Pi Community’s place within the “best new crypto” dialog is in query after a week-long free fall—the front-running altcoin has did not print a single inexperienced each day candle in a 32% drop.

March 14, or “Pi Day,” which traditionally triggered value surges, finally pale right into a “promote the information” occasion.

Nevertheless, this loss streak may come to an finish as a possible achieve hangs within the steadiness, current hours present indicators of stability because the altcoin discovered its footing simply in need of $1.

Private Struggles: Why are Pi Community Traders Nervous?

Whereas the bearish market backdrop—marked by Trump’s “tariff battle,” NATO tensions, and recession fears—has weighed on sentiment, Pi Community is going through private setbacks.

An anticipated Binance itemizing, backed by 86% approval in a group vote, has been delayed with none remark from the platform.

With a complete locked provide of $5.1 billion Pi coin additionally faces vital inflationary pressures from claimable balances and Pi Workforce distributed token unlocks.

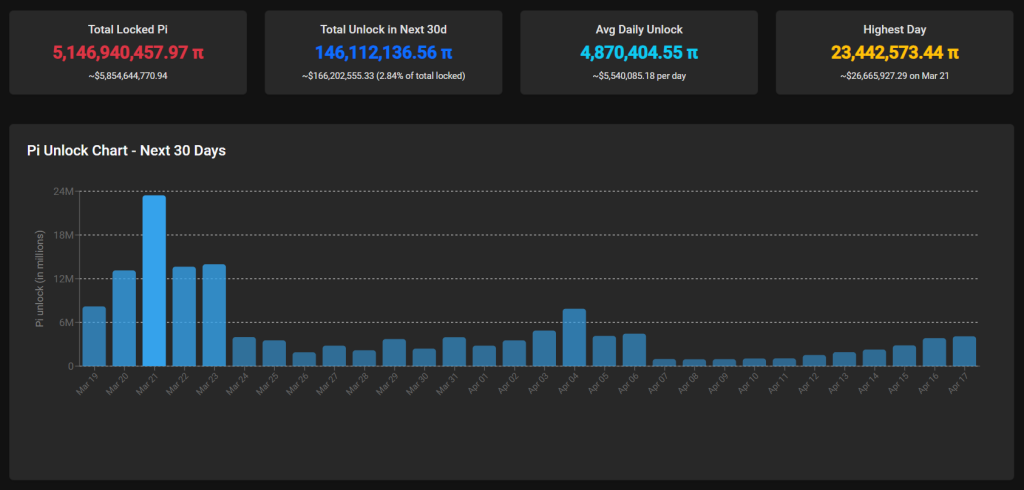

Blockchain monitor Piscan.io reports that over the following 30 days, 146 million PI tokens value $166.2 million will unlock.

Nevertheless, nearly all of these unlocks occurred over the previous week, coinciding with PI’s sharp decline. A major drop in each day unlocks is predicted within the coming weeks.

Compounding considerations, Pi Community lacks a robust ecosystem of decentralized functions (dApps).

With restricted real-world use circumstances, its value stays largely speculative, making it vulnerable to heightened volatility and short-term buying and selling stress.

PI Value Evaluation: Is $1 the Backside?

The Pi Community decline seems to be shedding steam on the $1.12 help, with promoting stress exhibiting indicators of exhaustion.

The Relative Energy Index (RSI) transferring common has reached the oversold threshold at 30, typically a precursor to reversals as consumers step in.

A restoration from this level may see the PI value climb to retest the higher boundary of the descending channel that guided its actions because the all-time excessive.

Whereas this rebound may reclaim a lot of final week’s losses, focusing on $1.355, the 20SMA presents a key resistance stage.

A rejection right here might set off additional draw back, with the decrease channel boundary round $0.85—a 24% drop from present costs—as the following goal.

Given the continued bearish market backdrop and Pi Community’s struggles, this bearish state of affairs stays a reputable threat.

11 Days Left To Catch This New ICO at a Potential Low cost

As crypto positive aspects show far and few between with the altcoin market in decline, buyers who again the flawed horse are lacking out on these restricted positive aspects.

That’s the place Meme Index (MEMEX) steps in, giving merchants elevated publicity to high-gaining alternatives.

Because the world’s first decentralized meme coin index, the Meme Index affords a curated choice of meme cash, balancing excessive development potential with efficient threat administration.

With 4 distinct baskets, buyers can tailor their methods to align with their objectives—whether or not aiming for regular development or high-risk, high-reward alternatives.

Time is working out—solely 11 days stay till the presale ends.

With nearly $4.2 million raised up to now, this could possibly be the ultimate probability to snag $MEMEX at a reduction earlier than it sees elevated demand post-exchange itemizing.

You'll be able to sustain with Meme Index on X and Telegram, or be a part of the presale on the Meme Index website.

The submit Pi Coin Dives 18% Toward $1 – Here’s Why Investors Are Nervous appeared first on Cryptonews.