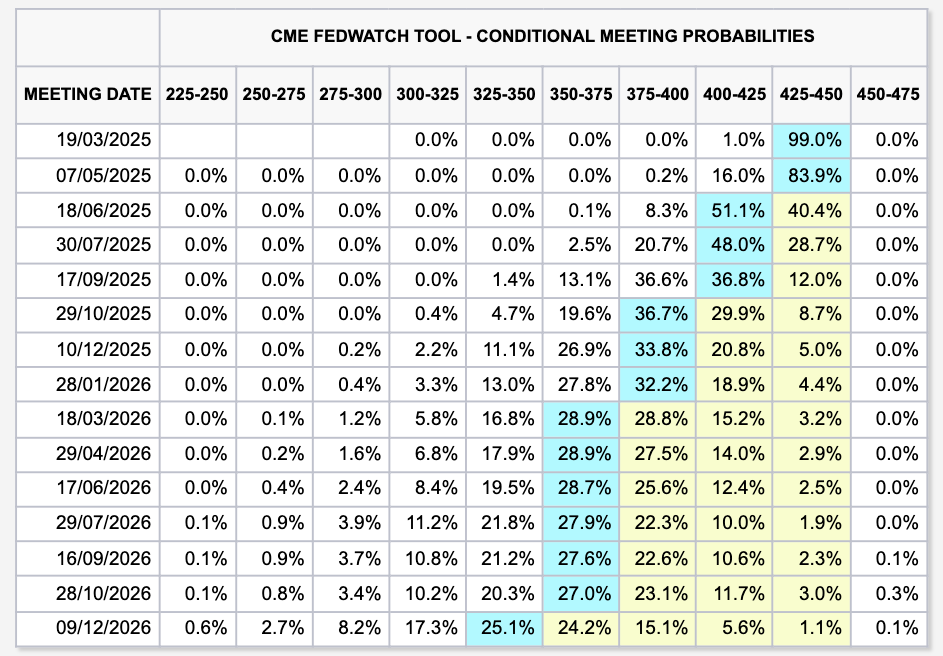

Danger belongings have been on edge forward of the Federal Open Market Committee (FOMC) assembly, with the Fed anticipated to carry charges regular till no less than June, per knowledge from CME Group’s FedWatch Tool.

Fed goal price possibilities (screenshot). Supply: CME Group

The character of subsequent commentary from Fed Chair Jerome Powell was of extra concern to merchants. Already hawkish, Powell faces strain from US commerce tariffs as inflation markets solely simply start to fall.

“Tonight's FOMC assembly is extremely doubtless maintain charges regular. Nonetheless, we shall be watching carefully for any dovish shifts, notably on progress and inflation expectations,” buying and selling agency QCP Capital wrote in its newest bulletin to Telegram channel subscribers on the day.

“Given that it'll take months for the influence of tariffs to ripple via the financial system, we count on the Fed to stay in ‘wait-and-see’ mode. The two April tariff resolution, whereas well-telegraphed, stays a key uncertainty.”

Whereas holding above $80,000 all through the week, Bitcoin’s destiny hung within the stability as US shares noticed notable draw back.

The S&P 500 and Nasdaq Composite Index traded down 4% and eight.7% year-to-date on the time of writing in comparison with 10% for BTC/USD.

“TC has discovered some help on the $80k, however that appears tenuous at greatest amid broader macro weak point,” QCP continued.

“We cannot try to name the precise second when the music stops, however within the quick time period, we wrestle to determine significant tailwinds to reverse this rout.”

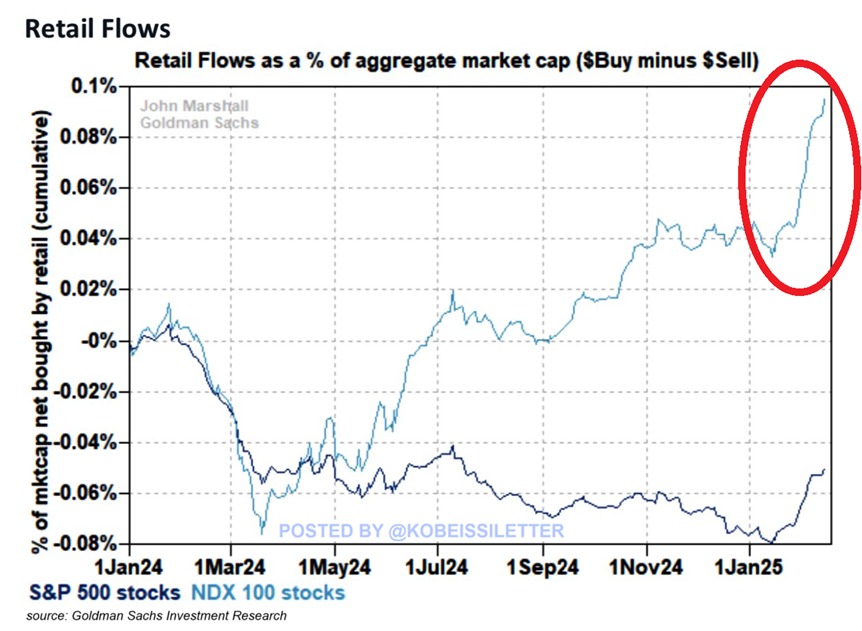

Buying and selling useful resource The Kobeissi Letter recognized a possible silver lining within the type of growing equities allocation by US retail traders.

“Retail internet inflows into Nasdaq 100 index shares as a proportion of market cap have reached 0.1%, the best in no less than a 12 months. Retail flows have DOUBLED in just some weeks,” it wrote in a submit on X.

“Moreover, JPMorgan’s retail investor sentiment rating hit a file 4 factors. That is ~1 level greater than the height of the meme inventory mania in 2021. Tesla, $TSLA, and Nvidia, $NVDA, have been the most well-liked names picked up by particular person traders. Retail traders are all-in.”

US shares retail flows knowledge. Supply: The Kobeissi Letter/X

Dangerous FOMC end result dangers $76,000 BTC worth drop

Analyzing BTC worth motion, fashionable dealer and analyst Rekt Capital hoped that the upside hole in CME’s Bitcoin futures market could be absolutely “stuffed” with a spike to $87,000.

Associated: Bitcoin futures 'deleveraging' wipes $10B open interest in 2 weeks

Such gaps, as Cointelegraph reported, proceed to behave as short-term worth magnets.

“Bitcoin continues to efficiently retest the CME Hole as help (orange field, $78k-$80.7k),” Rekt Capital explained alongside an illustrative chart.

“Extra, BTC has been doing so at a Increased Low (black).”

CME Bitcoin futures 1-day chart. Supply: Rekt Capital/X

Keith Alan, co-founder of buying and selling useful resource Materials Indicators, in the meantime instructed {that a} dovish Powell might have a transparent influence on worth momentum.

“A dovish tone that reduces recessionary fears might ship Bitcoin worth above the 200-Day and 21-Day MAs, and avert what appeared like an imminent loss of life cross between these two key MAs,” a part of an X submit stated.

Alan referred to 2 close by easy shifting averages, with the 200-day and 21-day MA sitting at $84,995 and $84,350, respectively.

BTC/USD 1-day chart with 21, 200MA. Supply: Cointelegraph/TradingView

Dangerous information, however, might spark a retest of multimonth lows at $76,000, he warned.

This text doesn't comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.