Solana's native token, SOL (SOL), rose 8% on March 19 as buyers turned to riskier belongings forward of US Federal Reserve Chair Jerome Powell's remarks. Whereas rates of interest are anticipated to remain unchanged, analysts anticipate a softer inflation outlook for 2025. In the meantime, key onchain and derivatives metrics for Solana counsel additional upside for SOL worth.

The cryptocurrency market mirrored intraday actions within the US inventory market, suggesting SOL's good points weren't pushed by industry-specific information, similar to studies that the US Securities and Alternate Fee might drop its lawsuit towards Ripple after clinging to it for 4 years.

Russell 2000 small-cap index futures (left) vs. SOL/USD (proper). Supply: TradingView / Cointelegraph

On March 19, the Russell 2000 index futures, monitoring US-listed small-cap corporations, surged to their highest degree in twelve days. Regardless of a broader slowdown in decentralized utility (DApp) exercise, Solana stands out.

Solana’s TVL continues to rise

Solana’s onchain volumes dropped 47% over two weeks, however related declines had been seen throughout Ethereum, Arbitrum, Tron, and Avalanche, highlighting industry-wide traits slightly than Solana-specific points. The Solana community’s complete worth locked (TVL), a measure of deposits, hit its highest degree since July 2022, supporting SOL's bullish momentum.

Solana complete worth locked (TVL), SOL. Supply: DefiLlama

On March 17, Solana's TVL climbed to 53.2 million SOL, marking a ten% improve from the earlier month. By comparability, BNB Chain's TVL rose 6% in BNB phrases, whereas Tron's deposits fell 8% in TRX phrases over the identical interval. Regardless of weaker exercise in decentralized applications (DApps), Solana continued to draw a gradual circulate of deposits, showcasing its resilience.

Solana noticed sturdy momentum, pushed by Bybit Staking, which surged 51% in deposits since Feb. 17, and Drift, a perpetual buying and selling platform, with a 36% TVL improve. Restaking app Fragmentic additionally recorded a 65% rise in SOL deposits over 30 days. In nominal phrases, Solana secured its second-place place in TVL at $6.8 billion, forward of BNB Chain’s $5.4 billion.

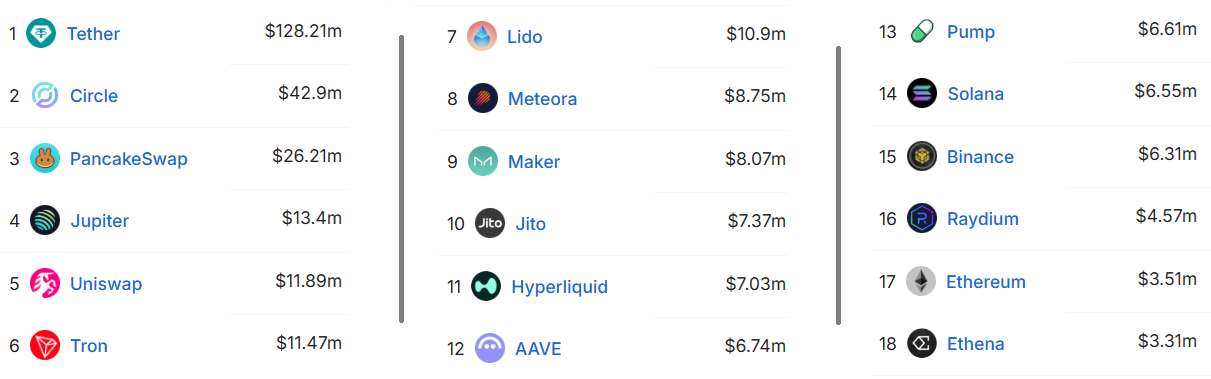

Regardless of the market downturn, a number of Solana DApps stay among the many high 10 in charges, outperforming bigger rivals like Uniswap and Ethereum’s main staking options.

Rating by 7-day charges, USD. Supply: DefiLlama

Solana’s memecoin launchpad Pump.enjoyable, decentralized change Jupiter, automated market maker and liquidity supplier Meteora, and staking platform Jito are among the many leaders in charges. Extra notably, Solana’s weekly base layer charges have surpassed Ethereum’s, which holds the highest place with $53.3 billion in TVL.

SOL derivatives maintain regular as token unlock fears subside

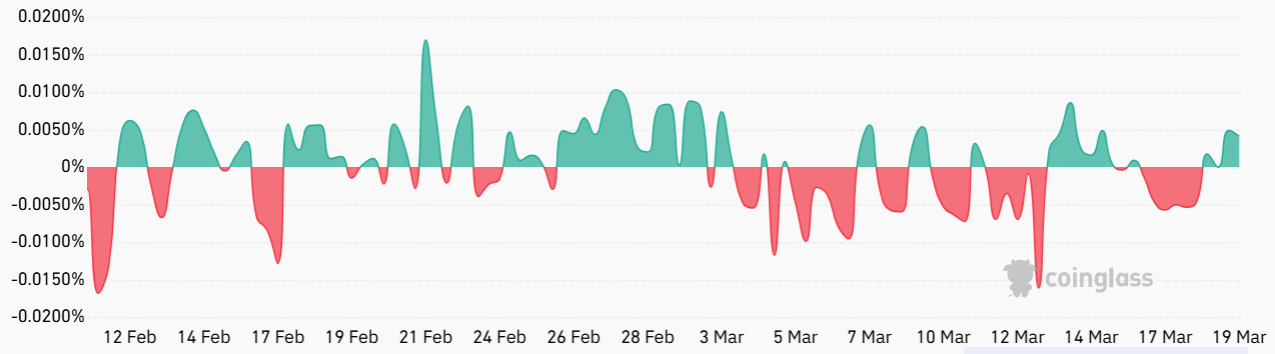

Regardless of a 27% decline in SOL's worth over 30 days, demand for leveraged positions stays balanced between longs (patrons) and shorts (sellers), as indicated by the futures funding rate.

SOL futures 8-hour funding fee. Supply: CoinGlass

Durations of excessive demand for bearish bets sometimes push the 8-hour perpetual futures funding fee to -0.02%, which equals 1.8% per thirty days. When the speed turns unfavorable, shorts are those paying to take care of their positions. The other happens when merchants are optimistic about SOL’s worth, inflicting the funding fee to rise above 0.02%.

The latest worth weak spot was not sufficient to instill confidence in bears, at the least to not the extent of including leveraged positions. One cause for this may be defined by the diminished progress in SOL provide going ahead, just like inflation. A complete of two.72 million SOL will likely be unlocked in April, however solely 0.79 million are anticipated for Could and June.

In the end, SOL is well-positioned to reclaim the $170 degree final seen on March 3, given the resilience in deposits, the shortage of leverage demand from bears, and the diminished provide improve within the coming months.

This text is for basic info functions and isn't meant to be and shouldn't be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed below are the creator’s alone and don't essentially replicate or signify the views and opinions of Cointelegraph.