Knowledge heart infrastructure supplier Hive Digital is doubling down on its long-term Bitcoin treasury technique and is utilizing the latest market sell-off to increase its mining capability and acquisition targets, signaling a rising shift amongst public miners to retain their mined property.

In an interview with Cointelegraph, Hive Digital’s chief monetary officer, Darcy Daubaras, mentioned the corporate stays centered on “retaining a good portion of its mined Bitcoin to learn from potential worth appreciation.”

This requires an lively method to treasury administration to optimize liquidity within the face of steep market corrections, similar to Bitcoin’s (BTC) latest 30% drop. Nonetheless, a long-term Bitcoin hodl technique is best than “[relying] extra on debt or fairness dilution for funding,” which is frequent within the mining business, mentioned Daubaras.

As Cointelegraph reported, public miners have more and more shifted to fairness dilution — or issuing new shares to boost capital — as a part of a broad deleveraging course of resulting from excessive rates of interest and declining creditworthiness.

Absent these methods, miners are often compelled to aggressively promote their mined Bitcoin to fund their operations or enlargement.

Whereas Hive isn’t against promoting a few of its Bitcoin holdings — it did so to fund the acquisition of Bitfarms’ 200-megawatt facility in Paraguay — it’s higher to “selectively promote Bitcoin to fund accretive investments, [which] creates a stability of rising our operations and positioning ourselves for long-term success,” mentioned Daubaras.

Supply: Frank Holmes

Hive added more Bitcoin to its balance sheet within the closing quarter of 2024, rising its “hodl” place to 2,805 BTC.

Associated: BTC miners adopted ‘treasury strategy,’ diversified business in 2024: Report

Significance of diversification, scalability

Bull market conditions make it simpler for miners to stack their Bitcoin, however long-term success requires navigating the minefield of risky costs, rising competitors, and rising electrical energy and {hardware} prices.

To fight these and different challenges, Hive has revamped its enterprise mannequin to incorporate AI data centers and has prioritized renewable vitality sources.

Hive Digital executives advised Cointelegraph in September that the corporate repurposed a portion of its Nvidia GPUs for AI duties, which may generate greater than $2.00 per hour in comparison with simply $0.12 per hour for crypto mining.

