The USA wants to determine a aggressive moat round extremely safe tokenized real-world property (RWAs) to stay aggressive within the age of borderless, permissionless finance, in accordance with Chainlink co-founder Sergey Nazarov.

In an interview with Cointelegraph’s Turner Wright on the Digital Asset Summit in New York, Nazarov stated that blockchain is a worldwide phenomenon that depends on open-source software program and distributed know-how, not like earlier technological shifts.

The chief added that the shift to on-line commerce, which gave the US a aggressive benefit attributable to a five- to 10-year head begin on the event of web infrastructure, just isn't relevant within the age of digital finance. The chief advised Cointelegraph:

“The US actually has to push its different two benefits of a really robust home market and the flexibility for it to create these extremely dependable monetary property. And that is what I believe the administration and the folks within the legislature are actually beginning to perceive.”

Actual-world tokenized property might grow to be a $100-trillion market within the coming years, because the world’s property come onchain, the Chainlink govt predicted.

Sergey Nazarov takes half in a panel on the 2025 Digital Asset Summit. Supply: Turner Wright/Cointelegraph

Associated: Ethena Labs, Securitize launch blockchain for DeFi and tokenized assets

Tokenized RWAs attain all-time highs

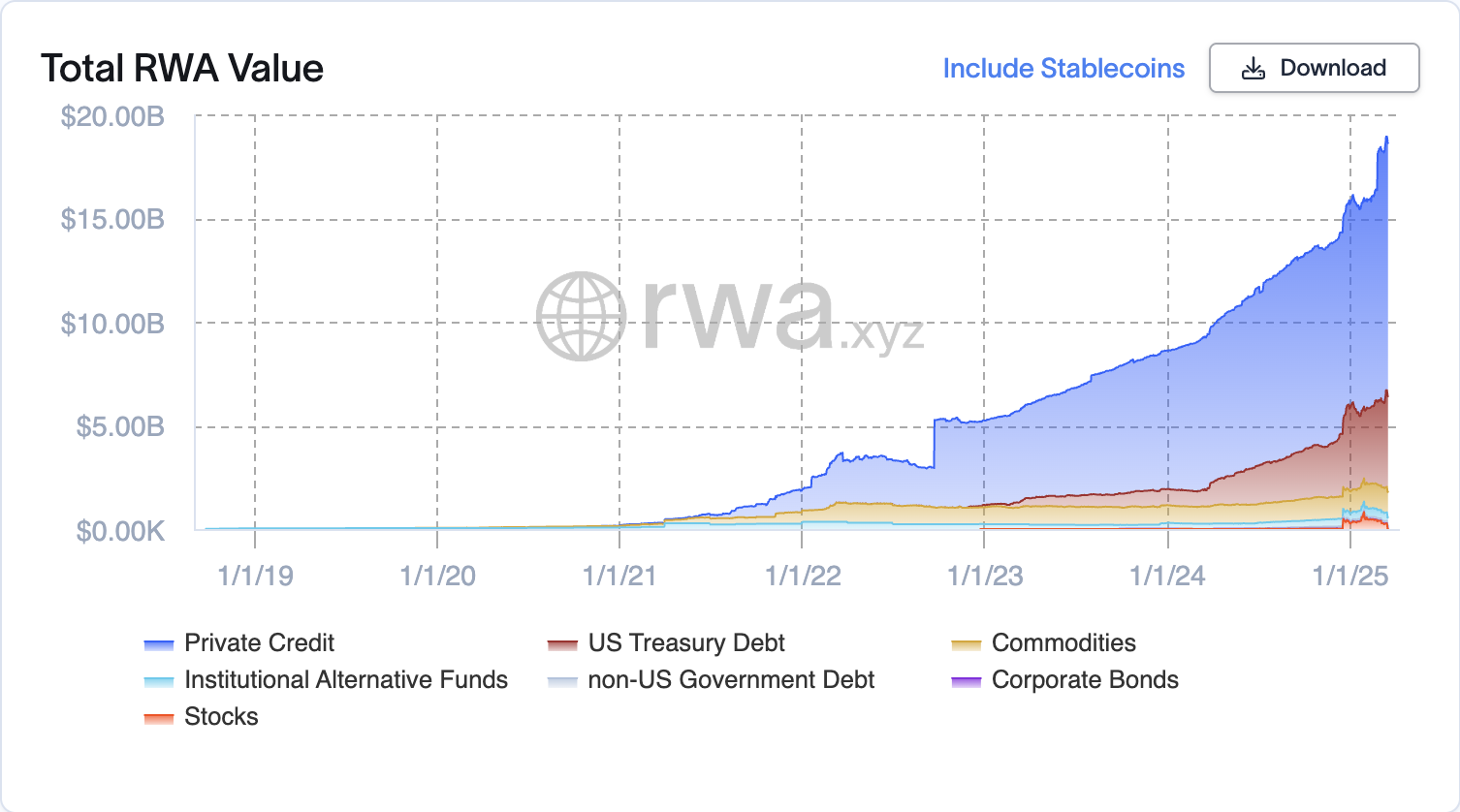

In line with RWA.xyz, real-world tokenized property, excluding stablecoins, hit an all-time high in 2025, topping $18.8 billion.

Personal credit score took up the lion’s share of the overall RWA market capitalization, with over $12.2 billion in tokenized personal credit score devices permeating the market on the time of this writing.

Complete tokenized real-world property, excluding stablecoins. Supply: RWA.xyz

Asset tokenization could make beforehand illiquid asset lessons, corresponding to actual property, extra liquid, eliminating the illiquidity low cost inherent in bodily properties.

In February, Polygon CEO Marc Boiron advised Cointelegraph that tokenizing actual property might fractionalize possession, remove intermediaries, and decrease settlement prices —transforming the slow-moving sector.

This actual property overhaul will be seen in Turkey, with initiatives corresponding to Lumia Towers, a 300-unit mixed-use industrial actual property improvement that was tokenized utilizing Polygon’s know-how.

It’s additionally happening within the United Arab Emirates, which is taken into account one of many hottest property markets on the earth. Proactive digital asset laws are driving a tokenized RWA boom within the Gulf state as institutional traders and builders flock to tokenization instead methodology of capital formation.

Journal: Real life yield farming: How tokenization is transforming lives in Africa