Blockchain community EOS has introduced its rebrand to ‘Vaulta’ with a shift to Web3 banking and banking advisory group, resulting in a value enhance for the EOS token.

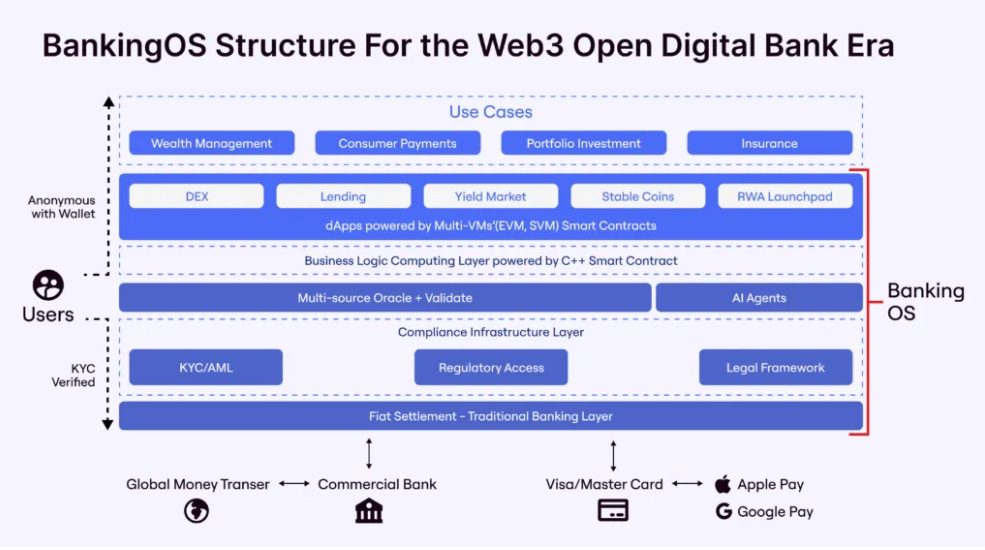

Its Tuesday announcement states that Vaulta will act as a scalable and sturdy working system that powers real-world monetary functions.

Moreover, it claims that the rebrand follows years of improvement, planning, and market remark. The purpose was to combine Web3 know-how with established monetary methods.

This, it argues, will unlock “the immense potential” of Bitcoin (BTC), in addition to different property and decentralized applied sciences. Vaulta immediately integrates with exSat – a Bitcoin digital banking resolution that enhances Vaulta’s “BankingOS” – to place Bitcoin as “the spine” of a DeFi ecosystem.

According to that, EOS Community now describes itself as “a scalable working system that powers Web3 banking.”

The crew expects the official transition to happen on the finish of Might. This, they add, will embody a token swap. At this level, the EOS token will transition to the Vaulta token. The swap can be bi-directional for 4 months, permitting customers to alternate their tokens at a 1:1 ratio, mentioned the blog post that gives detailed rationalization of the rebrand.

Nevertheless, the transfer is not only a reputation change, claims Yves La Rose, Founder and CEO of Vaulta Basis. Moderately, it’s a step to enabling accessible monetary entry for all as Web3 reshapes international finance. Vaulta, he provides, is “a holistic Web3 banking method.”

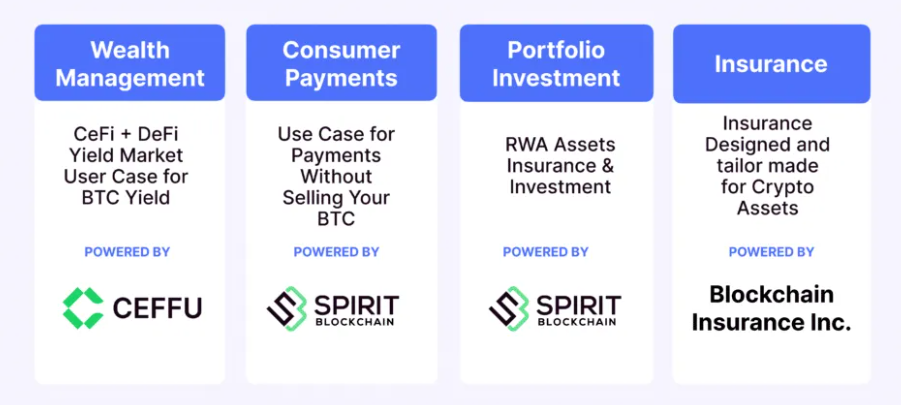

To perform its new targets, the crew says it's going to make the most of its present partnerships with Ceffu, Spirit Blockchain, and Blockchain Insurance coverage Inc., in addition to those it's going to announce within the coming months.

The partnerships will assist develop Vaulta’s Web3 Banking ecosystem capabilities via particular use instances for digital property, particularly the “4 Pillars”: Wealth Administration, Client Funds, Portfolio Administration, and Insurance coverage.

Subsequently, this may result in new yield-generation alternatives, says the crew, enabling entry to real-world asset (RWA) investments and establishing “insurance coverage tailor made for blockchain.”

EOS Value Jumps, Vaulta Banking Advisory Council Established

EOS has seen a considerable value rise over the previous day. Up to now 24 hours, the coin appreciated 17.2% to the value of $0.5764. At one level on the 18 March, it briefly jumped to $0.652838.

Over the previous week, it elevated by 16.8%, whereas it’s down 9% in per week and 36% in a 12 months.

EOS hit its all-time excessive value of $22.71 in April 2018, falling 97.5% since. Regardless of the latest bull market, it wasn’t in a position to transfer wherever close to this level.

This newest transfer appears to have woke up it.

Moreover, with the rebrand, the crew has created the Vaulta Banking Advisory Council. It contains banking and Web3 execs from Systemic Belief, Tetra, and ATB Monetary who will present their experience and assist with a compliant, high-level technique to establish “key real-world piloting alternatives.”

Alexander Nelson, Senior Director of Digital Finance at ATB Monetary, commented that Vaulta’s infrastructure has the potential to attach blockchain with conventional banking. Its rebrand “not solely opens the door for conventional funds to enter DeFi via Bitcoin but additionally paves the best way for larger institutional acceptance, he states.

In the meantime, EOS launched in 2018 as an ‘Ethereum killer’, with a record-breaking ICO of $4.1 billion.

Nevertheless, in 2019, the corporate behind it, Block.one, faced charges by the US Securities and Alternate Fee (SEC) for conducting an unregistered ICO. Block.one determined to settle, paying a $24 million tremendous that the SEC requested.

The submit EOS Price Jumps as Network Rebrands to Vaulta and Pivots to Banking appeared first on Cryptonews.