Cardano’s (ADA) value has managed a gentle 13.5% in March after experiencing a 32% dip in February. The altcoin continues to be down 15% in Q1, however technical knowledge is starting to level to the continuation of the latest optimistic value motion.

Cardano 1-day chart. Supply: Cointelegraph/TradingView

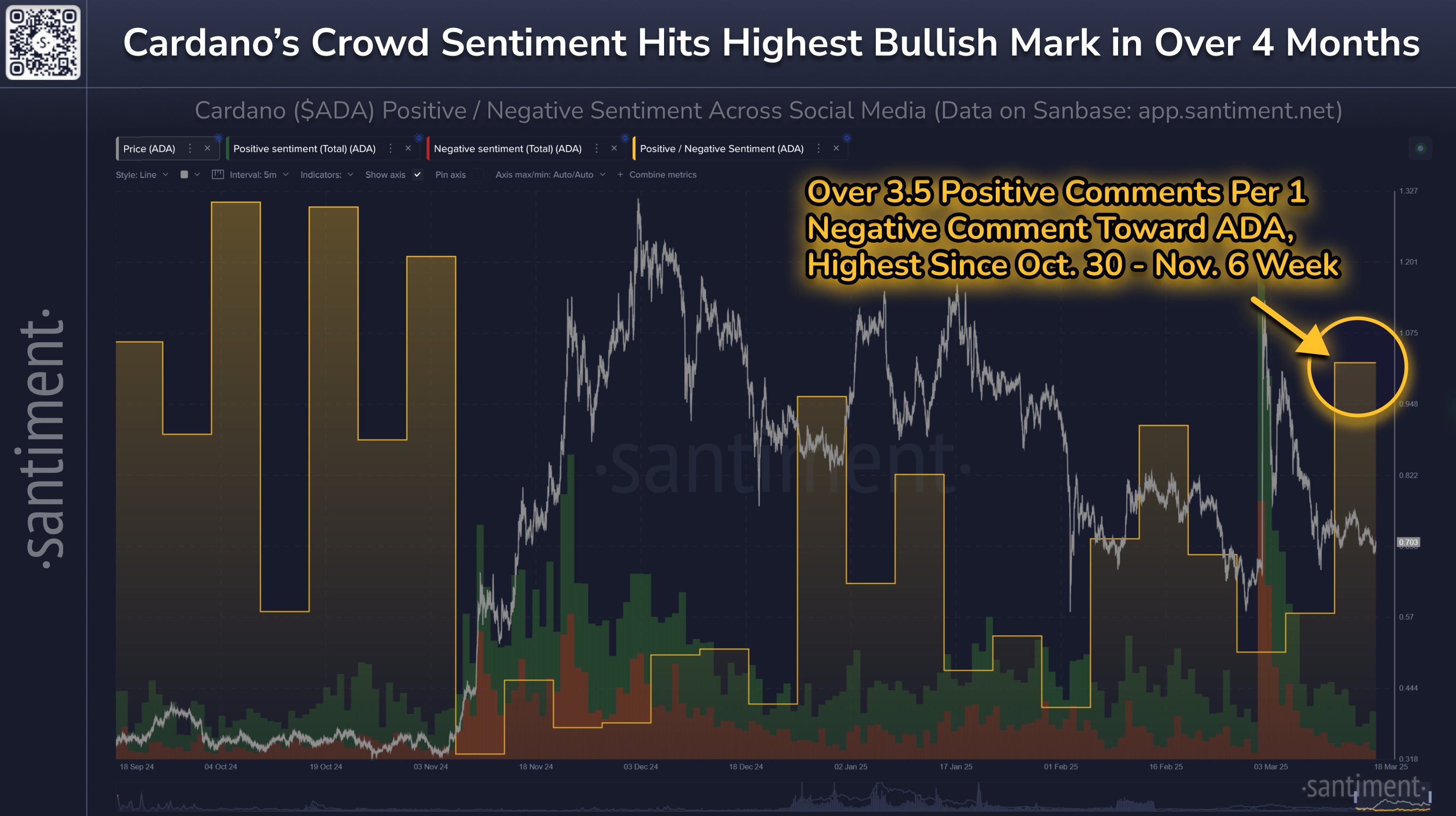

Regardless of ADA value transferring sideways between $0.78 and $0.70 over the previous 10 days, social sentiment associated to the altcoin has hit a brand new year-to-date excessive.

Cardano’s “bullish” sentiment soars to 4-month excessive

In keeping with Santiment, an onchain intelligence platform, Cardano’s social sentiment exhibited its highest optimistic measurement in 4 months.

ADA buyers acquired a lift from the US Securities and Alternate Fee’s (SEC) recent comments, which categorized Cardano’s use case as “sensible contracts for presidency providers.” The SEC assertion was adopted by ADA’s highest ratio of optimistic feedback for the reason that first week of November 2024.