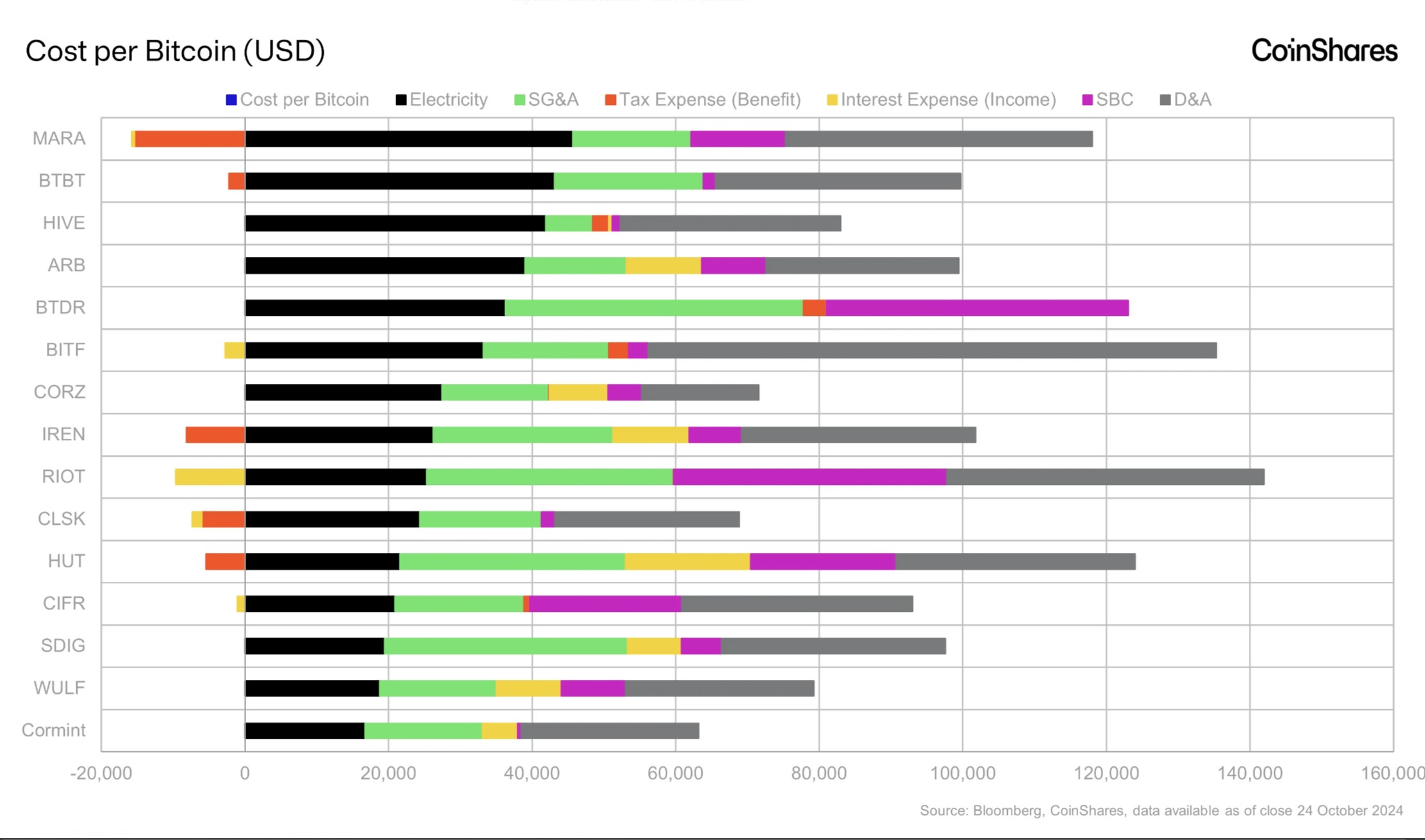

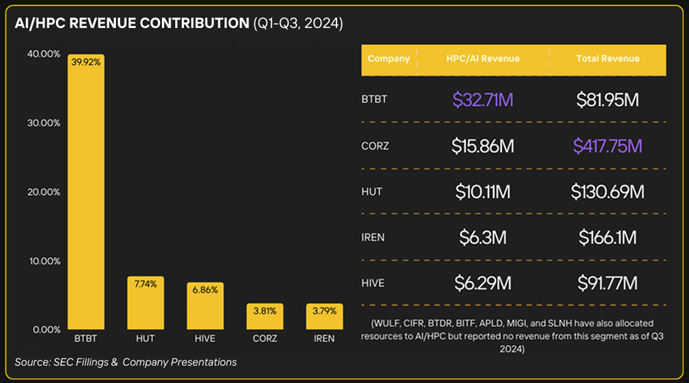

Other miners have followed suit, together with Core Scientific, Hut8 and Bit Digital. Their pivot was emphasised in an October mining report by asset supervisor CoinShares, which mentioned much less worthwhile Bitcoin mining “might clarify the rising development of mining corporations diversifying their revenue streams to incorporate AI.”

The price per mined Bitcoin has primarily doubled following the April 2024 halving. Supply: CoinShares

Miner diversification was additionally a key takeaway from a January report by Digital Mining Options and BitcoinMiningStock.io, which listed high-performance computing and AI as providing a “predictable income stream to buffer towards mining volatility.”

Excessive-performance computing and AI functions account for a rising share of miner revenues. Supply: Digital Mining Solutions

Journal: ETH whale’s wild $6.8M ‘mind control’ claims, Bitcoin power thefts: Asia Express