Bitcoin (BTC) worth motion turned bullish on March. 19 as markets grew anxious for the discharge of the Federal Open Market Committee (FOMC) minutes and a press convention from Federal Reserve Chair Jerome Powell.

BTC/USDT 1-day chart. Supply: TradingView

Usually, merchants maintain an in depth eye on FOMC minutes, together with Powell’s feedback, to acquire direct insights into the Fed’s tackle US financial well being, together with their plans for financial coverage and rates of interest.

Within the presser, Powell confirmed that the Fed intends to go away rates of interest unchanged, in its goal vary between 4.25% to 4.5%, the place they've been since December 2024.

Though the Fed downgraded its outlook for financial progress and emphasised that tamping inflation stays a sticking level, the Fed’s statements largely align with market members' expectations.

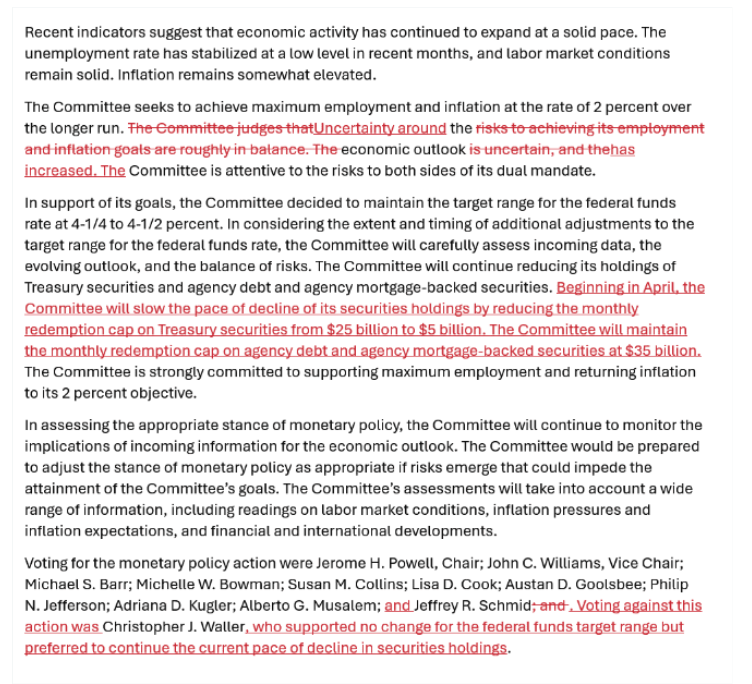

Crypto and equities merchants have additionally been forecasting the discount of the Fed’s financial coverage of quantitative tightening (QT), and the FOMC minutes confirmed that the central financial institution will scale back “the month-to-month redemption cap on Treasury securities from $25 billion to $5 billion.”

Adjustments to FOMC assertion (in crimson). Supply: FederalReserve.gov

Associated: Bitcoin price volatility ramps up around FOMC days — Will this time be different?

In response to Fed statements, Bitcoin worth added to its every day positive aspects, rallying to an intraday excessive at $85,950 on the time of writing.

The DOW additionally added 400 factors, whereas the S&P 500 index added 77. Powell and Fed policymakers’ verbal dedication to 2 extra charge cuts in 2025 additionally aligns with crypto merchants' expectations and will additional buoy the present recovery in Bitcoin price.

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a choice.