Cardano’s crowd sentiment rating by Santiment. Supply: X.com

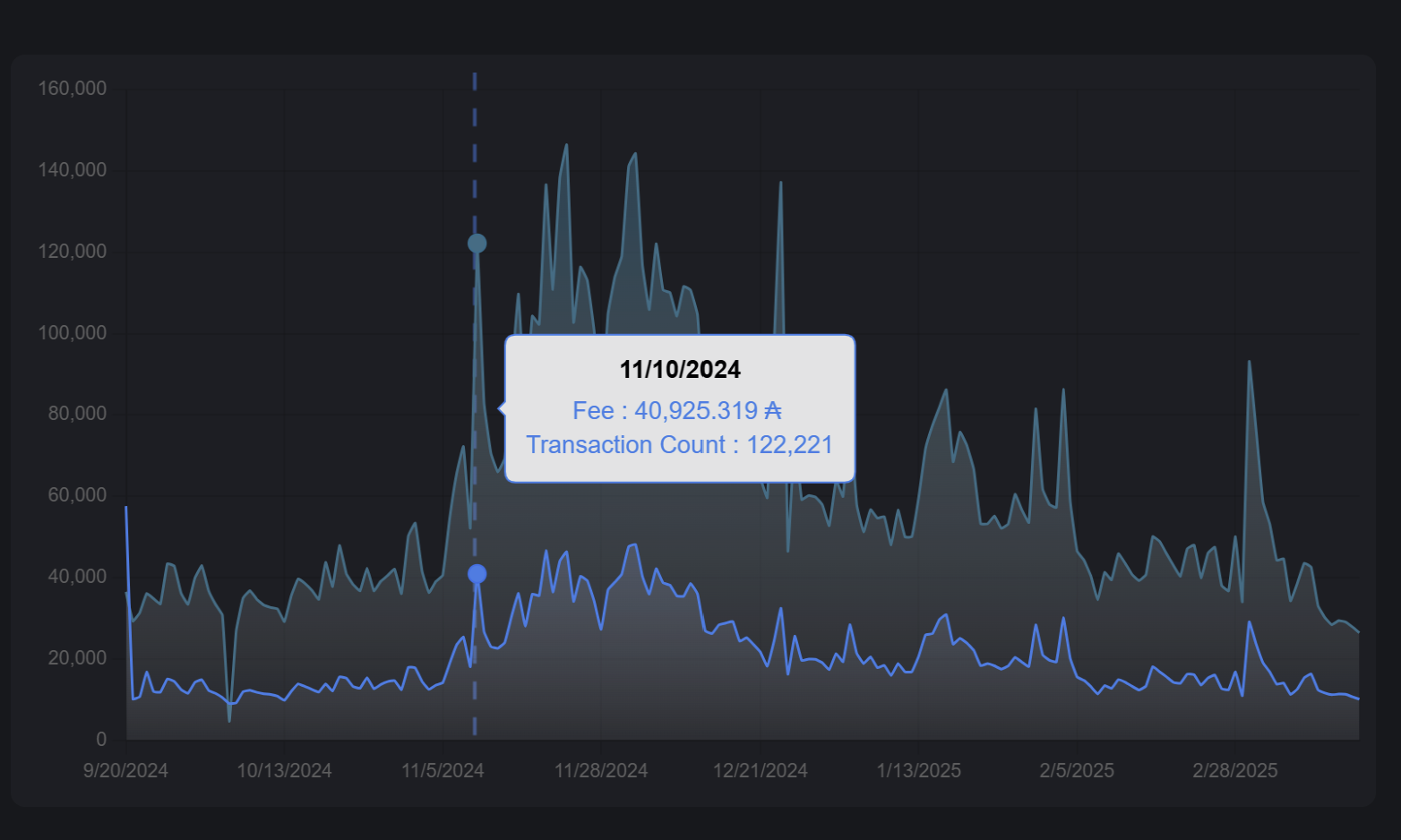

An increase in social sentiment is commonly aligned with elevated buying and selling exercise and, at instances, increased costs. In This autumn 2024, an increase in optimistic social sentiment and energetic transactions went hand in hand for ADA. Nonetheless, the surroundings is barely completely different proper now.

Knowledge from Cardanoscan.io confirmed a stark distinction between the variety of energetic transaction counts from early November 2024 and now. In This autumn, the typical transaction rely remained above 100,000 for many of November and December, however at the moment, it's roughly down 70%, with the variety of transactions coming in at 26,437 on March 18.

Day by day transaction rely and charges chart. Supply: cardanoscan.io

Whatever the weak onchain exercise, Michael Heinrich, CEO of 0G Labs, advised Cointelegraph that Cardano’s power lies in “lobbying” its neighborhood. Talking on ADA and XRP’s inclusion in a US Digital Asset Stockpile, Heinrich stated,

“They've time within the sport: these tokens have been round for some time, they’re liquid, and so they’re unlikely to spring any sudden surprises.”

Related: Cardano’s ADA lands spot in US Digital Asset Stockpile — Will it generate value?

ADA to rally 20% earlier than the tip of March?

No matter the underwhelming onchain knowledge, ADA value has been receptive to optimistic information prior to now.

The altcoin has maintained a place above the 0.50 Fibonacci retracement line regardless of ADA being in a downtrend since its 2024 excessive of $1.32. This means that ADA’s high-time body (HTF) chart stays on a technical uptrend.

ADA/USDT 1-day chart. Supply: TradingView

Cardano retained assist from the ascending trendline (black line) whereas oscillating between its parallel channel. At the moment, the speedy resistance lies on the higher vary of the channel at $0.78, which is supported by the 200-day exponential transferring common (200-DEMA, orange line). A optimistic candle shut above the 200-DEMA on the every day chart signifies a bullish shift, probably triggering a transfer above $0.78.

The speedy goal above $0.78 lies between 0.84 and $0.88, the place a every day honest worth hole (FVG) is current. A retest of $0.88 marks a 20% return from its present value.

Nonetheless, traditionally, Cardano has exhibited extended sideways motion, which might restrict speedy features. A break above $0.78 validates additional affirmation for a rally, however till then, the altcoin might proceed to vary between $0.78 and $0.70.

Related: Bitcoin is just seeing a ‘normal correction,’ cycle peak is yet to come: Analysts

This text doesn't include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.